Hello, this is Kenji from Hong Kong. I made my very first post-Covid business trip to Thailand last week, thanks to easing of restrictions in both jurisdictions. While I was exempt from compulsory hotel quarantine upon return (at one point this was three weeks), I was barred from dining out for the first three days and will have to queue up for three compulsory PCR tests.

Hong Kong government officials claim that the city is “back,” as it hosted a major financial forum and the Rugby Sevens tournament last week, but inconveniences like these stand out against competing regional cities like Bangkok.

Still, when we shift our gaze north to mainland China, things here don’t look so bad. A few infections can trigger lockdowns or other restrictions on movements, as we witnessed in a northern city of Zhengzhou. Apple recently confirmed that COVID curbs in the city had hit production of iPhones there, and warned of delayed deliveries for some models.

On top of the lingering impact of the pandemic, the tech world continues to face supply chain pressures stemming from Sino-American tensions, Russia’s invasion of Ukraine and climate change. But it is not all doom and gloom as some companies are finding ways to navigate this environment, as you will see in this issue of the newsletter.

Bracing for impacts

Key tech companies are doing all they can to cope with rising geopolitical tensions and pandemic-related disruption, particularly their impacts on supply chains. J.K. Lin, senior vice-president at Taiwan Semiconductor Manufacturing Co., told Nikkei Asia’s Cheng Ting-Fang that the world’s largest contract chipmaker is working to secure locally produced neon gas as part of its efforts to enhance supply chain resilience and also reduce carbon emissions.

The TSMC executive, who is in charge of risk management, emphasised that the company does not intend to localise its entire supply of neon, which is “not realistic and very costly,” but rather to build a more robust supply chain. The chip industry faced serious disruption following the outbreak of war in Ukraine, which controls about half of the world’s supply of semiconductor-grade neon gas.

Another example of a company bracing for potential disruption is Lasertec, a Japanese maker of inspection systems for cutting-edge chipmaking equipment.

In an interview with Nikkei Asia’s Mitsuru Obe, Lasertec President Osamu Okabayashi said he is “concerned” about the US-China tech war following Washington’s latest crackdown on Beijing’s chip ambitions, even though the impact on his company has been limited so far.

Okabayashi aims to take the company into new areas. “Semiconductors happen to be an area where our inspection technology is most in demand,” he said. “But we don’t limit ourselves to semiconductors. We look at any industry where we can deploy our core technology.”

China’s chip tweaks

China’s leading chip designers Alibaba and start-up Biren Technology are reducing the processing speeds of their most advanced chips to comply with US-imposed sanctions aimed at limiting Chinese computing power, write the Financial Times’ Qianer Liu, Ryan McMorrow, Nian Liu and Kathrin Hille.

Both companies had already conducted expensive test runs for their chips at TSMC but were forced to halt further production because of Washington’s new rules. In addition to stopping production, the US export controls have also forced the companies to make changes to their designs, according to people familiar with the situation.

The chip design industry was China’s best hope for creating advanced hardware to compete with international leaders like Nvidia and AMD, fuelled by billions of dollars in investment and policy backing. Alibaba’s chip arm T-head and Biren have spent years building the blueprints of chips to power China’s supercomputers, AI algorithms and data centres.

Meanwhile, both TSMC and Chinese engineers have had difficulty understanding what is compliant with the restrictions due to Washington’s unclear rules for calculating a key metric in the threshold for chips called the bidirectional transfer rate, or the speed with which chips send data to each other.

As a result, the Taiwanese company has requested Chinese clients self-report the specifications of chips and sign disclaimers.

A first for Tesla

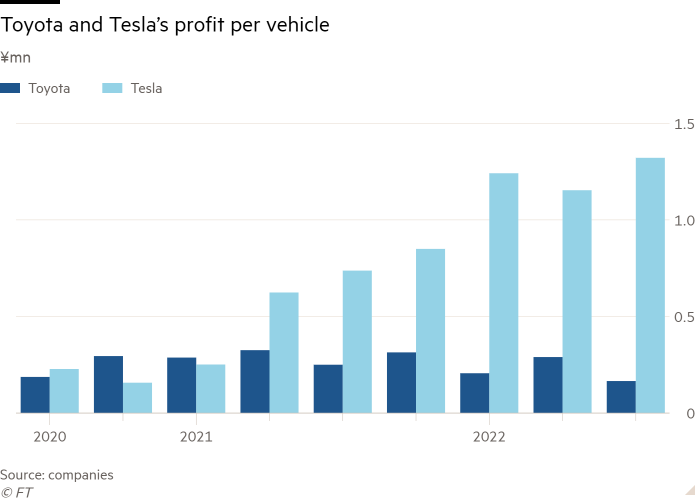

Even though Toyota Motor sold over seven times more cars than Tesla between July and September, the American electric vehicle maker surpassed its traditional Japanese peer in quarterly net profit for the very first time. Tesla was able to reach this milestone, writes Nikkei’s Kazuhiro Noguchi in Nagoya, thanks to its high profitability per vehicle, which far outstrips not only that of Toyota, but all major players, including Mercedes-Benz.

There are extraordinary factors that need to be considered for Toyota, such as a one-time loss for its exit from Russia. But the reversal in profit symbolises the tectonic shift taking place in the auto industry as the climate becomes an overriding concern for more and more consumers.

Sony’s paper play

As global leaders gather in Egypt for this year’s COP27 climate summit and companies come under increasing fire for their role in polluting the planet, Sony Group is taking steps to cut its use of plastic.

The consumer electronics maker will start eliminating plastic from its product packaging next year, Nikkei has learned, substituting it with paper boxes made out of biodegradable materials like bamboo and sugarcane fibres.

The move is set to begin with smaller products weighing less than 1kg, such as smartphones, cameras, and earbuds. These items accounted for about 40% of all products shipped by Sony during the financial year ended in March 2022. However the company has yet to specify a road map for ditching plastic packaging for bulkier items like big-screen TVs.

Hiroyoshi Niwa at Deloitte praised Sony’s initiative as “very novel.” It may be, but considering that packing materials made up 90,000 tons of the 440,000 tons of products Sony shipped last year, the company has a long way to go — as do its rivals.

Suggested reads

-

Apple’s bargain with Beijing: access to China’s factories — and consumers (FT)

-

How Intel plans to rival TSMC and Samsung as a chip supplier (Nikkei Asia)

-

Crypto groups scramble to prove stable finances after FTX crisis (Nikkei Asia)

-

Foxconn/Apple: dire effects of zero-Covid policy will widen (FT)

-

Walmart-owned Flipkart curbs M&A and hiring as losses mount in India (FT)

-

LG eyes wearable potential for stretchable, twistable display (Nikkei Asia)

-

China’s central bank struggles to force tech groups to share user data with state (FT)

-

Japan’s Murata to invest $305mn in China factory, eyeing EV surge (Nikkei Asia)

-

Shares of Indonesia’s Blibli climb in $509mn IPO (FT)

-

NTT DoCoMo to invest $4bn in Web3 using mobile infrastructure (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at [email protected]