This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Tulip mania was a bubble in fancy bulb prices that gripped Dutch society between 1634 and 1637. Ever since, we think of tulip mania whenever speculative exuberance comes a cropper. The current example is the bankruptcy filing of FTX, the Bahamas-based crypto platform founded by Sam Bankman-Fried.

Jamie Dimon condemned bitcoin as “worse than tulip mania” in 2017. Back then, Lex concluded that the JPMorgan Chase boss was only half-right. Tulip mania left participants with some very decorative flowers. Investors who bought bitcoin at peak prices would not even have those when the market crashed, we reckoned.

Another difference is that revisionist historians cannot find evidence of significant financial collapses as a result of tulip mania. In contrast, it is clear that FTX, at one time valued at $32bn, is a dead duck in its current incarnation.

Investor Sequoia noted that FTX generated $250mn in operating profits in 2021. That creates a slim chance of a restructuring under cover of Chapter 11 protection. However, many chastened investors will no longer wish to trade cryptos through FTX, or anywhere else.

It is FTX’s FTT token — as manipulable as the price of fancy tulip bulbs and dangerously entwined with other SBF ventures — that has laid FTX low.

For the moment, the bigger issue is how a business that is supposedly just an exchange and custodian appears to have mislaid billions in customer assets. That raises questions about Alameda Research, the investment vehicle of Bankman-Fried. Regulators are accordingly keen to talk to the fallen wunderkind.

Lex has always had a very clear view that cryptos have just three main functions: as a speculative medium; as a means of exchanging value secretively; as a badge of ideology.

We always assumed crypto prices would drop far more steeply than US equities in a bear market. We were right.

We made a jokey video a while back on the subject, animated by graphic artist Russ Birkett and narrated by silver-tongued Lex research boss Alan Livsey.

Contagion from FTX may knock over some other crypto ventures. It will not hurt “TradFi”, as crypto bros contemptuously call regulated banking. Indeed, the woes of FTX and tumbling crypto prices take pressure off banks and regulators to welcome digital assets into the financial mainstream.

Revisionist historians believe the bulb price crash did not hurt conventional, periwigged Dutch finance either. This had taken pains to keep flower trading separate from markets where its volatility would be dangerous.

As an aside, we were amused to observe how Coinbase, the largest publicly listed US cryptocurrency exchange, has limited losses from slumping trading fees. It is earning decent sums in interest on cash and Treasury holdings.

To comment on this, on FTX, or any other aspect of our coverage, please email me at [email protected].

Sheikhy premises

Low bitcoin prices and high energy costs are making crypto mining unviable. This is good for the planet since each $1 of bitcoin has exacted $0.35 of environmental damage according to one estimate.

Far bigger carbon savings are needed to restrict anthropogenic global warming to 1.5C. This was the subject of the COP27 climate summit in Sharm el-Sheikh, Egypt, this week.

Lex thinks nations need to co-ordinate their efforts better, with the US in a leadership role. We, therefore, welcomed John Kerry’s proposal for a global scheme for big business to buy carbon credits that would finance decarbonisation in the developing world.

The problem with the Kerry plan is that it is voluntary and applies private capital indirectly. We think this would pay for a much bigger slice of decarbonisation if it was raised and deployed using business methods.

Treat energy transition as a capital project, with the planet as client and the US as prime contractor. Subcontract parts of the task to other nations to exploit local competitive advantage. Syndicate the project finance.

