The end of the world is the end of the world no matter how rich and powerful you are. The ‘adpocalypse’ FTAV first wrote about after relative small-fry Snap issued a warning in May now looks to be consuming even Alphabet and Meta.

Most analysts and many investors seem to have assumed it was only an issue for spivvier social media companies, not Google and Facebook. But third-quarter results from the pair this week have now wiped a combined $170bn off their market capitalisations.

Expectations were that YouTube advertising revenue would rise 4.4 per cent for the third quarter. Instead it fell 2 per cent. Meta’s ad revenue fell 3.6 per cent year-on-year to a measly $27.2bn. Snap’s shares are down another 11 per cent since underwhelming results late last week.

Marketing budgets are typically first to be cut during economic slowdowns, so it makes sense that companies whose business models rely on mass surveillance ads are starting to feel the pinch.

Interestingly, old-school advertising house WPP appears to have side-stepped some of the doom and gloom precisely because, in the words of chief executive Mark Read, it’s no longer “just an advertising company”. Shifting consumer habits meanwhile seem to be exacerbating the slump for Big Tech.

Viewers’ dwindling attention spans mean YouTube “shorts” — videos lasting anywhere from five seconds to a minute, streamlined for passive consumption — have grown in popularity even as masters of the craft TikTok scoops up market share. Yet neither company has so far worked out how to monetise the fad.

Philipp Schindler, Alphabet’s chief business officer, put it like this on Tuesday’s earnings call, shortly after the company reported a 26.5 per cent drop in net income for the year to September 30:

We continue to experience a slight headwind to revenues as shorts viewership grew as a percentage of total YouTube watch time — the initial progress on shorts monetisation has been encouraging and we’re focused on closing the monetisation gap between shorts and long-form content on YouTube over time. Consumers are increasingly consuming short-form video. Shorts are being watched by 1.5bn plus logged on users every month.

It’s a similar story over at Meta, whose relentless pushing of Instagram’s short-video format Reels over photo-sharing over the summer was met with pushback from heavyweight influencers Kim Kardashian and Kylie Jenner. Calls for Instagram to “stop trying to be TikTok” (whose pre-tax losses increased by a third to $896mn in 2021) alight on a salient point.

Meta said on its earnings call on Wednesday that the total number of “ad impressions” served in the third quarter rose 17 per cent as the average price per ad fell 18 per cent. The year-on-year price decline was driven by foreign currency depreciation and lower advertiser demand, but also “strong impression growth, especially from lower monetising services (and regions)”.

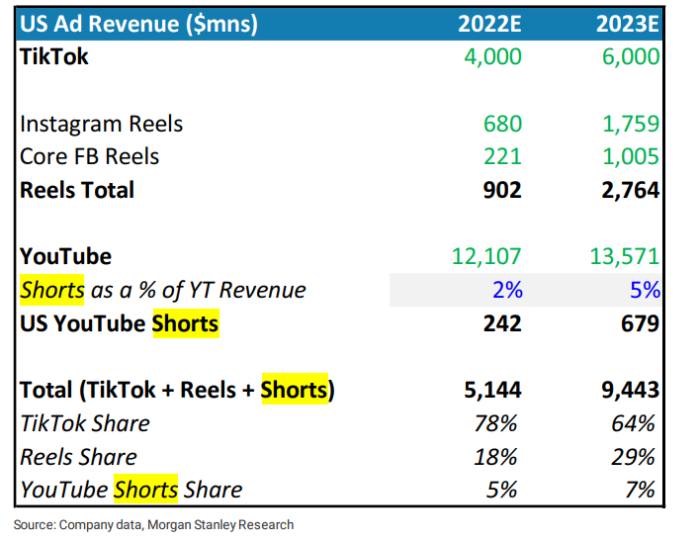

Analysts at Morgan Stanley remain bullish, forecasting combined US ad revenue for TikTok, YouTube Shorts and Meta Reels to reach $9.4bn in 2023 versus an estimated $5.1bn this year.

But companies need to adequately compensate creators if they hope to hit these targets, Morgan Stanley says. That might mean another land-grab of the type that has mostly destroyed value in online niches including media streaming, food delivery, minicab hailing, used car retail, etc.

Creators drive engagement … so this will be an interesting competitive dynamic as we believe the more scaled and cash flush META/GOOGL (with 10mn+ advertisers and already sophisticated matching/targeting ad tools) could use higher creator compensation terms to compete harder against TikTok.

It’s potentially good news for a lucky few creators of abbreviated dance routines, skits, pranks, stunts, performative charity acts and DIY hacks. The challenge now for the TikTok-alikes will be to find a balance between ads and short-form video that keeps viewers interested in both — and so far, the response from shareholders as well as from users suggests they’re pleasing no one.