One scoop to start: Wall Street lenders led by Citigroup and Bank of America could end up shelving a closely followed bond and loan deal to fund Apollo Global Management’s takeover of auto-parts maker Tenneco, sources tell DD. The banks have been forced to wire a $5.45bn cheque to the private equity giant after struggling to drum up investor interest, which is proving elusive.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

Masayoshi Son’s $4.7bn SoftBank debt

-

FTX’s “complete failure of corporate controls”

-

Coatue Management’s Philippe Laffont on surviving a tech rout

Masayoshi Son: down bad

Masayoshi Son cut an uncharacteristically subdued figure during SoftBank’s results presentation last week.

Gone were the days when the Japanese tech conglomerate’s 65-year-old chief exhorted investors to listen to Yoda and “feel the force”. Nor did he seek to compare himself to Jesus Christ. There was nary a flying unicorn or friendly robot in sight.

Instead, he delivered a brief (by his standards) 30-minute speech that he said could be his final appearance at the Japanese group’s financial results before handing over to the firm’s more sober chief financial officer Yoshimitsu Goto. Son also announced that he was stepping back from running day-to-day operations at SoftBank to “devote” himself to overseeing British chip designer Arm.

While SoftBank had just unveiled a $10bn investment loss during the latest quarter, there’s another reason that may have also influenced Masa’s decision to step away: he now personally owes SoftBank close to $5bn due to growing losses on the Japanese conglomerate’s technology bets.

Let DD explain.

The widening losses in SoftBank’s various investment vehicles have added billions of dollars to a tab that Son owes to the group. This is because SoftBank fronted him the money to invest in its technology-related funds.

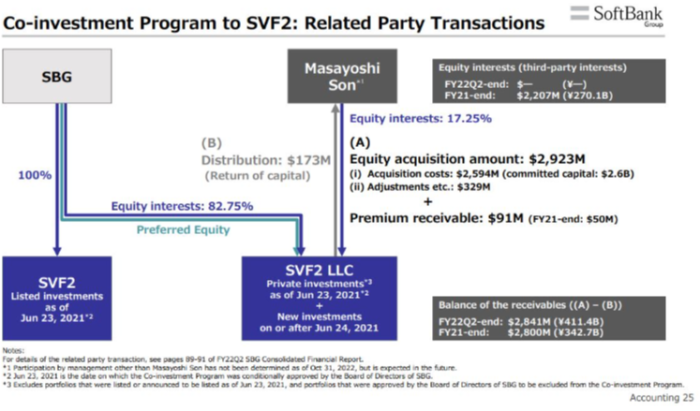

In the case of SoftBank’s second $56bn Vision Fund, Masa now owes $2.8bn in relation to his stake in the fund.

And while SoftBank previously netted off the equity value of Masa’s 17.25 per cent in the fund from this amount, the slide in the value of its investments wiped this out entirely by the end of September.

That’s right: Masa Son’s stake in Vision Fund 2 is now worthless.

It’s a long fall from the $2.8bn valuation placed on his slice of fund at the end of 2021, when heady valuations for start-ups enabled SoftBank to list portfolio companies such as WeWork and AutoStore.

Financial structure geeks may also be interested to note that SoftBank has a slug of preference shares that rank ahead of Masa’s common equity. See this slide from a recent investor presentation:

Son also owes SoftBank $669mn under a similar arrangement on its Latin American fund, although this is reduced to $252mn when his equity value in the fund is taken into account.

The total amount the Japanese executive owes his company is now at $4.7bn, when losses in the group’s shortlived internal hedge fund, SB Northstar, are also taken into account, SoftBank confirmed to the FT.

It may sound like a stressful proposition to owe billions upon billions of dollars to the company you founded, but DD readers shouldn’t lose too much sleep about Masa’s quandary. He’s under no obligation to repay the outstanding amounts for many years, as they only have to be settled when the funds reach the end of their terms.

Hopefully one of the hundreds of portfolio companies SoftBank has backed will turn out to be the next Alibaba by that time. It won’t be FTX.

FTX’s free fall bankruptcy gets even worse

When the situation is dire enough to shock the guy who helped unwind the largest corporate fraud in American history, you know things have really gone off the rails.

That’s the situation at FTX, the crypto trading exchange founded by former wunderkind Sam Bankman-Fried, which filed for bankruptcy last week.

John Ray III, the new chief executive of FTX who was appointed to run its bankruptcy, said he had never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information,” the FT’s Kadhim Shubber and Joshua Oliver and DD’s Sujeet Indap report.

It’s a bold statement from someone who helped liquidate Enron’s operations and represented plaintiffs in the Bernie Madoff and Allen Stanford frauds.

Ray’s comments, made in FTX’s first-day pleadings, set the tone for what looks primed to become one of the messiest bankruptcies in history. One goal will be to investigate potential legal claims against SBF.

