Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

The origin story of CS First Boston

-

Pressure mounts on Goldman’s top “fixer”

-

Monte dei Paschi’s controversial rights issue

Meet CS First Boston, the cheaper option for Credit Suisse

When you have what analysts estimate to be an over sFr4bn capital hole, every penny counts.

So it makes sense why Credit Suisse has settled on the name CS First Boston for its soon-to-be spun-off capital markets and advisory business.

Credit Suisse this summer had planned to name the unit First Boston, a brand that harks back to the go-go 1980s and the Swiss bank’s emergence on Wall Street when it acquired the investment bank in 1990.

There was one problem, though. Credit Suisse no longer owned the naming rights to First Boston, which had been acquired by a series of small financial services businesses that refused to sell, report DD’s Arash Massoudi and the FT’s Owen Walker and Andrew England.

Credit Suisse instead settled on a cheaper option: CS First Boston.

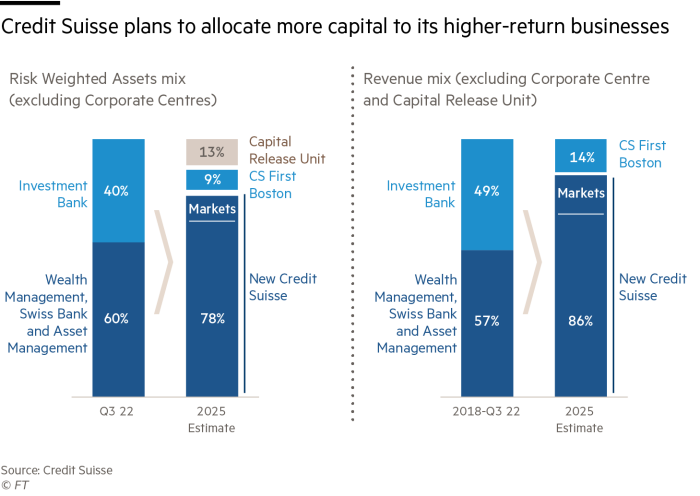

Though Credit Suisse may have saved cash on the rebrand, it unveiled a mass restructuring on Thursday that shaved billions from its market value.

In addition to the spin-off, which will be completed within the next three years, Credit Suisse will sell part of its securitised products unit to US investment groups Pimco and Apollo, divesting of one of its most profitable units.

Credit Suisse will cut SFr2.5bn of costs, representing 15 per cent of its cost base, by 2025. It added that the workforce would shrink from 52,000 to 43,000 over the next three years.

The plan is a testament to new chief Ulrich “Uli the Knife” Körner’s vision to slash costs and pare down its investment bank. What is left will be a bank more focused on wealth management and its Swiss domestic market.

The expensive restructuring is to be funded by a SFr4bn capital raise, backstopped by the Saudi National Bank, whose investment will make it Credit Suisse’s largest shareholder.

That deal with SNB, the largest commercial bank in the Gulf country, was poorly received. “It’s very painful to give 10 per cent of the bank away for just SFr1.5bn,” said a top-10 shareholder in the group. The nickname “Credit Saudi” has already begun to circulate around Zurich.

SNB said it invested to work with Credit Suisse on developing asset management, wealth management and investment banking services in Saudi Arabia. It also said it would consider investing in the spun-off CS First Boston business.

Board director Michael Klein will step down to advise the bank on spinning out CS First Boston, which he will later lead as chief executive.

Tightening finances in Switzerland may force the troubled bank to further accept the Middle East’s growing reservoirs of cash.

“The region is important to us from a wealth perspective, so it’s important to have large investors who are there,” said a person involved in discussions over the SNB investment. “Some other investors may have concerns, but it’s not something we worry about.”

‘David’s guy’: The pressure’s on for Goldman’s top fixer

Through countless management overhauls and lay-off rounds, one Goldman Sachs veteran has outlasted it all on his reputation for being a reliable numbers guy. After almost three decades rising through the ranks, Marc Nachmann is now reaping the rewards.

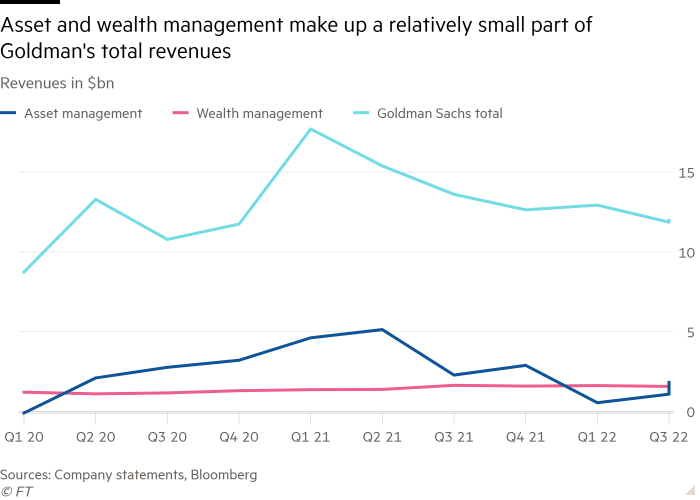

Nachmann has emerged as one of the top winners in Goldman’s latest reshuffle after being crowned the head of a newly merged $2.4tn asset and wealth management division.

