Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

In today’s newsletter:

The hurdles to Rupert Murdoch’s final act

Has Rupert Murdoch seen Succession? Watching the HBO drama about a dysfunctional media dynasty based loosely on his own family would hardly make for a relaxing escape. (His ex-wife Jerry Hall is reportedly a big fan.)

DD had to ask, seeing as the 91-year-old media mogul has pulled a plot twist to rival the finale of the hit show’s second season. After vowing never to reunite the two parts of his empire, News Corp and Fox News, that’s exactly what Murdoch has proposed doing.

It will now be up to Fox’s advisers, which include Goldman Sachs and Kirkland & Ellis, and News Corp’s consiglieri, which include bankers at Morgan Stanley and a team of lawyers at Gibson Dunn, to convince the shareholders of both companies of the merits of deal that remains a headscratcher for most.

A year ago, when the FT’s Alex Barker and Anna Nicolaou and DD’s James Fontanella-Khan wrote that a merger between the Murdoch companies was being considered, the PR operators at News Corp told the FT there was “simply no discussion” of a merger with Fox.

So what has changed?

Murdoch’s team said that the combination is a move to achieve scale in a cut-throat landscape. Despite being on the frontline of America’s culture wars, Fox’s $17bn market capitalisation gives it limited financial firepower compared to newly formed mega-conglomerates such as Warner-Discovery.

The numbers add up in theory, Lex notes. But there’s more to it than that. The chief motivation for the merger is consolidating power under Lachlan Murdoch — Murdoch’s eldest son and the Fox chief executive — as his father’s successor, four people close to the situation told the FT.

“The goal is to hand over everything to Lachlan in an orderly way,” said one person familiar with the matter. “Rupert is 91, time is of the essence. They need to get this sorted now.”

That raises the question of what’s to become of Robert Thomson, the chief executive of News Corp and one of Rupert Murdoch’s closest lieutenants.

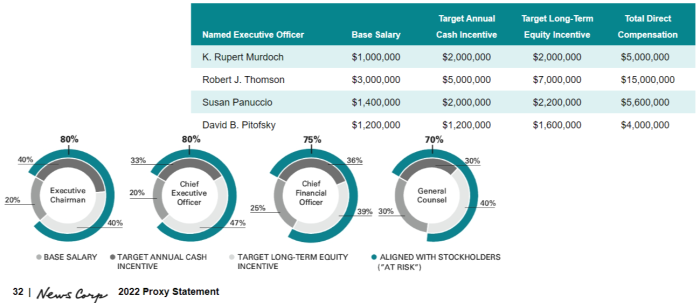

The journalist-turned-media executive, who was once managing editor of the FT’s US edition, has a good gig as it is. In addition to his $3mn annual base salary, he’s also eligible to receive a performance-based annual bonus with a target of $5mn and $7mn in equity awards, according to a filing published earlier this month.

Thomson is “like a son” to the Murdoch patriarch, said two people with direct knowledge of the talks, and would likely continue running the news operation while Lachlan would most likely lead the new entity as chair.

That wasn’t the original plan, though. Thomson was widely expected to take over the recombined group in the event of a merger. Lachlan’s sudden rush to the helm could come as an unwelcome change.

Should Lachlan find reason to install one of his own allies at the News Corp helm, Thomson would at least be ejected with a golden parachute worth up to $44mn.

We may be getting ahead of ourselves, though. While Murdoch and his family trust control roughly 40 per cent of voting shares, they still need a majority of independent shareholders to vote in favour of the proposal, said people familiar with the matter.

And shareholders aren’t exactly rejoicing at the idea. Four investors pointed to reputational and legal risks of being under the same roof as Fox News, currently embroiled in two multibillion-dollar lawsuits over its anchors’ claims that the 2020 US election was rigged.

“People don’t really want to own the Fox News business, even though it’s a fantastic asset in terms of cash flow . . . we would definitely prefer to have these conglomerates break apart and simplify, [rather] than be put together,” said one shareholder.

It’s possible that Rupert Murdoch has already considered the possibility of selling Fox News and come up short. “You’re unlikely to see any well-known private equity group like Blackstone or KKR taking over. The reputational risk is huge,” one media executive told the FT last year.

Whether or not it was his first choice, the merger plan rings eerily similar to the reunification of media conglomerates CBS and Viacom, worth $13bn today — less than half of the value of the separate groups ahead of the deal.

KKR goes zen on the yen

When Henry Kravis, George Roberts and Jerome Kohlberg founded KKR in 1976, the typical large US corporation was bloated, undervalued and low hanging fruit for leveraged buyout artists.

Now most S&P 500 companies are run with ruthless efficiency, making leveraged buyouts harder for KKR to pencil out. In Japan, however, the firm has spotted an opportunity reminiscent of the halcyon days for LBOs in the 1970s and 1980s.