Alphaville breaks down the 26-page document’s jaw-dropping details.

Among them: Customer funds had been used “to purchase homes and other personal items” for staff and advisers, and payments were approved through the use of “personalised emojis” in an online chat.

SBF used messaging platforms with an auto-delete function “and encouraged employees to do the same,” causing “pervasive failures” in record keeping and decision-making.

There were also $4.1bn of loans from Alameda, the trading firm SBF owned. Some $3.3bn of that money went to SBF directly and an entity he controlled. Millions more went to other employees.

When DD revealed the financials SBF sent to potential rescue investors earlier this week, we were blown away by the shoddiness of his work and $8bn of customer funds he said were “accidentally” given to Alameda.

Ray has been able to store just $740mn in crypto in cold wallets against what appear to be $9bn in customer deposits at the time of filing. It underscores how low recoveries may be for creditors.

Riding out a market sell-off

Philippe Laffont had a strong feeling that a market correction was coming.

“I had that vivid recollection” of similar big market swings in 2000 before the tech crash, the Coatue Management founder told the FT’s Harriet Agnew and Ortenca Aliaj in a rare interview. “And I just had this oh my God, this is happening again.”

The publicity-shy Frenchman, who cut his teeth as a research analyst in the late 90s at Julian Robertson’s Tiger Management in New York before striking out on his own at the end of the dotcom boom, was keen to avoid history repeating itself.

He began liquidating positions in Coatue’s hedge fund earlier this year and bracing for the inevitable. Its main hedge fund is down 17 per cent and its long-only fund is down 28 per cent as of November 15, according to one investor.

Still, he has fared better than some of his fellow “Tiger cubs” in the tech carnage that has wreaked havoc on funds over the past six months. The hedge fund of his fellow Tiger alum Chase Coleman has lost more than half its value this year.

“I feel like not digging yourself in a big hole is really important in money management,” he said. Some 70-80 per cent of Laffont’s assets are sitting in cash — a huge amount for the typical hedge fund.

Laffont believes that he and his fellow growth investors are in for a reckoning as the era of cheap money winds to a close.

In preparation, Coatue is raising $2bn for a structured equity fund — through which it can lend money to private companies rather than raising money through the traditional means of equity financing — as companies run out of cash and begin to weigh other options.

He has by no means given up on being a growth investor. Coatue has built a large stake in chipmaker Nvidia and has electric vehicles, artificial intelligence and climate technology on its radar.

Still, Laffont is taking a conservative approach and may hold on to his cash pile longer.

Job moves

-

Visa has named JPMorgan Chase’s former consumer banking chief executive Ryan McInerney as its next chief, replacing Alfred Kelly, who is stepping down in February.

-

Carlyle energy co-head Avik Dey is leaving the private equity firm at the end of this month, according to Bloomberg.

-

Evercore has hired Richard Hoyle, Lazard’s head of technology, media and telecom investment banking in the UK, as a senior managing director in its information and media group.

-

Lazard chair William Rucker has been named chair of private equity firm ICG, effective January 1. He will succeed Andrew Sykes, who has acted as interim chair since March 2022 and will return to his role as senior independent director.

-

Six dealmakers at US-headquartered investment bank KBW are leaving its City office to launch their own boutique, according to Financial News.

Smart reads

Britain’s missing bankers The number of bankers in the UK is dwindling. The FT’s Cat Rutter Pooley investigates whether that should be a cause of concern for the City, which is already fretting over losing clout to European financial rivals.

Tulsa survivors fight back In 1921, a mob of white residents in Tulsa, Oklahoma, including police, burnt down the area known as “Black Wall Street”, killing hundreds of black citizens. A legal reckoning is under way to force the city to finally confront its past, Bloomberg reports.

Brain games Observers of the FTX saga may be experiencing some cognitive dissonance when it comes to Sam Bankman-Fried, as crypto’s presumed white knight takes on a darker persona. Alphaville examines his altering egos.

And one smart watch to cap things off: the Qatar World Cup is just a few days away. The FT’s Scoreboard explains what it means for geopolitics and the tournament’s legacy.

News round-up

Scaramucci’s SkyBridge bought $10mn of FTX token in return for investment (FT)

Activision Blizzard games to go offline in China after NetEase deal falls through (FT)

Short seller Muddy Waters bets against Uruguayan payments firm (FT)

Adani, world’s third-richest person, considering opening family office in Dubai or New York (Bloomberg)

Saudi Aramco leads Riyadh’s $30bn investment push into South Korea (FT)

White & Case settles ‘toxic’ culture case with senior lawyer (Bloomberg)

Bulb Energy bailout to cost UK taxpayers £6.5bn (FT)

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here