Since beginning his Goldman career in 1994, Nachmann has excelled less because of his trading or investing expertise than his skills as a shrewd cost-cutter.

Nachmann rose through the ranks of the investment banking division and became the group’s co-head in London in 2019. A trusted ally of current chief executive David Solomon, Nachmann helped him carry out one of his early pledges — to get ahold of the bank’s opaque trading house, which had struggled to boost revenues over the past several years.

“Marc’s ‘the fixer’,” said one Goldman banker. “Private wealth and asset management are about to experience what it’s like to work with Marc, which they definitely have not experienced before.”

But in addition to the good faith entrusted to him by Solomon, Nachmann — referred to as “David’s guy” by another former Goldman colleague — shoulders an inordinate amount of pressure.

Nachmann’s success will be key to Solomon’s push to make Goldman less reliant on its two biggest engines, investment banking and trading.

Generating a more stable source of fee income by managing money for wealthy clients will be integral to closing the stock market valuation gap with rivals such as JPMorgan Chase and Morgan Stanley.

And as DD outlined last month, Solomon is already in hot water after his initial strategy to diversify the bank didn’t pan out as he’d hoped.

“Now, unfortunately for David, the clock is beginning to tick,” one Goldman banker told the FT earlier this month.

MPS’s controversial comeback strategy

What’s a bank to do if it fails to convince investors to back its seventh rights issue in under 15 years? Pay the pool of banks arranging the deal exorbitant fees to underwrite it.

That was the strategy employed by Luigi Lovaglio, the turnround specialist appointed this year by Mario Draghi’s government to revamp and privatise Italy’s Banca Monte dei Paschi.

After frantically trying to convince investors to foot the remaining €900mn of shares in the lender’s €2.5bn rights offering, of which Italy’s finance ministry has agreed to commit 64 per cent, Lovaglio finally persuaded arranger banks to get on board . . . for the unusually high fee of €125mn.

The underwriters — among them Bank of America, Citigroup, Credit Suisse, Mediobanca and alternative investment fund Algebris — appear to have stumbled upon a decent deal having offset the risk. Not all of the bank’s stakeholders feel the same.

One London-based investor in MPS has called for the European Central Bank to block the rights issue, the FT’s Silvia Sciorilli Borrelli and Martin Arnold report, arguing the Italian bank is indirectly buying its own shares in the offering.

“It is unclear, to say the very least, that a private investor in the position of MPS would provide an underwriting fee of such a scale to others in order to ensure the purchase of unsubscribed shares, and directly or indirectly contribute to the purchaser,” law firm RPC wrote in a letter this week to the ECB’s supervisory board on behalf of the investor.

While the ECB declined to comment on the letter, officials are expected to push back on the demand to withdraw their authorisation of the capital raise, according to one person familiar with the matter.

Officials in Brussels, meanwhile, are concerned that the rights issue could constitute illegal state aid.

It’s understandable why the Italian treasury might search for short-cuts in its quest to reboot the bank. The rights issue is a necessary condition to privatise the bank, and Italy can’t wait to get rid of its oldest banking headache.

If RPC’s client gets its way, however, the struggle is far from over.

Job moves

-

Samsung has appointed vice-chair Lee Jae-yong, the grandson of the company’s founder, as chair. Lee, who had served jail time over a bribery conviction but received a presidential pardon in August, fills a position that had been vacant since the death of his father, Lee Kun-hee, in 2020. More from Lex.

-

Goldman Sachs has appointed Kevin Johnson, the former president and chief executive of Starbucks, as an independent director of the firm.

-

Global Infrastructure Partners has hired Evercore chief financial officer Celeste Mellet as a partner and chief financial officer, based in New York.

-

Linklaters has appointed Françoise Maigrot as managing partner of the firm’s Paris office for a four-year term beginning in January, succeeding Bertrand Andriani.

Smart reads

Playing the field The concept of fund-of-hedge funds is appealing in theory: rounding up the finest hedge fund managers and combining them into a high-returning portfolio. But their performance hardly lives up to expectations. Multi-strategy funds offer a new and improved version, Alphaville writes.

Conflicts of interest Private equity dealmakers often dictate terms to the lenders funding deals, including assigning their legal counsel. This law firm designation model has spurred a number of ethical debates in the industry, The Lawyer reports.

The last pop superstar? The colossal success of Taylor Swift’s latest album might suggest a pop music renaissance. But the singer is the exception to the rule, the FT’s Anna Nicolaou writes, as music labels stretch themselves to satisfy fragmented audiences in the streaming era.

News round-up

Santander to pay $900,000 to settle pregnancy discrimination lawsuit (FT)

US firm Nuveen buying one of Europe’s largest private lenders for over $1bn (FT)

Twitter ‘cannot become a free-for-all hellscape’, says Elon Musk (FT)

Danske Bank braced for money-laundering fines of $2bn (FT)

Billionaires Slim, Larrea face off for Citi’s Mexico business (Reuters)

Law firm Greenberg Traurig latest to move to cut ties with Kanye West (FT)

Meta’s value plunges more than $80bn amid falling sales and rising costs (FT + Lex)

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here