One smart watch to start: As the economy takes a turn, private equity firms are increasingly selling companies to themselves. DD’s Kaye Wiggins breaks down the trend and what it means for the sector.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

The fight over JPMorgan’s A-list clients

-

Tiger Global’s China strategy bites back

-

René Benko in the spotlight

JPMorgan: a house divided

In February of 2020, a flock of A-list celebrities, athletes and financiers gathered at Alex Rodriguez and Jennifer Lopez’s home in Miami to celebrate the pop star’s Super Bowl performance with Shakira.

The championship game between the San Francisco 49ers and the Kansas City Chiefs wouldn’t be the only epic clash to ensue.

The fête played host to a fateful meeting between Gwen Campbell, Rodriguez’s financial adviser at Bank of America’s Merrill Lynch division, and JPMorgan Chase executive Mary Erdoes, who would eventually convince her to bring her valuable client list to the rival lender.

Campbell set up shop at JPMorgan Advisors, a separate division from the private banking unit overseen by Erdoes. Shortly after, infighting erupted between the two units over how to manage Rodriguez’s multimillion-dollar fortune.

That battle is still raging two years later, reports the FT’s Joshua Franklin.

The rift highlights a turf war between separate but overlapping business divisions at JPMorgan — tensions that grew more cut-throat when the bank acquired Bear Stearns during the 2008 financial crisis.

Campbell, who alleges that her coworkers at JPMorgan’s private bank have been trying to poach Rodriguez since she joined the Wall Street firm, hasn’t backed down despite her request for a restraining order against the bank being shot down last year.

She’s still working at JPMorgan in San Francisco and has been seeking financial damages through arbitration for what she alleges is a breach of contract. A hearing is scheduled for July.

Campbell alleges her time at JPMorgan hasn’t been easy. Her team of advisers has lost three members and she has complained in legal filings of having been periodically locked out of the bank’s computer systems.

The situation has prompted the involvement of Malcolm Gladwell, a New York Times bestselling author and a longtime Campbell client, who wrote to JPMorgan boss Jamie Dimon urging him to intervene on her behalf, according to messages seen by the FT.

“It just strikes me that they’re torturing her,” Gladwell told the FT. “I don’t understand why someone would willingly make someone’s life miserable for no reason.”

Gladwell also complained about how the saga has affected his own relations with the bank. “My financial adviser has been exiled like Napoleon on Elba. Is that the way you treat your clients?”

Tiger Global’s new China problem

When Chase Coleman’s hedge fund Tiger Global was riding high, China was the source of some of its greatest windfalls.

Now, with its $63bn portfolio of public and private holdings battered by a sharp sell-off in technology stocks, China is turning into a new headache for the embattled hedge fund giant, DD’s Antoine Gara, Ortenca Aliaj and Eric Platt report.

On Monday, Chinese stocks plunged after president Xi Jinping secured an unprecedented third term as party leader and economic data showed that China’s growth rate fell well below Beijing’s annual target of 5.5 per cent.

Shares in many of China’s largest and most prominent technology groups slid between 10 per cent and 25 per cent in the trading day, underscoring foreign investor unease about the future of the country’s tech giants following a regulatory crackdown.

The slide was particularly painful for Tiger, which has reshuffled its public stock portfolio over the past six months and maintained a large exposure to Chinese equities after its flagship hedge fund has plunged over 50 per cent.

Logistics giant JD.com, Tiger’s single largest public stock holding, slid 13 per cent. Chinese electric carmaker Li Auto and online jobs website Kanzhun fell between 17 per cent and 22 per cent, respectively.

It cut plunging investments in Carvana and food delivery app DoorDash after absorbing heavy losses and made Li Auto and Kanzhun top 10 public holdings at mid-year.

In a letter to investors discussing its woeful first half, Tiger was relatively optimistic about Chinese stocks nonetheless.

“While China remains out of favour among most investors, our Chinese longs have declined less year to date than their US counterparts,” the firm wrote to investors in an August 3 letter seen by the FT.

Another investor burnt by the Chinese equities rout is Charlie Munger, the vice-chair of Berkshire Hathaway who helped steer an investment currently worth nearly $20mn into Alibaba by the Daily Journal, the Los Angeles-based newspaper chain he chairs.

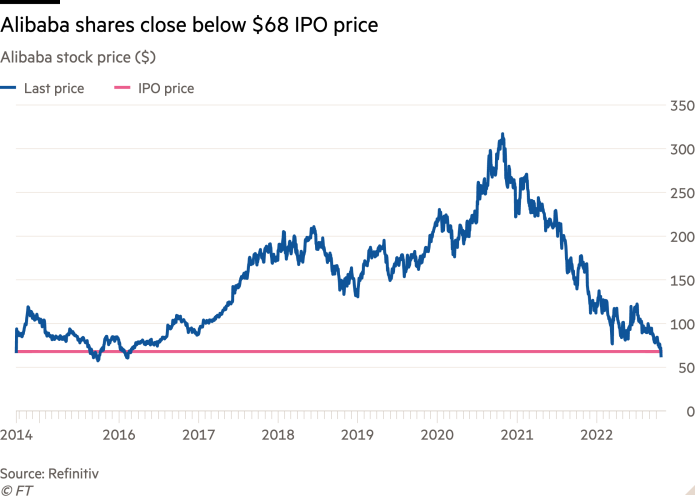

Shares in the tech group have declined by nearly 80 per cent since 2020 — and on Monday fell below its 2014 IPO price.

