This article is an on-site version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and Saturday morning

Good morning and welcome to Europe Express.

Agreeing on a common position on climate has never been an easy ride for the EU, but the current energy crisis made it even harder for some countries to sign off on a joint negotiating stance for the forthcoming UN climate conference in Egypt. We’ll bring you the latest on why environment ministers locked horns in Luxembourg yesterday.

And with energy ministers gathering today to have a first lunch discussion with the European Commission over what further energy measures it plans to put forward, I’ll unpack the latest thinking on capping the price of gas used for electricity.

Over in Paris, a parliamentary stand-off took place yesterday when not one, but three confidence votes were tabled (but ultimately failed to succeed) against the French government.

The UK meanwhile offered a rare moment of respite from the recent political turmoil as the Conservative party united behind Rishi Sunak, who is set to become the country’s youngest and first non-white prime minister.

Polish stand-off

Discussions to iron out the EU’s mandate for this year’s UN climate conference dragged on for longer than ministers (and their aides) expected yesterday, showing the strains that the energy crisis is putting on the bloc’s efforts to decarbonise, writes Alice Hancock in Luxembourg.

Two articles were up for negotiation: one that reflected the EU and member states’ readiness to update nationally defined contributions, the yardstick set out in the 2015 Paris Climate Agreement to measure climate mitigation endeavours.

The other concerned wording around the reduction of coal use, something that countries agreed to “phase down” at last year’s COP in Glasgow but more ambitious nations are keen to rule out altogether.

Approval of the EU’s negotiating mandate for COP must be unanimous among member states.

In eastern Europe in particular, coal has become a key source of energy as fuel poverty rises and people are forced to burn even football boots to keep warm.

Poland, according to three people in the room, was strongly opposed to more ambitious language on cutting coal use. “Same old, same old,” as one EU diplomat said, given that coal accounts for more than three quarters of fuel used for Poland’s power generation.

But what was more surprising was a second holdout from Poland on updating the national targets or nationally determined contributions to bring them in line with EU’s more ambitious emissions reduction efforts under Fit for 55 legislation (55 per cent by 2030 compared to 1990 levels). Warsaw’s (and others’) argument against more stringent targets was that these entail additional costs at a time when the bloc is struggling with the ongoing energy crisis.

In the end, a compromise was found by saying that NDCs should reflect the result of Fit for 55 negotiations between council and parliament. On coal, it said rather vaguely that the EU would “close the book” on unabated coal use.

Polish diplomats declined to comment on the talks.

Rob Jetten, the Dutch minister for climate and energy, said it was important to finish negotiations with parliament as soon as possible “so that we can really show the rest of the world . . . even during an energy crisis, the importance of energy efficiency and speeding up the energy transition”.

Cap in the eye of the beholder

The latest European Commission paper on the pros and cons of expanding the so-called Iberian model to the rest of the bloc, seen by Europe Express, is certainly a conversation starter for energy ministers gathering in Luxembourg today. But it is not the concrete solution leaders were asking for last week.

Still, some member states in favour of expanding the Iberian model will feel vindicated by the commission at least weighing options on the topic. “The paper is a bit like a Rorschach test: every member state will read what they want, based on their emotional disposition toward the Iberian model,” said an EU diplomat.

The paper flags several issues and complications when capping the price of gas used in electricity generation:

-

More subsidies: Member states would be obliged to pay their gas-fired power plants a subsidy which covers the difference between the actual gas price and the capped price. Countries which rely heavily on gas-powered plants (Germany, Italy, the Netherlands) would incur the highest costs, while France would benefit the most from subsidised power imported from, say, Spain. Northern and eastern member states would hardly see any benefits from the measure.

-

Right price: Current proposals circulated by member states envisage capping the price of gas used for power production at €100-120/MWh. But with gas prices having currently dropped to about €60/MWh, “this measure would not produce any results”, the paper reads.

-

Other cap: The functioning of this cap will have to take into account the existing cap of €180/MWh for electricity generated from non-gas sources.

-

Consumption increase: There is a risk for the cap to increase gas consumption and endanger the security of supply, so the paper argues for a cap set at a price sufficiently high so that gas-fired power does not become cheaper than electricity from other sources.

-

Make UK pay: The cap also risks subsidising power exports to non-EU countries, including the UK. “To address this effect would require to agree with the relevant third countries on an extension of the scheme beyond EU borders,” the paper suggests. Good luck with that.

