Before getting started, a quick plug for Lex Populi. This column publishes in FT Money for the first time this weekend. Targeted at private investors, it aims to demystify, inform and entertain. I hope you will enjoy it.

This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Conventional warfare becomes a primarily industrial conflict when viewed through the lens of cold-hearted economics. The side with the best equipment in the greatest quantity generally wins. That is as true today in Ukraine as it was in the world wars recently commemorated here in the UK.

Ukraine is winning because a steady supply of superior western projectiles is allowing it to destroy inferior Russian equipment. Its war gear has mostly come from the US, to a value of more than $15bn. But European states are also stumping up, as a witty video love letter from Ukraine to France recently underlined.

“Je t’aime,” murmurs Jane Birkin huskily, while self-propelled guns blast away in the background.

Reflecting the mood of the times, defence industries were a focus for Lex this week. To comment on this, or any other aspect of our coverage, please email me at [email protected].

The Ukraine war provides key proof that the uneasy post-cold war rapprochement between east and west has collapsed. So it is back to bellicose business as usual for European armaments companies such as BAE Systems, Dassault Aviation and Rheinmetall.

Conventional warfare, or the credible threat of it, is good for all of them. Insurgencies in places such as Iraq were, by contrast, low-value conflicts where heavy firepower lacked an obvious target. Defence company diversification into cyber warfare looked like a category error meanwhile. Some of the terminology is the same. But the skillset is quite different.

BAE published a buoyant update this week, even as the UK commissioned five Type 26 warships for £4.2bn. Plans by Airbus and Dassault to build a modern warplane are more nebulous. Lex thinks they should combine their efforts with an Anglo-Italian consortium to better counteract the arms-making dominance of the US.

Consolidation is already on the agenda for Rheinmetall, a big supplier to a German military undergoing a €100bn upgrade. The group is buying Spanish munitions maker Expal for €1.24bn. Ammo is running low in Europe. The vendors, therefore, got a decent 10 times EV/ebitda multiple on the sale.

The last two sentences point to the ethical concerns some investors have about defence industries. There have been more than 200,000 military casualties in Ukraine so far, each one of them a human tragedy. Ukraine has been devastated by Russia’s unprovoked invasion.

The cost of reconstruction is estimated at more than $1tn. Lex believes an international agency should co-ordinate the effort. Whoever leads Ukraine after a peace settlement will need to root out the corruption riddling the country, or significant sums will disappear.

Crypes!

Plenty of value has already evaporated at FTX, the US crypto platform whose charismatic boss Sam Bankman-Fried was briefly the acceptable face of his industry. In court papers, new chief executive John Ray III said there had been “a complete failure of corporate controls” at FTX.

An estimated $8bn is missing. Money appears to have shuffled between FTX businesses. FTX management owed billions to one unit, Alameda Research. We think it will take years to identify and sell a modest tally of real assets.

Some cryptos were apparently stored on thumb drives, described by one of my colleagues as “the digital equivalent of keeping your savings in a shoe box”.

