FTX’s Sam Bankman-Fried has resurfaced after a short silence, which in the era of 24-hour trading and billionaire-owned rumour mills counts as a very long silence.

SBF said he’s sorry in a 21-tweet thread. There’s a lot of talk about responsibility, transparency, and so on. He also had a salty message for Binance chief CZ, who kicked off this whole mess.

But that’s not nearly as newsworthy as FTX starting to allow some withdrawals. This could either be good news or very very problematic! While we wait for the dust to settle, we can look at hints that SBF gives about what happened at FTX this week, and why.

Here are a few notable tweets that could possibly mean something:

SBF says the exchange has more assets than “client deposits”.

It probably matters that he used the word “deposits” instead of “liabilities” here, because the word “deposit” could mean a few different things.

Deposits could mean real-world fiat currency. Or fiat and customers’ custodial assets. Clearly the firm doesn’t have more assets than liabilities, because if that was the case it wouldn’t be in trouble at all.

Market-making firms on FTX global also use it as a custodian for their trading equity, according to three people with knowledge of market-making operations, and that money is frozen as well. We expect market makers are significantly discounting the likelihood of getting that money back.

It’s also unclear how SBF squares this Tweet with reports that it lent billions of dollars’ worth of customer cash to Alameda, as the Wall Street Journal reported today (cf. our earlier coverage). The reporting is based on a single source, so we suppose that an investor could have misunderstood what SBF meant. But also maybe not. Especially if SBF’s count of the firm’s “assets” assumes that Alameda will fully repay the reported $10bn loan it got from FTX.

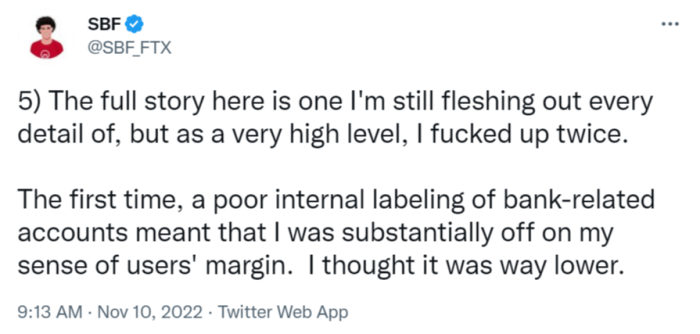

Don’t you hate when that happens!

Who among us hasn’t mislabelled their “client risk requiring collateral” spreadsheet as “posted client collateral”? In this scenario prop-trading firm Alameda would be a client, of course; just a client that’s reportedly mostly owned by the guy who owns the exchange.

It’s not clear what exactly “bank-related accounts” means, but FTX executives have been very publicly incorrect about actual bank-account policy and client protections in the past.

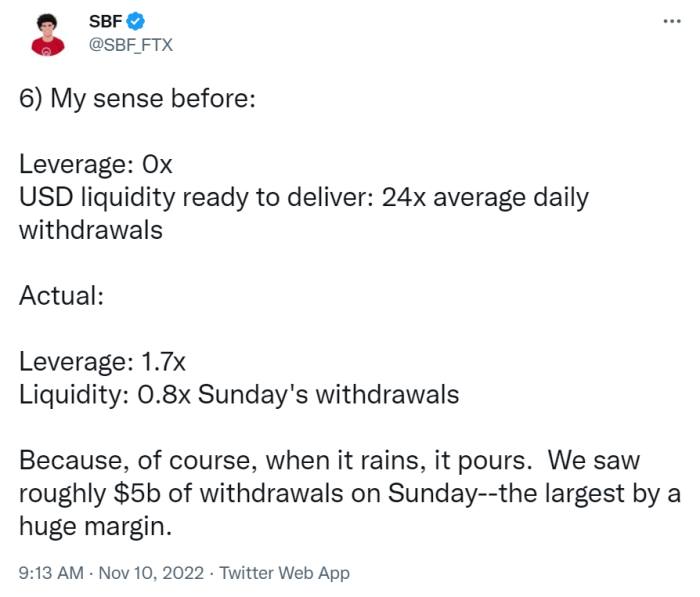

Sorry, what?

So the head of FTX — a platform that is popular in part because it makes it fairly easy to use leverage while trading — thought that its clients had . . . zero leverage?

This stretches the limits of credible belief. On one hand, FTX is known for auto-liquidating customers who fall into the red. This is ostensibly to protect its other customers from this exact type of situation.

In other words, there shouldn’t have been a giant buildup of client leverage! To end up in a $10bn hole, FTX might have suspended its liquidation policy for one whale “client”, perhaps one rhyming with Shmalameda. Or maybe SBF did simply kick his clients’ cash over to his in-house trading firm.

