This article is an on-site version of our Energy Source newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday and Thursday

Welcome back to Energy Source.

A scathing repudiation of the Biden energy agenda it was not.

Just 36 hours ago, polls and pundits suggested the Republican party was on track to sweep the midterm elections, comfortably regaining both chambers in a damning indictment of the president and his policies — not least his green pivot.

Yet despite prices at the pump hovering around $4 a gallon, inflation running at more than 8 per cent and Joe Biden’s unflattering approval ratings, the red wave did not materialise.

At the time of writing it seemed the GOP would eke out a narrow win in the House. Control of the Senate is likely to hinge on a runoff in Georgia — and could remain in Democratic hands.

Election chatter will rumble on for a while. But when the president heads to Sharm el-Sheikh tomorrow, it will not be with his climate plans in tatters, as many had feared. (For more on the COP27 talks, check out our sister newsletter, Moral Money, which is providing a daily blow-by-blow of events in Egypt).

Today we break down what the midterm results say about — and mean for — US energy policy. In Data Drill, Amanda dissects voters’ energy priorities going into the election. Thanks for reading.

— Myles

Five takeaways from the US midterm elections

1. Soaring petrol prices didn’t matter so much

“This was a missed opportunity for Republicans going into the election,” said Frank Macchiarola, senior vice-president at the American Petroleum Institute, Big Oil’s lobby group in Washington.

It certainly felt that way. With petrol prices climbing above $5 a gallon to hit a record high earlier this year, fanning decades-high economy-wide inflation, all while an energy crisis raged globally, the spectre of Jimmy Carter’s presidency — derailed by spiking oil prices — seemed to be hanging over Joe Biden’s first term.

And let’s be honest, it wasn’t just Republican politicians obsessing over prices. We in the media repeated, as if was axiomatic, that $5-a-gallon gas was poison for Biden’s White House.

The White House seemed to agree. Ron Klain, President Biden’s chief of staff, was “obsessed” with the petrol prices in swing state Nevada, said one person familiar with the matter. When prices dropped a cent or two, Biden’s comms team would tweet an update. And barely a week went by without Potus trying to ease the pain at the pump. Consider:

-

Record-breaking oil releases from strategic stockpiles

-

Repeated calls for more shale production

-

Threats to hit producers with new taxes and investigations

-

Pleas to Opec for more supply, including that fist-bump with MBS in Jeddah

-

Lifting of pollution rules

Yet, horror of horrors! Despite all that effort, prices this week remained 60 per cent higher than when Biden entered the Oval Office.

Whisper it, but maybe in the middle of a war, following a global pandemic, and with questions about women’s rights and the very future of the republic in the air, American voters thought other matters deserved some attention too.

When the dust settles, maybe we’ll discover that enough voters also thought Biden’s climate and clean energy agenda — one central to his pitch for the presidency — was worth sticking with.

Or maybe the administration’s tactical move to blame oil companies for the price inflation worked. Or perhaps Democrats could have defended even more House seats if gasoline prices had been lower. We can’t say. What we do know is Americans have never paid more for their gas than this year — and yet Biden’s presidency remains on the rails.

2. Smooth(er) sailing to Sharm el-Sheikh

Even with election results still being tabulated, Biden is headed to the UN COP27 climate conference with an unexpected wind at his back.

The signal from the election, Biden will no doubt argue in Sharm el-Sheikh, is that his clean energy and climate agenda has been validated by voters. That will give him credibility as he leans on other countries to do more to slash emissions.

The climate talks will still be difficult. The US’s primary initiative is climate envoy John Kerry’s plan to get the world’s biggest companies to buy carbon credits from developing countries that are cutting emissions.

The scheme has been criticised given the struggles to develop effective carbon offset markets. Still, it could provide a blueprint to funnel more climate cash to poorer nations, a key aim of this year’s COP27.

The Biden administration is also likely to continue pressing countries to cut their methane emissions from oil and gas output. This might be easier now that he is not under pressure to get domestic US producers to increase their production too.

Democrats’ better than expected showing will also be seen in Sharm el-Sheikh as a win simply for what it avoids — the return to dominance of a Republican party that has sought to undermine action on climate change at every turn. For now, the US remains at the table.

An overhaul of America’s clunky permitting system is probably back on the agenda. But a flood of new crude production is not.

Kevin McCarthy — the likely new speaker of the House of Representatives — will look to scrap red tape Republicans believe has hampered American oil and gas operators from boosting production.

The big issue for the industry is faster approvals to build pipelines. If McCarthy or the Republicans can deliver that, it may also be good news for clean energy developers that have faced the same onerous permitting rules.

A divided government need not hinder energy progress, reckons the API’s Macchiarola.

“We saw the crude oil export ban lifted in a Republican Congress and the Obama administration. We saw the Energy Independence and Security Act during the Bush administration and the Democratic Congress. So it doesn’t mean that Congress stops working and the administration stops working,” he said.