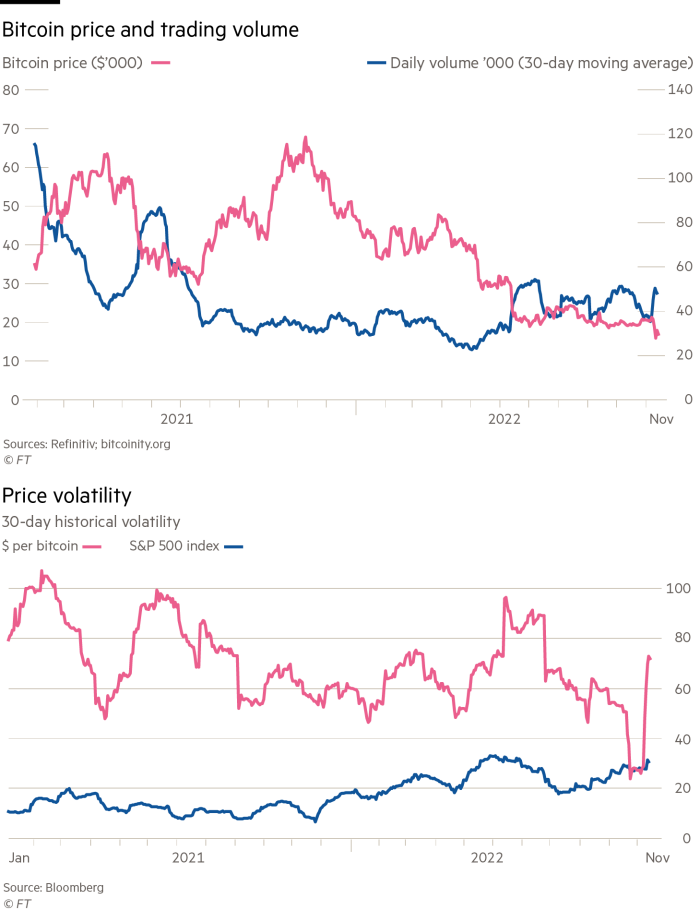

Contagion is incipient within the digital assets business, with concerns this week focusing on Singapore-based exchange Crypto.com. Lex is, therefore, intrigued by relatively low volatility in quoted bitcoin prices.

We do not set much store by these prices. They appear highly susceptible to manipulation. One method would be via “wash” trades. Here, a whale investor buys and sells to themselves at a support price using different wallets, in an effort to bolster confidence.

Chaos in crypto is a sideshow compared with the shakeout in Chinese property. Wheezes here include using the deposits of new homebuyers to finance the completion of dwellings for older customers. The sector is now in dire straits

Shares in developers such as Country Garden and Logan Group rallied this week after regulators offered fresh liquidity. But Lex believes Chinese homebuyers are shunning property purchases, leaving their cash sitting in savings accounts.

Counter arguments

Expect lots of articles assessing US consumer demand — or the lack of it — next week. Thanksgiving is on Thursday and many Americans will hit the shops afterwards for Black Friday sales.

Lex, whose time horizon is medium-term, remains bullish on value retailers Walmart and Target. Shares in the latter fell this week after it cut its holiday season sales outlook. Walmart is better placed for a downturn because it has a heavier weighting to groceries and has raised its earnings forecast.

We are more bearish on Experian. This is a big, UK-listed credit checking group with heavy exposure to the US. It had a stellar run during the post-GFC credit expansion. We reckon demand for credit reports will now reduce alongside demand for loans themselves.

If you ask luxury goods bosses whether a consumer downturn could hurt them, the typical haughty reply is “Our customers are far too rich to notice such things!”

Richemont’s Johann Rupert is the exception to the rule. He has warned of tough times ahead. Lex thinks the seriously wealthy will still do just fine, thanks to enriching secular trends such as digitisation. But aspirational luxury shoppers will have to cinch in their Gucci belts.

The growth and resilience of French luxury giants such as LVMH is one reason the Paris stock market exceeded London in value for the first time this week.

Equities are not the only game in town, as we pointed out. Even so, it was another piece of negative financial news for the UK, whose chancellor Jeremy Hunt delivered an austerity-era Autumn Statement on Thursday. This should fill the £55bn hole in the government’s budget. It will do so at the cost of steep tax rises, deep spending cuts and very little stimulus for growth.

Stuff I enjoyed reading this week

FT colleagues too numerous to mention have collaborated on a brilliant range of maps illustrating the Ukraine war. These demonstrate the scale of the Ukrainian counteroffensive — and how much further it would need to go to liberate the whole country.

Perusing these gives me a much better sense of what is happening than TV and radio news reports on fighting in places with names containing many Zs and Ks.

I meanwhile read Me Talk Pretty One Day, a collection of essays by US humourist David Sedaris. This was published years ago and contains no insights into finance. But it is very funny, particularly if you have ever tried learning a foreign language.

Sedaris describes a fellow adult learner attempting to explain Easter to a Moroccan classmate in broken French, as follows: “He weared of himself the long hair and after he die, the first day he come back here for to say hello to the peoples . . . he nice, the Jesus.”

Enjoy your weekend, whatever language you communicate most comfortably in.

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here