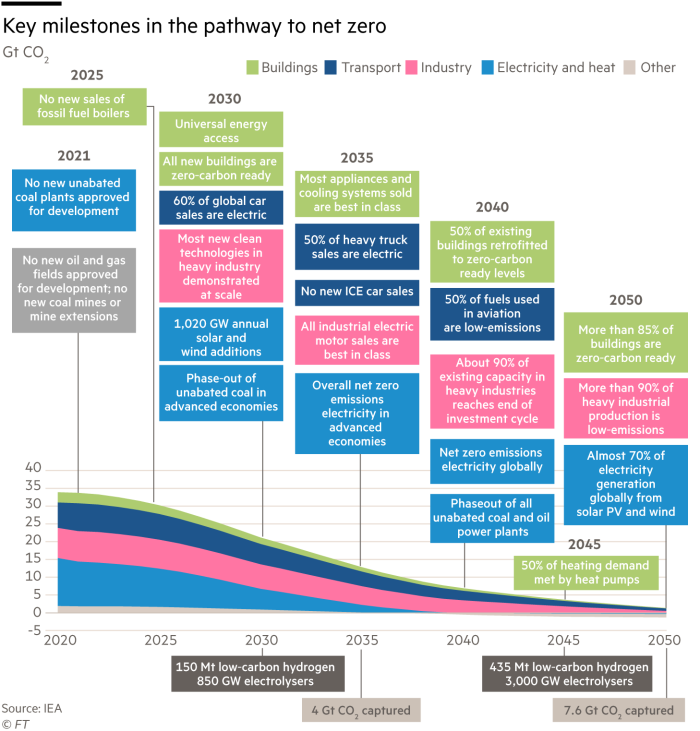

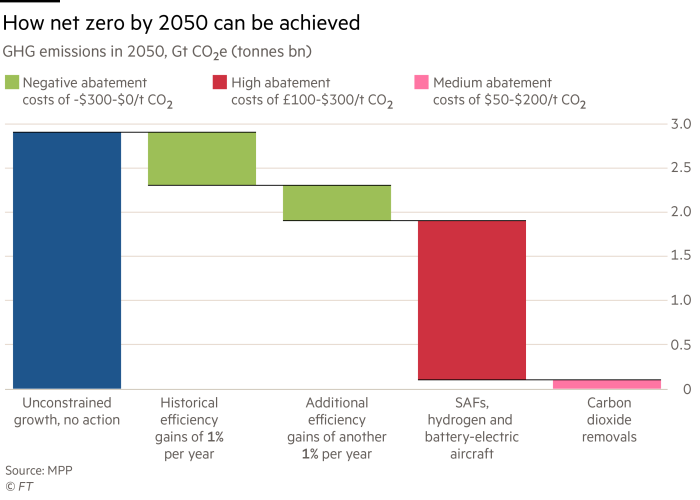

The transition plan looks pretty intimidating, I admit. But the challenge is less terrifying when split into smaller sub-assemblies, for example decarbonising air travel.

COP27 has been a muted affair partly because immediate security of supply is so pressing.

