This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

In about 375BC Plato likened government to a ship adrift while its crew fought over which incompetent should steer. The analogy is relevant to modern Britain thanks to the antics of Tory prime minister Liz Truss. She resigned this week after trashing the reputation of the UK for sound financial management.

Potential replacements include candidates whose suitability is impaired by their purported hypocrisy, disloyalty, mediocrity or eccentricity.

Truss will stay in post only until the Tories — no longer unequivocally “the party of business” — have found a replacement for her. The new PM, or whoever succeeds them at a much-needed general election, will have the job of restoring the confidence of global investors. This has been on the slide since England and Wales voted to take the UK out of the EU in 2016.

The referendum was the start of the Conservatives’ experiment with “unorthodox economics”, which in this case is a polite term for deliberate financial illiteracy. The vote and subsequent secession were entirely valid as assertions of national independence. But it was plainly nonsense that some nebulous “Brexit dividend” would outweigh the cost of higher trade barriers with continental Europe.

Truss and her chancellor Kwasi Kwarteng promulgated more growth myths with their proposals for hefty unfunded tax cuts and a pledge to “grow the pie” last month. The market choked on this further serving of Pieism.

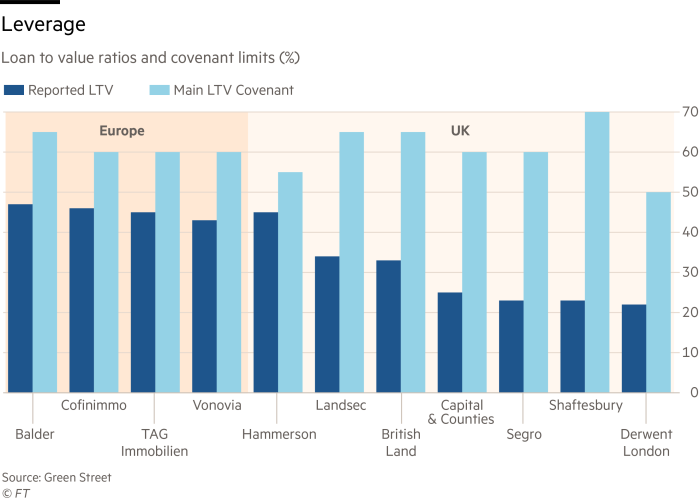

Lex reckons Brexit has left UK stocks at a persistent one-fifth discount to global averages. This is one reason the incomes of struggling fund managers are under pressure. Gilt yields are higher as a result of the “mini” Budget, pushing up the fixed-interest funding costs of British businesses. This is a particular problem for the property sector, which has a relatively high dependence on debt.

Last Friday, Lex was at the front of the peloton of commentators noting the end of Trussonomics as Jeremy Hunt replaced Kwarteng. This relative moderate is in the curious position of crowdsourcing his economic policies from the gilts market. By reversing out of the bulk of the “mini” Budget, he hopes to reduce gilt yields and with them the cost of government debt.

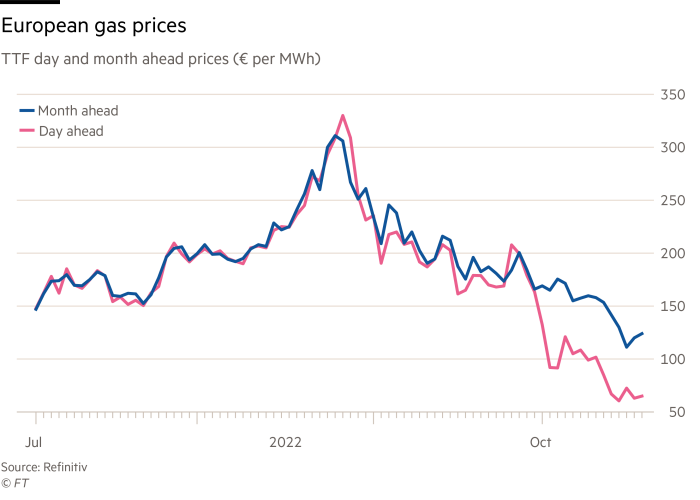

Hunt also set a six-month timespan for a UK government subsidy for household energy bills. The cost of the scheme had already been reduced from an estimated £150bn to £120bn by falling energy prices. Day-ahead natural gas prices have dropped more than 80 per cent at one key European hub.

This represents a victory for western Europe over Russian energy blackmail attempts. Storage is full and the weather has so far been mild. That leaves the ticklish question of how Europe will fare next winter with far less Russian gas likely to flow next autumn. We will examine the issue next week.

Lower prices may not save the UK energy sector from higher windfall taxation. Banks are exposed to the same threat. Mortgage distress could make rising profits embarrassing for lenders, as I noted in an Inside Business column this week. We think some banks may attempt to avert the blow with forbearance packages and nifty reserving in third-quarter results.

The borrowers

Rising interest rates and faltering growth mean investors are scrutinising the financial resilience of indebted businesses. Strong cash flows and powerful franchises are sources of reassurance. One example is Blackstone, which reported strong third-quarter results this week.

Private equity, the original métier of the US alternatives manager, is highly procyclical. Lex remains sceptical whether valuations of Blackstone’s private investments are harsh enough. But this still looks like a very robust business.

The Wall Street giant will be able to exploit the weakness of others amid continuing financial turmoil. It has been among the distressed debt investors snapping up collateralised loan obligations sold off by UK pension funds raising cash to cover margin calls on their interest rate hedges.

Continental Resources boss Harold Hamm is another tough customer. He is buying out minorities for $4bn, cheekily using the cash balances and borrowings of the US shale driller. With net-debt-to-ebitda of under 1 times, that looks easily bearable for the family business.

Tech start-ups toying with the idea of venture debt as a substitute for non-existent equity financing should think again, however. We are also perturbed by Enel. The Italian energy utility is on a prospective debt/ebitda ratio of 3.5 times. We believe the shares point towards a dividend cut.

Enel is in better shape than Monte dei Paschi di Siena. This basket case of an Italian bank is making its umpteenth attempt at a turnround. Targets are overambitious. As Lex noted, MPS was a glorious bank in the 15th century. It has gone steadily downhill since then.

Ukraine is also in a parlous financial state, though a Russian invasion provides a better excuse than centuries of mismanagement. The budget deficit is $5bn per month. US Republican threats to reduce support have scared Ukrainian politicians.

Lex believes the west should offer $400bn in frozen Russian assets as collateral for Ukrainian sovereign bond financings. This would be legally complicated. But it would be a way to extract compensation from Russia even as the war continues. And it would reduce the burden on US taxpayers.

Pasta milestone

On Lex, we sometimes worry that we do not write enough about the UK, a country that has become something of a corporate backwater in recent years. So we make no apology for regular coverage in the past three extraordinary weeks.

The Americas, Asia and the EU will be a little higher in the mix in weeks to come, I suspect. Please let me know what you think of this or any other aspect of our coverage at [email protected].

In the meanwhile, a couple of recommendations for further reading. First, Valentina Romei’s amusing Alphaville post, which dismisses the idea that the UK and Italy are in the same boat financially. Italy is now better managed, she says. Second, read Cat Rutter Pooley’s trenchant City column on why UK shares will stay cheap.

Plato, by the way, favoured government by technocrats. Recent events in the UK suggest the philosopher may have been right.

Enjoy your weekend,

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here