One thing to start: “If you are lucky enough to have lived in Paris as a young man, then wherever you go for the rest of your life, it stays with you, for Paris is a moveable feast.”

Get swept into Ernest Hemingway’s Paris in the first of a new series in which writers travel in the footsteps of a notable earlier visitor.

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: [email protected]

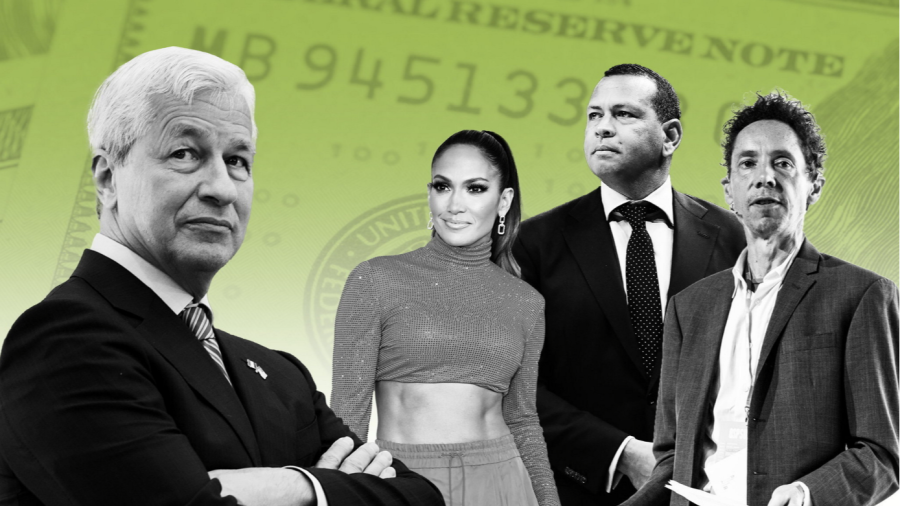

JPMorgan’s tug of war for rich customers

Infighting at JPMorgan Chase over how to manage the fortune of retired baseball star Alex Rodriguez has escalated into a two-year battle within the bank, involving prominent personalities such as pop sensation Jennifer Lopez and author Malcolm Gladwell, as well as chief executive Jamie Dimon.

The tug of war has laid bare tensions inside JPMorgan, pitting the lender’s storied private bank against a wealth advisory business that was acquired as part of the 2008 purchase of Bear Stearns during the financial crisis, writes Joshua Franklin in New York.

At the centre of the squabble is a prominent financial adviser named Gwen Campbell. She brought along clients including Rodriguez when she joined JPMorgan from Bank of America’s Merrill Lynch division in 2020 and set up shop at JPMorgan Advisors, as the old Bear operation is now known.

Campbell has accused colleagues at JPMorgan’s private bank of trying to lure away Rodriguez. In one instance, the private bank tried to leverage an existing relationship with Lopez as part of their strategy, according to people familiar with the matter.

Gladwell, a New York Times bestselling author of books including The Tipping Point and a longtime Campbell client, has rushed to her defence, firing off a letter to Dimon on her behalf, according to messages seen by the Financial Times. Dimon has not responded directly, instead tasking other executives to reply to clients’ concerns.

“I thought he was supposed to be a statesman, Jamie Dimon. This is like a game an 11-year-old would play,” Gladwell told the FT.

“Quite apart from what he’s doing to Gwen, I’m a client. My life savings are with JPMorgan. My financial adviser has been exiled like Napoleon on Elba. Is that the way you treat your clients? I’m small-fry but a lot of her clients are not small-fry.”

Read the full story here

Goldman Sachs doubles down on the rich

Goldman Sachs has decided that doubling down on investment advice for rich people is the way to push up the bank’s value to investors. Now it has to go find some more clients. The Wall Street bank’s existing — and very strong — business in providing workplace financial advice will be key to building up the steady wealth management revenues that chief executive David Solomon covets, writes Brooke Masters in New York.

More than half the companies in the Fortune 100 already hire Goldman to provide some kind of financial counselling to their employees. The bank has gradually built its offering with bolt-on acquisitions including Ayco, United Capital and NextCapital. It now provides everything from robo-advice on whether to rent or buy a house to a white-glove service that helps top executives with financial planning, writing wills and filing their taxes. That last offer, provided by Ayco, incidentally is the same service that Goldman’s own partners get and it has a 98 per cent customer satisfaction rating.

But it’s the next level down that Solomon is counting on to help it find the wealth management customers of the future. These mid-level executives often use their company-paid services to draw up a financial plan, and Goldman hopes that many of them will then turn to the bank for a longer term relationship — on their own dime. “Coming in through the workplace is very powerful,” says Larry Restieri, CEO of Ayco and co-head of workplace and personal wealth. “We can solve for the hardest part of being a wealth adviser, which is finding clients.”

This comes as Solomon has announced the second significant restructuring since he became Goldman chief executive four years ago. The US bank will shrink from four divisions to three. Having separated asset and wealth management in 2019, Solomon is now putting them back together again. Marc Nachmann, the co-head of Goldman’s trading division, will run the combined asset and wealth business, and Julian Salisbury, previously co-head of the standalone asset management division, will become chief investment officer.

