Here’s a meaningless statistic: Liz Truss’s premiership will be the first in modern times in which no UK-listed companies were bought. Several takeover offers arrived during her Downing Street layover — Aveva, RPS, Biffa — but of the 13 takeouts and take-privates completed so far this year, none has been on her watch.

OK, it’s probably not the most surprising datapoint. Truss’s six weeks in office were during a relatively slow year for global M&A, due mostly to the seizing up of LBO financing. But things look a bit different for incoming premier Rishi Sunak.

The market for articles about how UK plc is on sale has remained buoyant, after all. Weak sterling, record institutional underweighting, docile laws, value obsession, Brexit effects — you know the kind of thing, since you’ve probably been reading about it for decades.

And it’s consensus that Britain will be picked apart again once credit markets right themselves. Half of private equity investors see the UK as more attractive than other markets available to them, with another 41 per cent saying it was significantly more attractive, a Numis survey of PE professionals found. Institutional owners are too biased towards value (say 38 per cent) so are expected to be receptive or highly receptive to public-to-private offers (say 83 per cent).

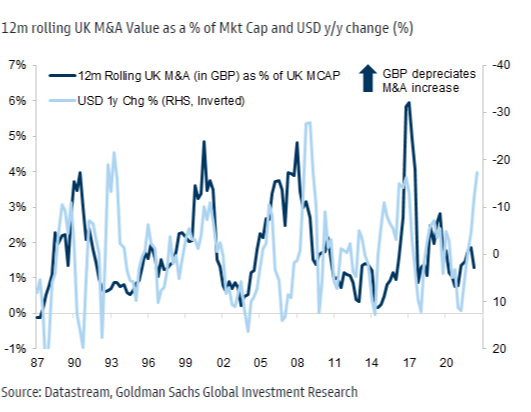

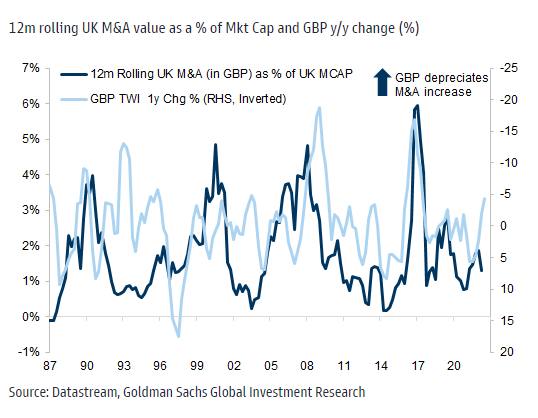

Over at Goldman Sachs they have put some data behind the theory in a note advising clients to go long UK mid-caps. Foreign investors eat about 5 per cent of London’s market cap a year after the pound falls 10 per cent, from 2 per cent in a normal year, it says:

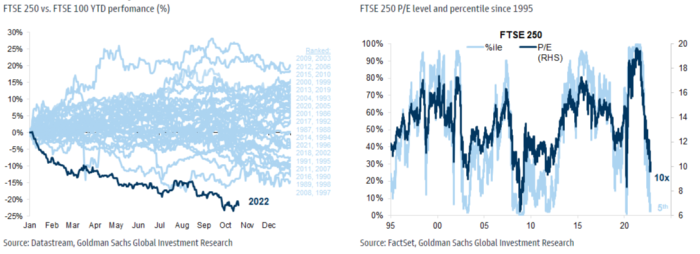

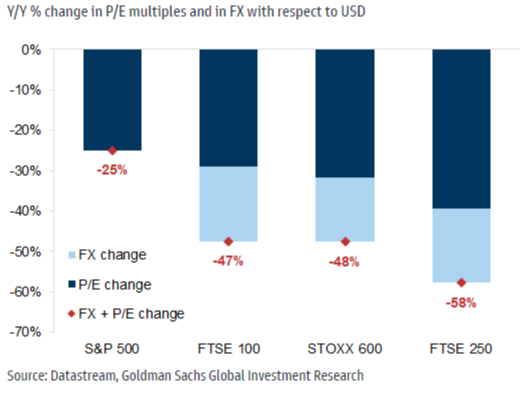

Goldman’s not particularly bearish on the UK economy, setting its base case to trough GDP halfway through 2023 after four consecutive negative quarters. Yet the FTSE 250 is heading towards its worst year on record so looks cheap on current earnings forecasts, it says:

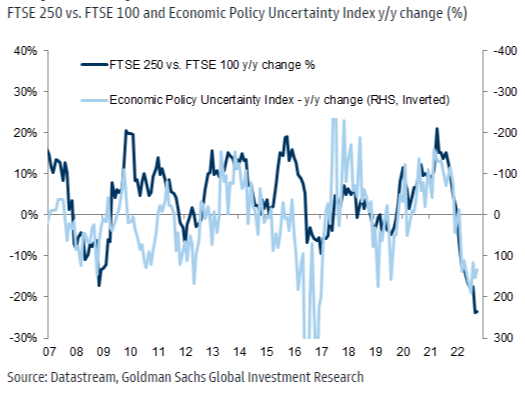

Plus, oddly, the UK mid-caps outperform in periods of economic flux:

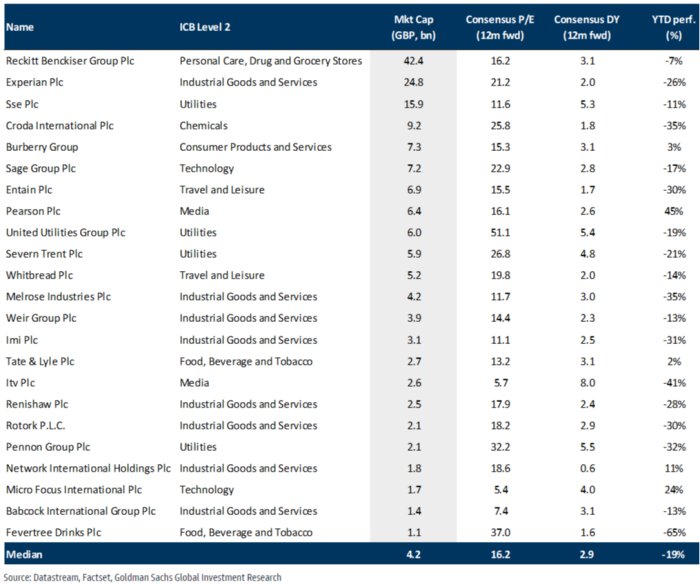

Goldman Sachs’s UK target list has few surprises. It’s mostly lapsed targets (Entain), active targets (Micro Focus), corporate clients (Pearson) perma-speculation names (ITV, Burberry, Sage), bond proxies (United Utilities, SSE, Pennon) and geographical aberrations (Experian, Network International).

The most politically charged stocks above are defence contractor Babcock and aerospace/engineering roll-up Melrose. Any offers in their direction would give the new PM a chance to try out the veto powers provided by the UK National Security and Investment Act, whose introduction last year was championed by former Goldman Sachs analyst Rishi Sunak.