Barely six months into his new job, CNN chief executive Chris Licht strode into a sunlit conference room to make his pitch to rescue America’s first 24-hour news channel from a serious mid-life funk. It was mid-October and around the table was perhaps Licht’s single most important audience: the board of his parent company Warner Bros Discovery, gathered in a luxury Los Angeles hotel for the first strategy “retreat” for the merged company.

Warner’s restless chief executive David Zaslav was in the room, along with his mentor John Malone, the libertarian cable billionaire and one-time Trump donor, and Warner’s biggest shareholder Steve Newhouse, the scion of the media dynasty behind Condé Nast. Between them these three men had a century of experience in the cable business — and no shortage of views on what was best for CNN.

Licht, a respected television producer who most recently ran Stephen Colbert’s Late Show, came armed with sprightly patter and a deck of slides. But nothing could hide the ominous turn in CNN’s fortunes.

By every conceivable financial measure, the network that brought America cable news was floundering. Revenue, ad sales and profit were down, while costs were up. Ratings, meanwhile, were dreadful; earlier this month CNN fell behind MSNBC on an US election night for the first time in its history, attracting 2.6mn viewers versus Fox News’s 7.4mn and MSNBC’s 3.2mn. “I hate to say it but when I look ahead, I see problems without end,” says one CNN executive. Deep cuts, including potentially hundreds of jobs, are imminent.

Licht’s plan, spelt out to the board, was to take CNN back to its roots; closer to the founding spirit of Ted Turner, who sought to “make news the star” rather than the opinion coursing through the channel in recent years. In Zaslav’s words, the new CNN would be “fighting for journalism first”, and “more than just politics”. Licht’s own twist was trying to make CNN feel more like a newspaper; packaging breaking news with other lifestyle and sports content in the hope it might keep viewers glued, even on slow days.

CNN trails home in the midterms

7.4mn

Fox viewers on election night in the US this month

3.2mn

MSNBC viewers on election night in the US this month

2.6mn

CNN viewers on election night in the US this month

Some opinion would remain, but with a markedly different tone. “One of the biggest misconceptions about my vision is that I want to be vanilla, that I want to be centrist. That is bullshit,” Licht told the Financial Times. “You have to be compelling. You have to have edge. In many cases you take a side. Sometimes you just point out uncomfortable questions. But either way you don’t see it through a lens of left or right.”

Colleagues later noted one curious aspect to the board briefing. Licht faced no financial interrogation, according to people familiar with the meeting. Zaslav, Malone and Newhouse made it plain: the numbers were secondary to rebuilding a brand they saw as tarnished by left-leaning advocacy that became more pronounced in the Trump years. They wanted it fixed, and they were full-square behind Licht.

Licht had a mandate from the top. But to his detractors within CNN’s top ranks, that was precisely the problem. “What does it say about our editorial independence?” asked a second disgruntled CNN executive, who was furious at Warner board members “trashing” CNN in public, notably Zaslav’s call for “less yelling” and Malone’s plea for the network to get more “actual journalists”.

Perhaps more importantly, the new approach seeks to challenge an uncomfortable truth for all news networks in America. The Trump era — brimming with anger, division and discord — had made for spectacularly good ratings and record profits. Polarisation was good for business. Licht’s CNN was going to attempt the seemingly impossible: repairing the network’s finances while swimming against this tide.

“I never remember a single advertiser complaining that the talent was too opinionated,” the CNN executive says. “Look, there is no audience in the middle. It doesn’t exist. It’s a mirage.”

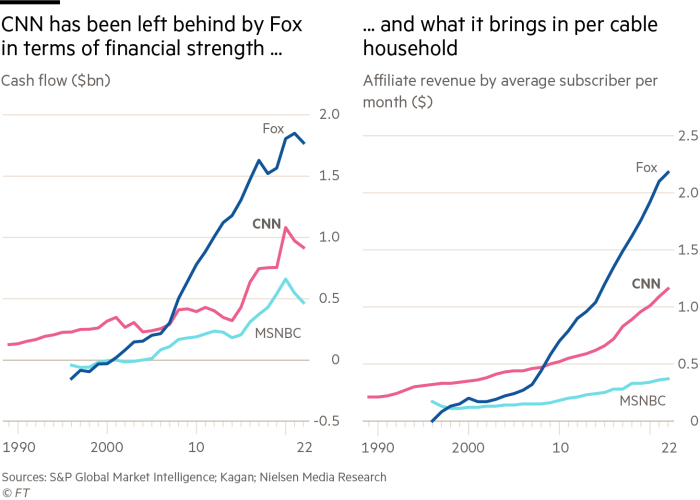

For all the gloom, CNN is a worldwide news brand that is still generating significant amounts of cash; Licht’s team estimated operating profits this year will be $700mn-$750mn, according to three people familiar with the accounts. But that is almost half a billion dollars down on CNN’s peak profitability under Licht’s predecessor Jeff Zucker, a television impresario who drove a more opinion-heavy CNN through the Trump news boom.

