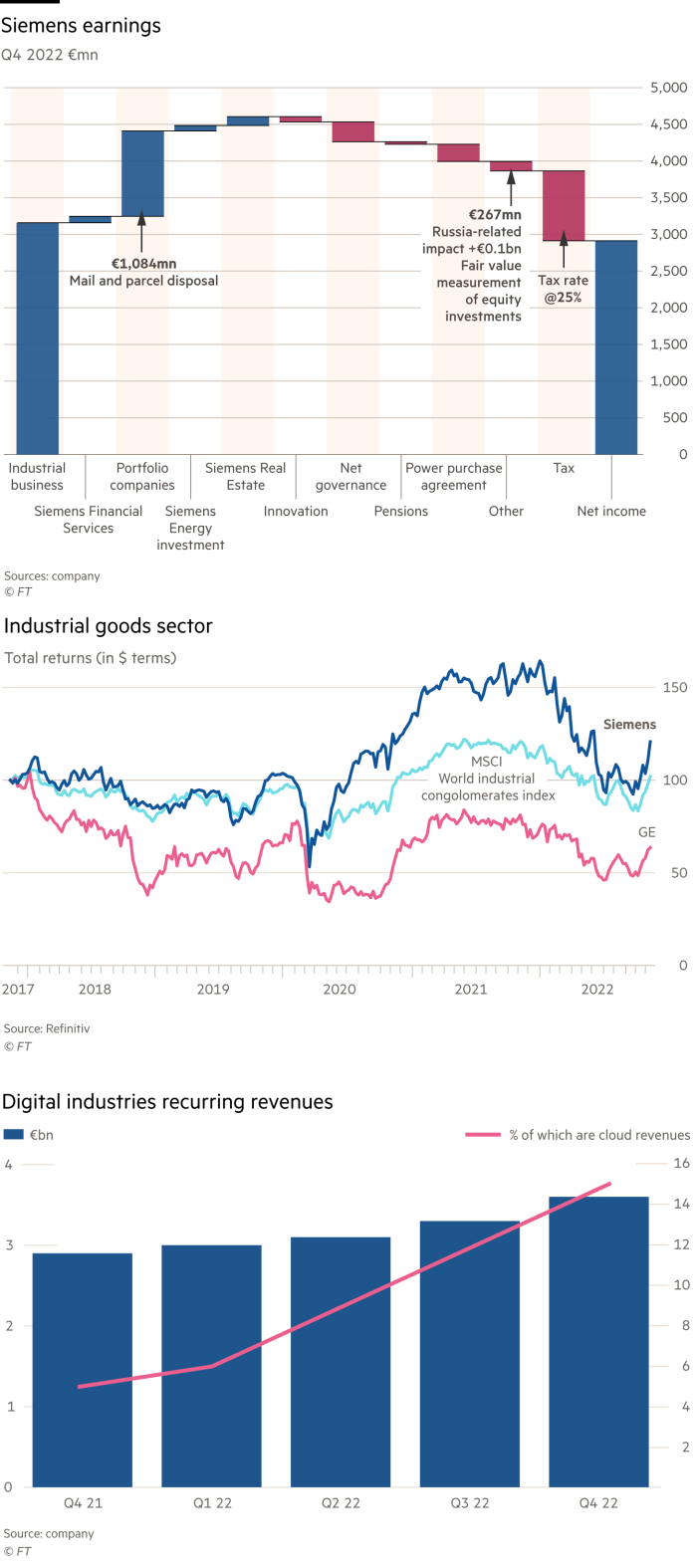

Ill winds from the energy crunch are doing little to bluster Siemens. The German industrial titan reported results on Thursday well ahead of expectations. Full-year profits from the industrial business hit a record high of €10.3bn. New orders and revenues were both a tenth better than analysts were expecting. A bullish outlook from management helped push shares up more than 7 per cent in morning trade.

Chief executive Roland Busch will continue the legacy of his predecessor of streamlining the conglomerate to focus on core digital products. As part of the former, Busch wants to combine five businesses involving drives and motors into a new company next year with 14,000 employees and annual revenues of €3bn.

A spin-off or sale can be expected once that is complete. Assuming similar earnings and valuation as competitor ABB, this motors/drives unit might be worth €9bn. That is roughly a tenth of Siemens’ market value.

But it is Siemens’ digital industries, which house software and automation businesses, that provide most of the optimism for Siemens’ outlook. Revenues in the most recent quarter grew 18 per cent year on year and a €14bn order book is a record high.

Automation revenues up 23 per cent outpaced those at divisions of rivals Schneider and ABB in the latest quarter, notes Jefferies. A company growth target of 12 per cent next year is three times higher than consensus had been pencilling in.

Recurring revenues of €3.6bn were 14 per cent higher than last year. Importantly cloud revenue growth was stronger; these represent 15 per cent of the total up from just 5 per cent a year ago.

At 14 times forward earnings the valuation is in line with its 10-year average but well below peers trading closer to 20 times. The strength of the German group’s free cash flow can help close that gap. Analysts have already forecast the group will increase free cash flow by more than half by 2025 to more than €10bn, which should mean more dividends to shareholders.

Siemens’ restructuring appears to be working. Its valuation discount plus the secular growth from its automation business should support the shares.

If you are a subscriber and would like to receive alerts when Lex articles are published, just click the button “Add to myFT”, which appears at the top of this page above the headline.