What planet are you on if you think Elon Musk’s mission to populate Mars might make sense? Planet Earth is the answer, with the specific location of Sharm El Sheikh, Egypt. It is here that UN head António Guterres warned this week’s COP27 conference that the world is on a “highway to climate hell”.

What is needed, as Elvis once remarked, is a little less talk and a little more action. To co-ordinate this, governments should take a rummage in the tool box of finance and business.

Energy transition is simply a capital project, albeit a large, complex one costing some $100tn plus over 30 years. We know what capital projects are: dams, motorways and ship canals. We know how they work too: a government specifies infrastructure, pump primes with public money, sets milestones and offers extended contracts bearing dependable returns. That levers in private capital.

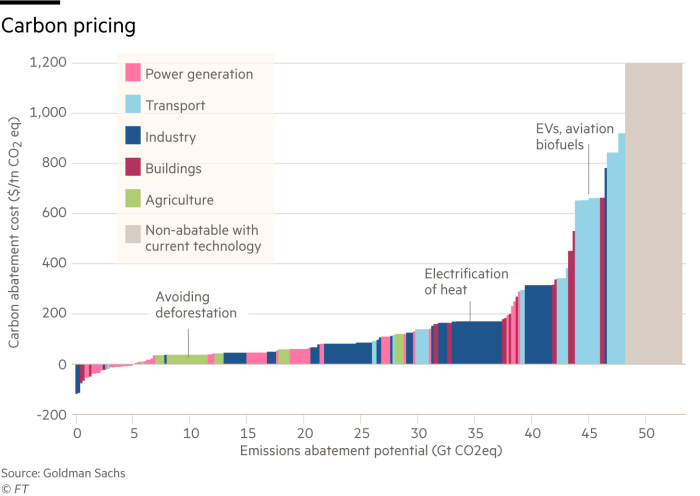

The path of transition has already been helpfully mapped by the likes of the International Energy Agency. The most cost-effective net-zero energy system of the future would use renewables for everything running on electricity — roughly 50 per cent of the total. The world’s sunniest and windiest areas should be incentivised to generate some renewables for everyone else.

The biggest obstacle is Balkanisation. At present, each country proposes a nationally defined contribution to carbon reduction and works on it, or not, in isolation.

Civil engineering projects succeed because a prime contractor breaks a job up into chunks that are parcelled out to specialised subcontractors. The US would inevitably figure as the prime contractor. It already herds cats within a bunch of supranational organisations.

Finance would then be easier to subdivide too, via international debt syndication. New York and London have centuries of experience here. Once technologies are in the money, they grow fast.

Modular technologies harness the power of markets to pretty spectacular results. We do less well on big investments. Cross border hydrogen pipelines are a case in point. If governments supported these on a multilateral basis, private capital would soon materialise.

The Lex team is interested in hearing more from readers. Please tell us what you think of applying the methods of business to energy transition in the comments section below.