Chart of the week

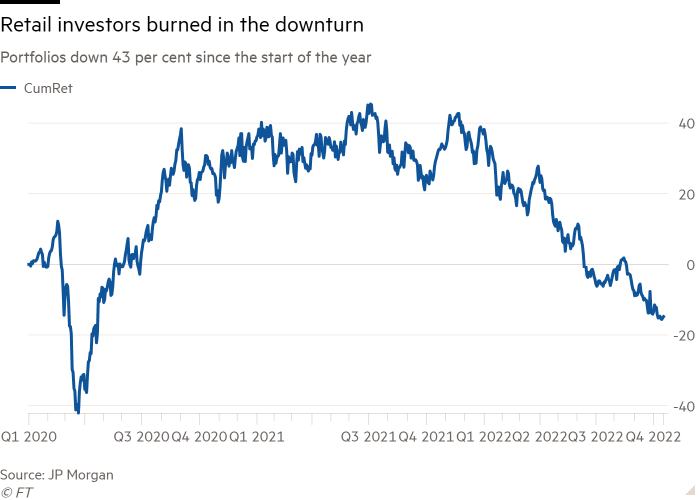

Retail investors are nursing steep losses this year, leading many to shun individual stocks in favour of funds that track the biggest high-tech companies on the Nasdaq in the hope of clawing back losses, write Madison Darbyshire and Joshua Oliver.

Personal portfolios in the US fell 44 per cent between early January and October 18, according to data compiled by JPMorgan Chase, in a reflection of the acute pressure applied to highly valued equities by rising interest rates and a darkening economic outlook.

“Retail investors have been conditioned to invest into growth categories,” said Jose Torres, senior economist at brokerage IBKR. “But as the money supplies contracted, there’s less liquidity driving up asset prices.”

10 unmissable stories this week

The fallout from the “mini” Budget revealed the various ways lenders are exposed to gilt prices. Here’s an in-depth look at how banks, including Barclays, Lloyds and NatWest, and regulators reacted to the UK bond market meltdown.

The Financial Conduct Authority has been asking private equity firms how rising rates and the bond market turmoil unleashed by the government’s “mini” Budget are affecting them and their investors, as it assesses potential risks in an industry that has ballooned in influence over the past decade.

Global stock markets could be heading for a Japan-style bear market lasting decades, says Boaz Weinstein, the founder of New York-based hedge fund Saba Capital who is credited with spotting the “London Whale” derivatives trader a decade ago.

The LDI crisis is spurring a seismic shift in the gilt market, writes Patrick Jenkins. Reduced demand from pension funds will change the government bond market.

Abdallah Nauphal offers a different perspective on the investment strategy. The chief executive of Insight Investment, one of the biggest players in the LDI market, argues that UK defined benefit pension schemes have never been in better shape thanks in large part to the discipline imposed by LDI.

Schroders lost £20.2bn in assets from the division that houses its liability-driven investing business in the week after the “mini” Budget, an early sign of the impact wrought on asset managers by volatility in the UK government bonds market. Meanwhile the pace of fund outflows slowed at Jupiter Fund Management in the third quarter, as the company announced a new share buyback programme under recently appointed chief executive Matt Beesley. Jupiter is axing around a quarter of its product range.

Blackstone Group’s profits declined in the third quarter as tightening financial conditions and plunging stock market valuations caused the world’s largest alternative asset manager to dramatically slow its sale of investments.

Activist investor Cevian has sold out of Vodafone after barely a year without much value improvement, and SoftBank cashed out of ecommerce company THG at a £450mn loss. Both examples illustrate that while UK stocks might look cheap, in the absence of an abundance of buyers they won’t necessarily provide value, writes Cat Rutter Pooley.

The Bank of England said liability-driven investment funds were “significantly better prepared” to manage shocks following the emergency bond-buying programme it launched last month. The Bank said its £65bn intervention had injected liquidity into the system and reduced the risk of a repeat of fire sales that had damaged pension schemes.

The giant BT Group pension fund took an £11bn hit as its investments were shaken by market turmoil triggered by the government’s “mini” Budget. The former monopoly’s defined benefit pension scheme, one of the largest in the country, said that its parent sponsor did not have to provide any cash to cover the fall in value of the scheme’s assets.

And finally

When Édouard met Eva: the National Gallery’s pleasurable small exhibition Discover Manet & Eva Gonzalès unfolds the relationship between the great painter of modern life and an obscure Spanish student, writes the FT’s chief art critic Jackie Wullschläger. The show uses Manet’s portrait of a Spanish student to explore a tense, tender teacher-pupil relationship.

Meanwhile last week curiosity got the better of me and I spent three minutes in a small chamber on Westbourne Grove at minus 110 degrees Celsius. Depending on how you see it, cryotherapy (£80 for the pleasure) is either the ultimate in total body and mind rejuvenation, or the latest swindle in the name of ‘wellness’. Have you tried it? Email me: [email protected]

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at [email protected]

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here