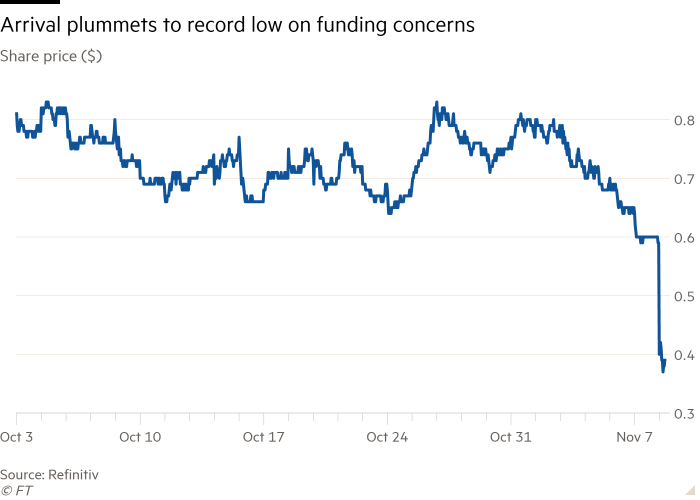

Shares of British start-up Arrival plunged by a third after it warned it could run out of cash in less than a year.

It added it would struggle to remain viable even after cost cuts and the axing of 700 jobs as it reported a larger loss for the third quarter than in the previous year.

“The company does not currently have cash on hand to fund operations for the coming 12 months, and that material uncertainties about going concern remain after consideration of these mitigating actions,” it said.

Shares tumbled 35 per cent to $0.38 by Tuesday late afternoon.

The start-up had unveiled a radical plan last month to save its dwindling cash pile, by focusing on the US and ditching plans to sell a van in the EU, as well as losing hundreds of roles.

The company, which floated last year through a scrutiny-lite reverse merger, risks being delisted in May if it does not raise its share price above $1, under Nasdaq stock exchange trading rules.

At the end of September, the company had $330mn of cash or equivalents, it said.

Its cash burn was about $180mn in the third quarter, though it expects this to drop to $60mn once all of its cuts are made, which will be in the first quarter of next year.

Arrival’s finance chief John Wozniak said the company had held “preliminary discussions” with a “handful of parties” to raise fresh money, but it will take up to “six months” to materialise.

The gulf means the company risks running out of cash during summer 2023, unless it can find new investors or a buyer.

The business was “exploring all funding and strategic opportunities to obtain this necessary funding”, it added.

In the third quarter, Arrival made a loss of $310mn, compared with $30.6mn a year earlier, after writing off about $232mn from past investments.

Arrival, which is backed by Hyundai and BlackRock and was once valued at €15bn, has been plagued by delays that are not uncommon among electric vehicle start-ups.

Over the weekend, the Financial Times reported that its first commercial van for the US market would take years to be developed, while the company needed additional funding to proceed with the project.

Morale inside the business had fallen to “rock bottom” among staff, the FT also reported, while the business had been distracted by side projects including an electric jet plane and hampered by a vehicle fire.

Arrival automotive boss Mike Ableson said he expected the US van to take “12-18 months” to begin production, once the company had raised additional funding.

Company president Avinash Rugoobur added that the delay meant the business would not begin generating revenues until after 2023.