Europe’s gas price has retreated to saner levels. That doesn’t mean we are out of the energy-crisis woods yet.

By rights, one might expect EU gas prices to be skyrocketing. The conflict in Ukraine continues. Key infrastructure to deliver Russian gas to Europe has been blown up. And gas from Russia — which pre-crisis accounted for 30 per cent of Europe’s supply — has slowed to a trickle.

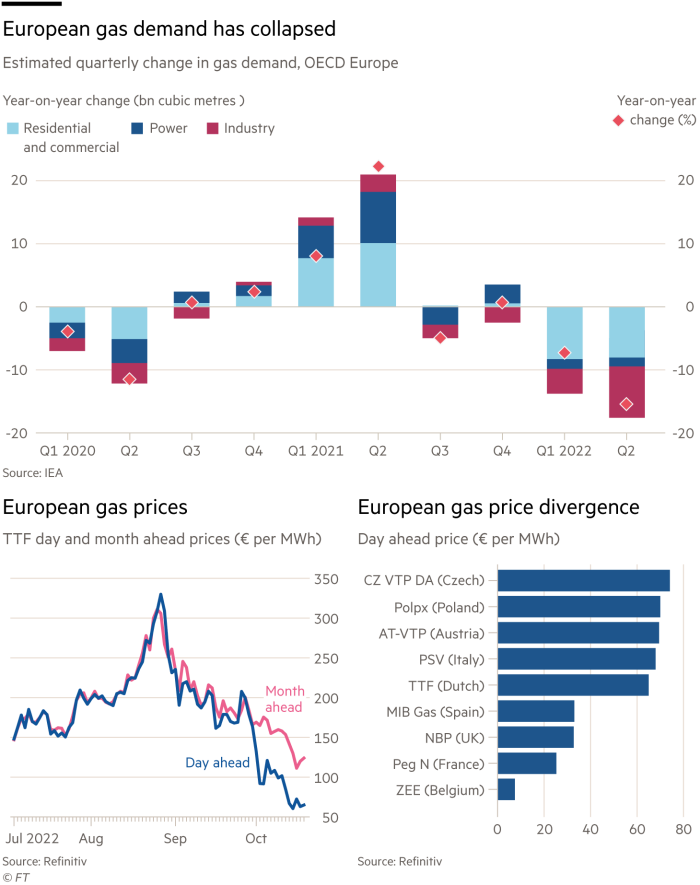

Even so, day-ahead natural gas prices at the continent’s TTF hub have dropped by more than 80 per cent since the peak in August, and are now even lower than they were a year ago.

In part, that reflects Europe’s stronger position as winter looms. Plans to curb gas prices may still be rather hazy. But with Russian gas still flowing for much of the summer, it has managed to fill its gas storage. At the same time, China’s economy has been spluttering — which frees up gas supplies. The market has also been doing its — unpalatable — job; high energy prices have cut European demand by 10 per cent in the first half of the year.

But the decline in the day ahead price also speaks to Europe’s infrastructure constraints. With mild weather, full storage and limited connectivity across countries, there just is not any place to put more gas.

Indeed, loaded tankers have been moored off the coast of Spain and the UK waiting for permission to dock, while gas prices for the coming winter are double the spot. Spreads have opened between regions that have access to a lot of LNG, such as the UK — where gas trades at 33€/MWh — and those that do not, such as the Czech hub on €74/MWh.

Even if one looks through the temporary pressure on the spot price, the forward curve has come down sharply since August. This is welcome news for beleaguered households and industry, and the stretched governments which have pledged to support them. But do not get complacent. If the winter turns cold, we could still be in for a tight market.

The real test for Europe lies further ahead. With a lot less Russian gas coming in, full stores for the following winter are a more nebulous prospect.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.