The oil and gas industry will also try to win support for faster permitting to allow for more liquefied natural gas exports.

“We’re going to really promote LNG exports in the coming year and we think that’s an issue that can have bipartisan support,” Macchiarola said.

Even if they get their cherished permitting reforms, US operators have made clear they have no intention of unleashing a torrent of new output — their investors are quite content instead with the flood of cash still heading their way as producers keep a lid on spending.

In fact, the Energy Information Administration on Tuesday slashed its expectations for US oil production growth next year by about a fifth.

4. Full speed ahead for the Inflation Reduction Act?

As Tuesday’s expected red wave turned into more of a dribble, Democrats and clean energy executives breathed a sigh of relief. The Inflation Reduction Act, Biden’s $370bn climate bill, and other legislation designed to advance clean energy, remained safe, they believed — and popular. Had Republicans won a strong majority it could have been imperilled.

In fact, said analysts, although Republicans had focused on the colossal spending by Biden in his clean energy programmes — an effort to pin the rampant inflation in the economy on his legislation — the IRA likely helped bring out younger Democratic voters.

May Boeve, executive director of the climate group 350.org, said the results gave Biden and Democrats “breathing room to implement real climate solutions and ensure that the historic climate legislation that was passed in August — the Inflation Reduction Act — can be implemented.”

Abby Hopper, head of the Solar Energy Industries Association, agreed, saying the administration and industry could now move on to building momentum in the next two years to embed Biden’s clean energy revolution in voters minds.

“The best thing we could do . . . is to have projects on the ground, jobs being created, tax revenue happening, local politicians seeing evidence of growth in their communities and states and jurisdictions,” she said.

5. A rethink in Riyadh

The midterm results will have implications for global energy politics too.

Opec+’s decision in October to slash production caused a deep rift between Riyadh and Washington — and the relationship hasn’t recovered. Opec officials and the Saudi energy minister say the decision was purely technical and not political at all. But senior Democrats seethed, threatening to tear up the security alliance with Riyadh. It is no secret that MBS and others have enjoyed a closer relationship with Trump-era officials than with Biden and his lieutenants.

Republican control of the House is helpful for the kingdom, because Democrats will not be able to force anti-Saudi or anti-Opec legislation through Congress on their own.

But if Saudi Arabia was hoping the midterms would bring a decisive swing in the balance of power on the Hill back towards friendlier Republicans, the results will force a rethink in Riyadh.

That’s true for Moscow too, which might have hoped for a surge behind the Maga Republicans who said they wanted to cut weapons and financial support for Ukraine.

The White House will feel emboldened in its stand-off with the Saudi-Russian oil axis. How Opec+ reacts will be plain during a decisive few days next month, when the cartel meets in Vienna on December 4; the EU embargo on Russian oil (and US price cap) starts on December 5; and the Senate run-off in Georgia will take place on December 6. (Derek Brower, Justin Jacobs, and Myles McCormick)

Data Drill

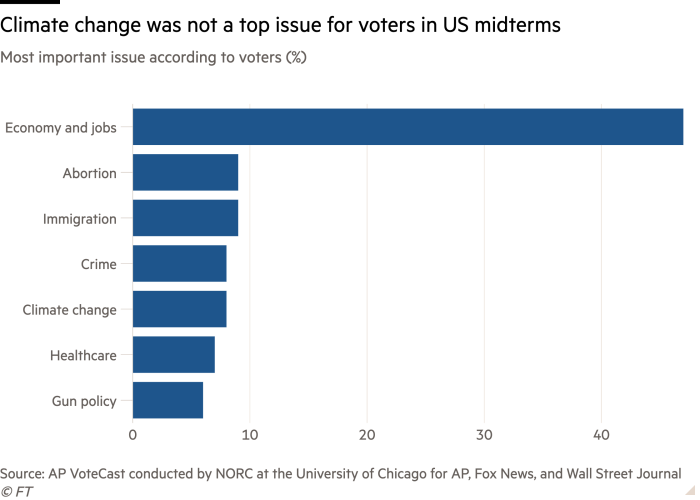

Half of all voters cited inflation as the single most important issue in this election, with Republicans twice as likely as Democrats to select this response, according to polls by AP VoteCast.

Among the inflation crowd, 16 per cent said petrol or other transportation costs were the most important factor, second behind groceries and food.

When it came to selecting an approach to energy policy, Democratic voters were nearly three times as likely as their Republican counterparts to choose expanding renewables over boosting fossil fuel production, according to AP VoteCast.

Network polls also show Republicans were more likely to identify petrol prices as a financial hardship while Democrats were much more likely to identify climate change as a serious problem. (Amanda Chu)

Power Points

Energy Source is a twice-weekly energy newsletter from the Financial Times. It is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here