Japanese companies are cheap, often trading at yawning discounts to their net assets, and they contain treasure troves of miscellaneous businesses that would be more valuable if run as independent companies.

KKR tells DD’s Antoine Gara and the FT’s Kana Inagaki that it is increasingly bullish on Japan as a home for the firm’s investments.

Henry McVey, chief investment officer of KKR’s $25bn balance sheet, said the New York-based group is boosting its exposure to the country.

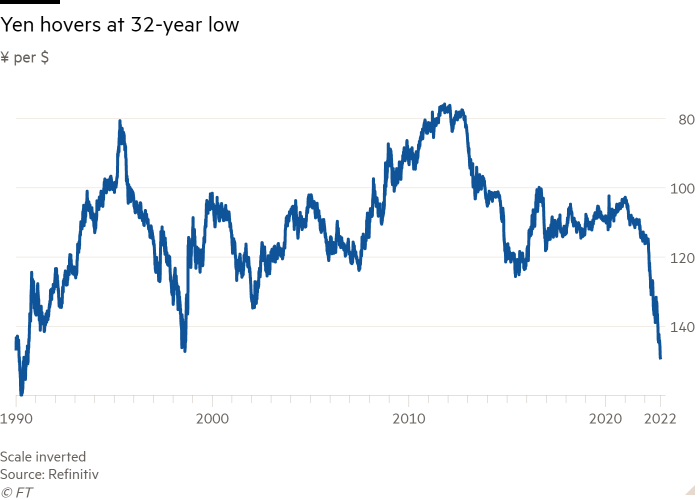

“You’ve got attractive stock market valuations, investors have exited and now the country is enjoying the benefits of a cheap currency,” he said.

Over the past few years, KKR has bought businesses from Hitachi, Panasonic and other conglomerates seeking to sell non-core businesses.

“There’s a secular trend towards corporate carve-outs in Japan,” he noted. “If you look at the number of companies in Japan that have over 100 subsidiaries, it’s still a huge proportion of the stock market.”

KKR, however, suffered a setback in the summer when a car parts company it bought from Nissan and rebranded as Marelli entered court-led restructuring after a sales collapse during the coronavirus pandemic.

Opportunity abounds, but deals remain tricky to pull off, as evidenced by the slow burning courtship to take Toshiba private. Years of effort have gone into the endeavour with no guarantee a deal will materialise this autumn.

Job moves

-

Suella Braverman has departed as UK home secretary, adding to a sense of chaos engulfing Liz Truss’s government.

-

A22 Sports Management, a company representing Super League football clubs, has appointed German media executive Bernd Reichart as its new chief executive as part of an effort to relaunch the competition.

-

US data analytics group Palantir Technologies has hired British politician John Woodcock (also known as Lord Walney) as a consultant to help scout a new UK base, Bloomberg reports, as it seeks to become the underlying operating system for the UK’s.

-

Namkoong Whon, the co-chief executive of South Korea’s dominant messaging app provider Kakao, has resigned after an hours-long outage of the company’s mobile services sparked a public backlash.

-

RBC Real Estate Capital Partners has hired Blackstone’s Jonathan Haas and JPMorgan Chase’s Oliver Pepper as a director and a vice-president focused on loan origination, respectively.

-

Moelis & Co has hired two former Morgan Stanley bankers, Arek Kurkciyan and Dennis Crandall, as managing directors on its healthcare investment banking team.

-

Jones Day has hired Patrick Haney as a partner in its business and tort litigation practice, based in Washington. He joins from Kirkland & Ellis.

Smart reads

Face the music Kanye West’s business partners have yet to speak out on the controversial star’s anti-Semitic social media posts. That silence can be dangerous, writes Endeavor chief executive Ari Emanuel for FT Opinion.

‘I have f***ing killed it’ Former Morgan Stanley chief executive John Mack may have led the investment bank into a crisis, but he has few regrets. Bloomberg’s Max Abelson reviews the former Wall Street titan’s memoir, Up Close and All In.

And here’s a smart listen: Xi Jinping has fallen short on his promises for China’s economy even as he prepares to enter an unprecedented third term in power. The FT’s Edward White discusses his odds of turning things round on the latest episode of Behind the Money.

News round-up

Goldman Sachs retreats from mass market in long quest for higher valuation (FT)

JetBlue, Spirit Airlines inch closer to forming fifth-largest US carrier (Reuters)

Credit Suisse’s loan portfolios attract Japan’s biggest lender (Bloomberg)

Zambia questions ex-minister over alleged Glencore political payment (FT)

Ukraine’s Naftogaz restructuring blocked by hedge fund VR Capital (FT)

Retail investors become vigilantes in hunt for crypto’s most wanted man (FT)

Netflix shares jump after gaining 2.4mn subscribers (FT)

Law firms under pressure to cut jobs as cheaper rivals cash in on recession fears (Financial News)

Sequoia Financial sells minority stake to Valeas for $200mn (Bloomberg)

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here