Bottom line: The Iberian model is marred with complications and hardly a one-size-fits-all solution.

But the commission doesn’t miss the opportunity to suggest a different, structural, more long-term solution: market redesign. This would focus on two parts: first, restructuring a remuneration scheme for renewables and nuclear based on their true production costs. Second, it would level the playing field for different energy sources to compete on the short-term market. All that, of course, pending member states’ approval.

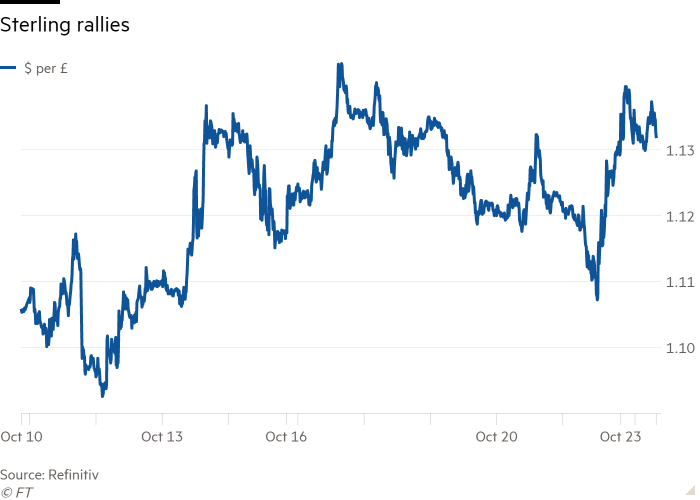

Chart du jour: Sunak effect

The pound climbed by as much as 0.9 per cent against the dollar in early trading and the UK government’s borrowing costs improved yesterday when Sunak was confirmed as the new prime minister. Investors are betting that the former chancellor will stick to the economic policies that have calmed markets in recent days.

Facing the music

Going back to work on Mondays is never much fun, but it was a particularly tough day at the office for Emmanuel Macron’s centrist alliance in the National Assembly, writes Leila Abboud in Paris.

The French government led by prime minister Élisabeth Borne faced three no-confidence votes, two submitted by the leftwing Nupes coalition and one from Marine Le Pen’s Rassemblement National party.

Such a feat has never been achieved by a government under France’s Fifth Republic and is a reflection of how much has changed since Macron lost his parliamentary majority in June. The government’s weakened hand meant it had to use the French constitution’s equivalent of a nuclear weapon — the 49.3 clause — three times last week to ram through parts of draft laws on the national budget because it did not have enough votes to pass them otherwise.

The 49.3 clause allows the government to cut short parliamentary debate, ignore amendments and pass laws by decree, but it also gives the opposition the right to immediately file for a no-confidence vote. That is what happened yesterday with Le Pen giving a fiery speech to defend her party’s motion. “The presidential term has barely begun but it already has the whiff of the end of reign about it,” she said.

For their part, the Nupes denounced the use of the 49.3 as “the weapon of the weak . . . and those who cannot win the argument”.

Beyond the fiery words, the events in the National Assembly proved that the opposition is not united enough to overthrow the government. After the debates that went late into the night, all three motions failed to rally the necessary 289 votes.

Macron’s government held on because the conservative Les Republicains, which hold 62 seats, refused to join the rest of the opposition.

How long will this dynamic hold?

Given the economic and energy crisis brewing, “it would be irresponsible to touch off a political and institutional crisis right now”, wrote the LR deputies in a joint op-ed on Sunday. “The government must listen to the opposition.”

What to watch today

-

King Charles III appoints Rishi Sunak as prime minister

-

EU energy ministers meet in Luxembourg

-

Ukraine reconstruction conference takes place in Berlin

Notable, Quotable

-

Le reset button: Olaf Scholz meets Emmanuel Macron in Paris tomorrow in a bid to rekindle frail Franco-German relations. In recent weeks, Paris and Berlin have clashed over everything from fighter jets and air defence systems to gas pipelines and a planned price cap.

-

Russian roulette: Russia’s threat with a “dirty bomb” has added a new dimension to fears that the eight-month long war will go nuclear, as analysts warn that the key message was that whichever weapons are used, Ukraine should be braced for further escalation.

Recommended newsletters for you

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: [email protected]. Keep up with the latest European stories @FT Europe