“[We] invested some money in China because we could get more value in terms of the strength of the enterprise on the price of security than we could get in the United States,” Munger said at a shareholder meeting in February.

The next few months will be critical in determining whether Coleman and Munger’s theories hold up.

The new Mr Selfridges?

Being called a clown by a tabloid newspaper is an unpleasant enough experience for any billionaire. But being called a clown by a newspaper that you (at least partly) own is surely worse.

René Benko knows the feeling. Kronen Zeitung, the rightwing newspaper in which Benko is a major shareholder, branded the controversial tycoon “Clown of the Week” on Sunday after he became embroiled in an Austrian anti-corruption probe.

While Benko may not be a household name, many of his assets are, including the luxury London department store Selfridges and the Chrysler Building in New York.

The politically connected billionaire was talking to investors in Saudi Arabia last week when he found out the Innsbruck headquarters of his sprawling property empire Signa Group had been raided by a squad of Austrian police, the FT’s Sam Jones reports.

He’s the latest high-profile individual to become caught up in the investigation that last year toppled the government of the young conservative chancellor and Benko’s former ally, Sebastian Kurz.

Benko has had legal troubles before. An Austrian court found him guilty of bribery, ruling that he had paid former Croatian prime minister Ivo Sanader to intervene with then Italian prime minister Silvio Berlusconi to quash a tax bill Signa was liable for in Milan.

He hasn’t been charged with any crime related to the latest developments in Austria, where many — particularly those who are well connected in the country’s conservative establishment — believe the prosecutors are conducting a witch hunt.

But he could face issues unrelated to the probe. Many have begun to wonder about the complex financial engineering underpinning his European business empire.

Benko, in response, is sticking to his mantra: quality will always prove its worth. And as he likes to joke, only two people in Europe have better quality real estate portfolios than he does: the British monarch and the pope.

Job moves

-

Tony Fratto, the founder of Hamilton Place Strategies (now called Penta Group) and a former senior Treasury official under George W Bush, is joining Goldman Sachs as a partner and global head of corporate communications.

-

Olympus has appointed its chief strategy officer Stefan Kaufmann, as its first foreign chief executive since the 2011 accounting scandal and the ousting of the Japanese group’s then-boss Michael Woodford.

-

Credit Suisse’s chief compliance officer Rafael Lopez Lorenzo is leaving the bank after a little more than a year in the role, Bloomberg reports, in the latest high-profile departure from the Swiss lender.

-

Keurig Dr Pepper, which is controlled by JAB Holdings, has named Sudhanshu Priyadarshi, the former finance chief of Vista Outdoor, as chief financial officer. He replaces Ozan Dokmecioglu, who succeeded Bob Gamgort as CEO earlier this year.

-

Carlyle Group has hired former Morrison & Co executive Geoff Hutchinson as head of private equity for Australia and New Zealand.

-

JPMorgan has hired Deutsche Bank veteran Richard Sheppard as co-head of its UK investment banking business, according to an internal memo seen by DD.

Smart reads

Old school vs new school UBS chief executive officer Ralph Hamers’ tech-focused vision has clashed with that of wealth management head Iqbal Khan who has built a loyal support base around his lucrative model of providing bespoke services to wealthy clients. Bloomberg examines their diverging paths.

Faces of the fentanyl crisis Cocaine has resurfaced as a popular vice among New York’s professional set. The deaths of a Credit Suisse trader, a corporate lawyer and a social worker who unknowingly ingested fentanyl while taking the drug underscore the rising risks, The Wall Street Journal reports.

Cracks in the foundation Blackstone’s $126bn Real Estate Income Trust has emerged as a crown jewel in its property empire over the past decade. But ominous developments in the property market could jeopardise its success. Our FT Alphaville colleagues investigate.

News round-up

Saudi Aramco exec spent week in Indian jail for having satellite phone (FT)

Goldman settles £20mn employment tribunal case with former banker (FT)

Credit Suisse fined €238mn in French money laundering deal (FT)

FCA asks private equity about knock-on effects of market turmoil (FT)

Goldman executives clashed over consumer bank before retail retreat (FT)

Red Bull co-founder and F1 team owner Dietrich Mateschitz dies at 78 (FT)

Top Fox lawyer’s ‘big screw up’ could reveal Lachlan Murdoch’s secrets (Semafor)

US bankers head to ‘Davos in the desert’ despite Saudi tensions (FT)

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here