If the slide continues, it is a problem that Warner Bros Discovery, carrying $47.5bn in net debt, cannot afford. Only six months after the $43bn merger of Warner with Discovery closed, Zaslav is under investor pressure to cut billions of dollars in expenses through a restructuring he recently described as “messy”. The company’s stock has been cut in half this year as Wall Street lost its patience with the extravagant “streaming wars” of Hollywood. One way or another, in the years to come CNN will need to earn its living within Warner. Can Licht turn it round?

Tricky hand to play

All the main cable news channels have lost viewers since Trump’s exit from the White House, but CNN’s ratings are the worst in the pack. At the end of October, CNN’s US audience sank to the lowest level since 2015, drawing only 431,000 viewers a day. On election night its audience fell 49 per cent from the last midterm vote in 2018, sending chills across the newsroom. “We usually own the night,” commented one CNN journalist.

Perhaps most worrying, CNN’s share of cable subscriber fees, the boon that made its business model one of the greatest in the history of news, is expected to fall by as much as 6 per cent in 2022, according to two people familiar with accounts. That is the second successive year of decline; executives see no end in sight. After three decades of distribution money propelling the business, CNN’s leadership need new sources of revenue just to stand still.

One veteran at CNN called it the “bleakest time” at the network since he joined in the mid-1990s. The same point was put to Licht last week during a remarkable town hall hosted by CNN anchor Alisyn Camerota, where blunt questions submitted by staff cast doubt on the chief executive’s strategy, credibility, and even whether his staff message warning of upcoming job cuts was “humane”.

“This has been a hell of a year,” said a contrite Licht according to a recording obtained by the FT. “I said in my first town hall how this organisation has been taking gut punches. The last thing I want to be is another gut punch. And I know what we are doing right now is another gut punch.”

Over CNN’s 42 years in the cable business, Licht’s predecessors have seen plenty of ups and downs: ratings panics, editorial scandals and strategy troubles. Settling on CNN’s identity has also been a near-constant struggle since it was outflanked by Fox News on the right, and MSNBC on the left.

But the programming challenges were always against the backdrop of commercial growth. Even if ad sales fell, steady cable distribution revenue kept rolling in. CNN’s profit has fallen precipitously this year, but it remains in the 42-year-old company’s top six results.

Licht’s unique challenge stems from being CNN’s first leader to face a ratings crunch, an ad recession, low morale, tough cost-cutting targets, an editorial reset and structural decline in CNN’s business model — all at the same time.

“He’s been dealt the toughest hand,” says a third fellow executive. “It looks like he hasn’t done a good job. It’s not the case. His predecessor enjoyed much more benign conditions.” Within a few weeks of becoming president, Licht was charged with cancelling CNN Plus, a $300mn streaming project that itself was just a few weeks old.

Adding to the challenge is an organisation still grieving the departure of Zucker, who was ousted earlier this year after failing to declare an affair with a senior colleague. Intense, hyper-driven, and with an eye for sizzle and spectacle, he had become a singular presence at the modern CNN. Don Lemon was almost in tears as he noted Zucker’s exit live on air.

“Jeff was much adored in many ways,” says one 25-year veteran of the CNN newsroom. “He drove the whole organisation in a very personal way and that all dropped off a cliff after he left . . . [Zucker’s exit] threw us for a loop. And we haven’t really recovered.” The first CNN executive adds: “Licht has no superpower, not like Zucker”. “The only person saving him is Zaslav and that’s because they care about the politics more than the business.”

The downside to the ratings bump under Zucker — and the Trump presidency that drove it — was the impact on CNN’s brand.

What was once billed as the most trusted name in news had become the most polarised news brand in America. No other television news outlet has as big a gap between left-leaning respondents who trust CNN’s output, and those on the right who think it is biased, according to surveys since 2018 from the Reuters Institute for the Study of Journalism at Oxford university.

Rick Davis, a celebrated former CNN executive who retired last year after America’s longest career in cable news, argues the network’s uncomfortable position with right-leaning viewers predates Trump’s relentless attacks. He recalled conservative talk-radio pioneer Rush Limbaugh lambasting the “Clinton News Network”, which in the mid 1990s faced no competition in rolling news.

“You can put CNN aside. The whole country has changed,” says Davis, who produced CNN’s second hour on air in 1980 and went on to oversee eight separate political shows. “Nobody in America thinks the political landscape is the same as 10 or 20 years ago in terms of how you cover news . . . It made sense to include more analysis and informed opinion that made for distinctive programming.”

Another former Warner executive who worked with Zucker acknowledges that while Trump changed the rule book for journalism, in the case of CNN it went too far. “In the history of CNN . . . every time CNN skews its overall brand to politics, it loses,” says the former executive.