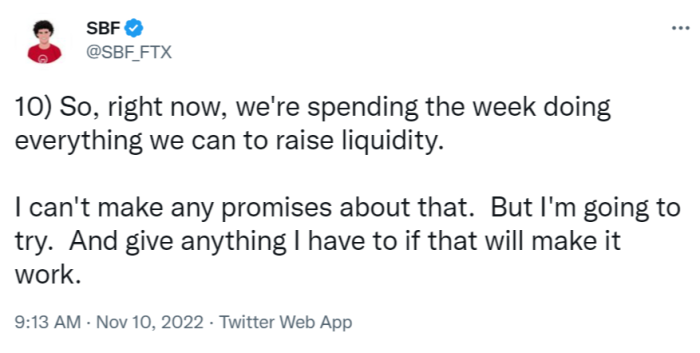

The ultimate consequence of either of these scenarios for FTX’s clients is negligible: either way they’re stuck. For SBF the consequences could be quite different. In any event, now it’s fundraising!

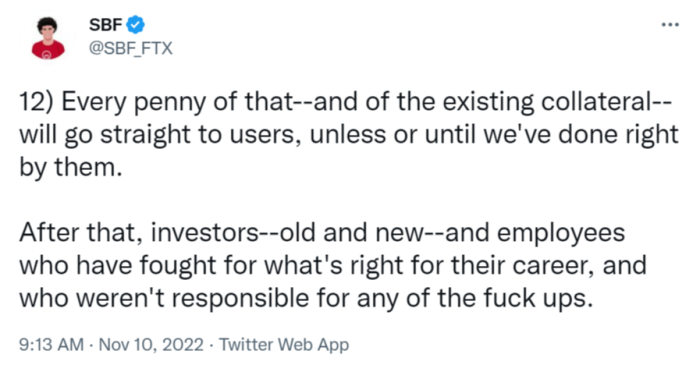

We should also point out that FTX’s employees got a significant amount of compensation in the FTT token, which is down more than 80 per cent in the past seven days.

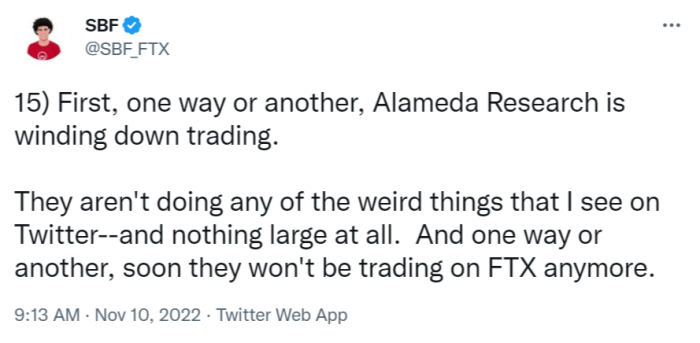

“One way or another, Alameda Research is winding down trading.”

Interesting! Though it’s not clear when trading will be fully wound down.

One trader tells Alphaville that a public Alameda wallet borrowed tether from a lending protocol earlier today. That sparked a round of rumours that Alameda was going to short the token in size, which may have helped push it off of its US dollar peg.

In other words, SBF is saying he will quit his job if investors make that a condition of a rescue. It’s unclear what that would mean for his ownership of the firm, however.

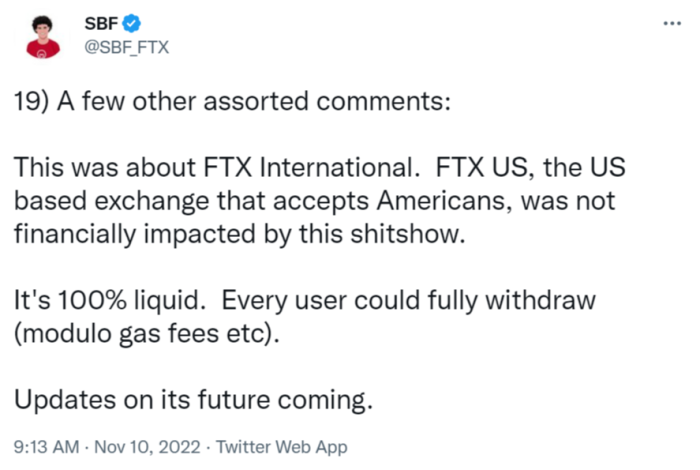

Whether intentional or not, the tweet above could be interpreted as a request for US regulators to leave him alone please. 🙂

Oh, and we can’t forget the “this is not investment advice and I probably don’t know what I’m talking about, so please do not sue me for this specific Twitter thread, I’m facing enough legal problems already” disclaimer at the end:

Maybe a little more software developing and a little less League of Legends would have helped?