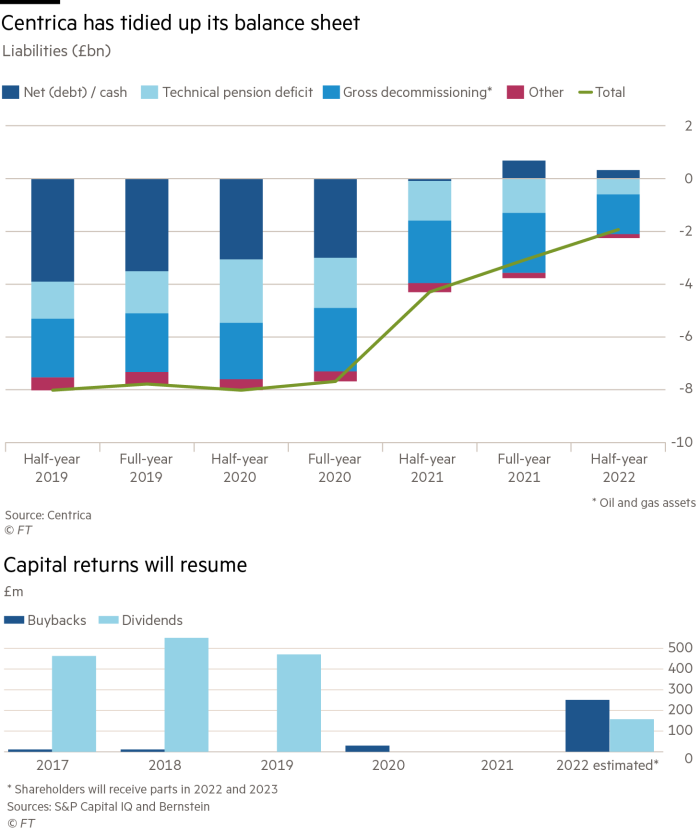

Steep prices for hydrocarbons have produced windfall profits for businesses such as Centrica. The UK energy utility has diverted £250mn of bumper 2022 profits into a share buyback. The UK may punish such giveaways with higher windfall taxes

The context for Centrica is that it is turning round after a period when it could not afford to make capital returns.

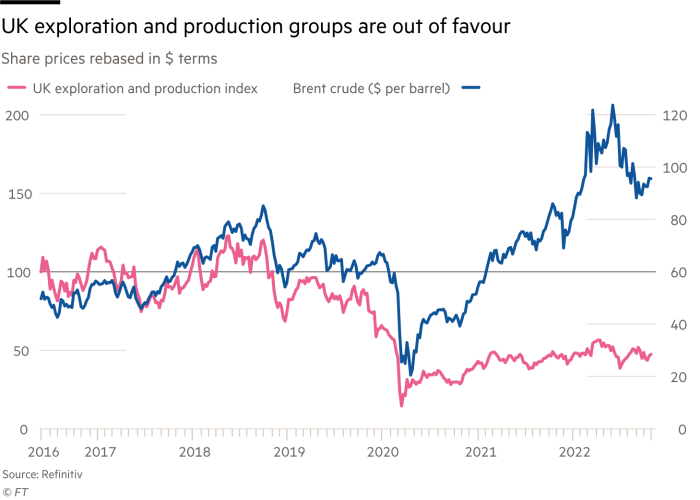

Oil and gas explorers remain in the doghouse. Ithaca Energy was priced at the lower end of its range this week. But it is a miracle that the business has been able to get its initial public offering away at all. Its bosses will have to pull off another coup by refinancing $625mn of 2026 notes to remove payout restrictions.

Stuff I learnt this week

Germans are different to English people. False correspondence is easy for UK-based consumer businesses to imagine as they hungrily survey Germany’s larger, stronger economy. There are some cultural similarities including pragmatism, beer, stodgy food and a love of Mediterranean holidays. But bosses of British consumer-facing businesses, such as Primark, are often disappointed when they export a product that works in Doncaster to Düsseldorf.

It is OK to be wildly optimistic about your business in the US. Despite the litigious culture of the US, criminal securities fraud is hard to prove. There is a special exemption for “puffery”. But times are becoming more judgmental. Perhaps a lawyer should hold up a sign emblazoned with the word “puffery” every time a chief executive indulges in it during investor presentations, just to be clear.

It is mathematically tough for investors to give alternatives managers more money. Many backers have a percentage limit on the value of their exposure to buyouts and the like. The prices of their quoted assets have dropped. But the presumed prices of unquoted assets have not, removing any headroom to buy more.

Two other articles worth reading

Higher interest rates are a problem for cash-strapped tenants as well as buy-to-let landlords, Cat Rutter-Pooley pointed out. I also liked Camilla Cavendish’s well-balanced piece on Ukrainian refugees in the UK, six months after a government support scheme was launched.

The seven-year-old staying with his family in our house has picked up reasonable English in that time. He is a mother-tongue Russian speaker like many Ukrainians. The problem, he tells me, is that he cannot remember all his Ukrainian. This matters, he says, because he now has to help a new classmate — who only speaks Ukrainian — adjust to life in an English school.

Enjoy your weekend, whatever language you speak at home.

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here