Licht has begun to recalibrate the tone. Outspoken on-air talent such as media anchor Brian Stelter and John Harwood, White House correspondent, have left CNN. Once ever-present “breaking news” banners are now more infrequent. Licht, who has a record of revamping morning programming at CBS and MSNBC, also launched “CNN This Morning”, backing a trio of presenters who hail from Louisiana, Alabama and Minnesota. CNN wants to be seen to be climbing down from a metropolitan pedestal.

It is far from a revolution, but CNN insiders say polling suggests audiences have already noted the change in tone. Licht simply sees it as a return to basics after the mission-creep of the Trump years: “If everything is a crisis, if everything is 11, if everything is breaking news, then no one listens when there actually is a crisis. When you say, ‘No, no — really — the house is on fire now.’”

Hunt for growth

The unanswered question is whether the editorial shift makes commercial sense.

Jon Klein, who ran CNN’s US operation in the pre-Zucker era, believes “objective journalism” is the “smartest strategy for CNN and the only strategy that will work”.

“They will get higher ratings if they stop pushing opinion but they have to hurry. Cord cutting is happening,” he says. Klein reckons “trusted news that is not coming with you with a spin” is “an enormous” business opportunity. “It will be like turning the light in the lighthouse back on. Everyone will go: what took you so long?”

Warner’s ad sales team are also convinced advertisers will prize the chance to appear alongside a trusted brand, and pay a premium for it. CNN already sells ads at higher rates per viewer than Fox News or MSNBC, according to S&P Global Market Intelligence. Licht is betting on his editorial strategy reinforcing that advantage.

But serious questions remain, even among Licht’s top team. Regular cable news viewers are at the most partisan, news-obsessed edges of an extremely polarised country. With Fox and MSNBC catering to those audiences, CNN had in the past relied on big events for its largest audiences. But the sheer range of digital news outlets and entertainment options has even undermined that advantage.

Licht brushes off the scepticism. “There are tens of millions of people who have decided the old cable news is not part of their life any more, that it is not worth their free time,” he says. “I have to imagine we can get to a place where, I don’t know, you got 250,000 of them between the ages of 24-54 that will engage with you. That would look like one hell of a success.”

His other big bet will be on CNN’s digital assets, which includes one of the world’s biggest English language news websites, hosting more than 500mn visits a month according to Similarweb. The operation has been neglected within CNN for the past two years; Licht has invested in the tech to improve a clunky user experience.

It speaks to CNN’s need to ultimately find new sources of growth in a world where cable television fees, which still account for the majority of its revenues, are in long-term decline. For now, contracts with cable distributors effectively stop CNN from being able to stream its news channel on online platforms (the US version of CNN Plus had no live news). But Warner executives are hopeful that can be overcome. A new platform will be released next year to replace HBO Max; CNN is expected to be a prominent brand in the Warner streaming package.

The problems facing Warner Bros Discovery

$43bn

Value of merger of Warner Bros and Discovery, headed by David Zaslav, above

$47.5bn

Net debt of the new entity. The value of the company’s stock has been cut in half

$5.5bn

Cost savings sought by the company’s management in restructuring

Licht’s more immediate concern are cuts within CNN, which is already reeling from the abrupt cancellation of CNN Plus. While Licht asked his executive team to look at ways to “right-size” the network, in recent weeks this hypothetical exercise became a full-blown cost cutting drive. About $100mn of savings must be found this year, which equates to just under a tenth of CNN’s budget. It is expected to lead to not just hundreds of job cuts but closures of programming and even potentially whole stations in the CNN empire. Licht told staff the cuts would be unveiled in early December.

These are technically separate from the $5.5bn of cuts Warner is seeking across the group. But Warner’s financial troubles are setting the bar for CNN’s tough performance targets. Under the ownership of the sprawling telecoms group AT&T, CNN was never big enough to be material for its parent company, and enjoyed being left to its own devices; with Warner, it is more under the microscope of group finance chief Gunnar Wiedenfels. “I’ve never seen a CFO this powerful,” says one of CNN’s management team.

Warner’s need to repair its balance sheet and pay down some of its debt has fed perennial speculation that CNN may be put on the block in months to come. One former Warner executive said he had been approached by potential buyers as they sized up whether to bid.

Some of Warner’s top ranks see CNN as a detachable asset that could be sold without harming Warner’s core streaming business. But Zaslav has quashed serious talk of a sale; he is what Licht has called a “CNN fanboy” who sees the asset as too valuable to lose. Even if it was to be sold, CNN’s dip in profitability could mean the asset might change hands as little as $6bn-$8bn — not enough to transform Warner’s debt pile.

During last week’s town hall, Licht said he had heard “zero discussion” of a sale. His focus for now is on the grim business of laying off staff, but he hopes quick decisions will lift the fear gripping the organisation. “There is no worse thing that a leader has to do,” he said. “It is absolutely gutting. I wake up at 3am thinking about it.”