Investors who poured money into funds aimed at protecting them from the sell-off in shares are finding many of the strategies have backfired, offering little or no safeguard from a drawdown that has sliced $13tn off the US stock market.

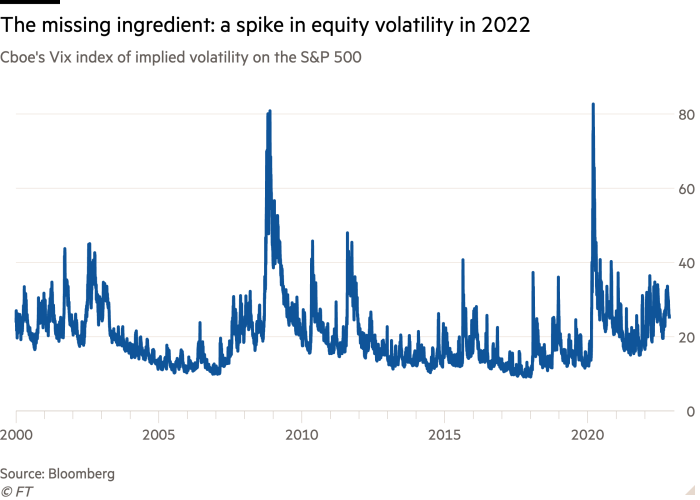

Funds that focused on buying equity put options, which are often used as insurance against stock declines, have struggled to make gains even as the S&P 500 suffers its worst drawdown since the 2008 financial crisis. Those who prepared for violent swings by buying call options on the Cboe’s Vix index — which would pay off if the market gauge of expected volatility spiked — have also been left wanting.

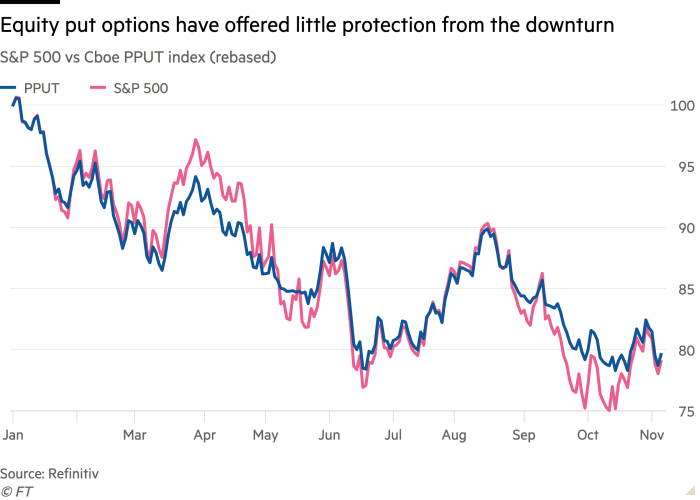

A Cboe index that tracks a theoretical portfolio that buys both stocks within the S&P 500 and equity put options — known as the PPUT index — has fallen roughly 20 per cent this year, not any better than the total return of the S&P 500.

Dylan Grice, co-founder of Calderwood Capital, a hedge fund advisory and research firm, said the performance of put options this year had raised “fundamental” questions about the point of some strategies. “It’s like an insurance company that doesn’t pay out when you have an accident,” he said.

The lacklustre performance has been driven in part by the slow grind lower in the stock market, which has driven up costs without providing the sort of sharp sell-off that provided mammoth pay-offs in the early days of the coronavirus pandemic in March 2020 or the midst of the financial crisis in September and October 2008.

Many mutual funds and exchange traded funds that are marketed as hedging against declines in the US stock market use relatively simple strategies, continuously buying contracts that would protect their portfolio if the S&P 500 falls below a given threshold. They adjust those thresholds each month, spending heavily on new put contracts in the process.

While the Vix has been well above its historical average throughout 2022, it has stayed in a relatively narrow range, limiting returns for traders. In past crises, a return of 200 per cent or 300 per cent from a relatively small bet on the so-called “fear gauge” could offset declines on an endowment or pension plan’s wider portfolio. Recent swings between 25 and 35, in contrast, provided only a fraction of the return that some investors enjoyed when the index shot from 13.68 in February 2020 to 82.69 a month later.

“You have had to be a very nimble tail hedge manager and a lot of them . . . are rules-based and formulaic and that’s a dangerous place to be,” said Peter van Dooijeweert, a hedging specialist at hedge fund Man Group. “The Vix has been completely useless as a hedge since the initial days of the Ukraine war.”

Funds that use a broader mix of assets to hedge against downturns have had a far better year. The Eurekahedge tail risk index, which tracks a basket of specialist hedge funds, is up 13 per cent year to date by contrast.

That is because the volatility in sovereign bond and currency markets has been far higher than in the equity market. Ice’s closely followed Move Index, which tracks the swings in the US Treasury market, this year surged to its highest level since the coronavirus-induced turmoil of 2020. That has made it a far more lucrative space to trade options — and for funds that have focused on other asset classes the results have been solid.

“The crisis we’ve been through has really been a rates led crisis,” said Thomas Leake, the head of solutions at volatility-focused hedge fund Capstone. “It has really been about central bank tightening and about the market being uncertain about the future path of interest rates and that’s led to a big, big increase in the market price of interest rate volatility.”

Saba Capital Management’s Boaz Weinstein told the Financial Times last month that his tail risk fund, which had climbed 31 per cent, was holding assets that protect against credit defaults rather than equity puts because they do not perform as well when markets grind lower.