This article is an on-site version of our The Future of Money newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday

Hey Fintech Fam!

Some “personal news” from me this week, I’ve decided to move on to a new role which means, unfortunately, this will be my last time at the helm of this newsletter. Writing The Future of Money has been one of the highlights of my FT experience.

Aside from getting to know some of the most interesting people in fintech-land, the thing I will miss most about this job is earnings season. Seriously! Sure, you can learn a lot about a company from their quarterly filings, but the conference calls are where the magic happens. It’s the best place to learn about where a company is headed, what executives are worried about and what investors actually care about. Also if you tune into enough of them you may catch a few sassy exchanges and dad jokes along the way.

For this week’s newsletter, I analysed earnings transcripts from the six major US banks to see how sentiment towards fintech has changed over time. Plus we have the latest fintech M&A data from S&P Global Market Intelligence and a column by a PayPal founder who argues that the expansion of fintech products has made our financial lives worse.

Write to The Future of Money team at [email protected].

Latest news

Fintech off the brain

Fintech was one of the hottest topics on the big Wall Street banks’ earnings calls last year. But the level of concern has changed as valuations across the tech sector deflated this summer.

Executives typically avoid talking about competitors on their quarterly conference calls, but the proliferation of fintech throughout the pandemic compelled Wall Street’s top brass to address the rapidly growing threat directly.

Last year, chief executives and chief financial officers at the largest six US banks — JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley — said “fintech” 17 times during their earnings calls as the sector boasted rapid customer growth and eye-popping valuations, according to Sentieo data. Before 2021, executives only said that word three times since 2016.

The vast majority of fintech mentions came from JPMorgan executives, who used the word 12 times last year. JPMorgan chief executive Jamie Dimon was particularly vocal about the threat from fintech, saying the sector posed “huge competition” and dedicating a section of his annual letters to shareholders to the topic.

“Obviously, fintech will be a challenge. There’s a lot of money there. They’re very smart people,” Dimon said last July, a few months before announcing a controversial 26 per cent increase in the bank’s tech budget. “I’m quite comfortable we’ll do fine.”

In more recent quarters, concerns about fintech competition have been replaced by questions about the economy and preparation for a potential recession.

Rising interest rates have tipped the scales in favour of the highly diversified incumbents, according to industry analysts and consultants. Major US retail banks have over the past week reported expanding lending margins from higher interest rates while keeping their deposit costs steady.

On Friday, Morgan Stanley chief executive James Gorman became the first US major bank CEO this year to mention the word “fintech” during an quarterly earnings call.

“You’re going to see a little bit of a washout in some of the fintech space,” said Gorman, whose company has spent roughly $20bn on fintech acquisitions in the last two years as a way of transforming the storied bank into a formidable digital business. Although fintech valuations are near all-time lows, Gorman said he’s not tempted by the current opportunities he sees in the market.

“At these prices, the sellers are only there if they need to sell,” he told analysts. Valuations likely won’t rebound to a more attractive level until the end of next year, he added.

Gorman’s grim assessment and the relative quiet from peers is illustrative of the power shift underway in the financial services sector. Incumbents are picking up momentum at the expense of the fintech upstarts, which are being squeezed by higher borrowing costs and an ice-cold equity market.

Meanwhile, margins are expected to shrink for the many niche fintech players that paid top dollar for deposits in order to grow market share.

“Consolidation across financial services has been the catchword for a decade,” Gorman said. “That’s just reflecting the reality that scale matters.”

Deal tracker

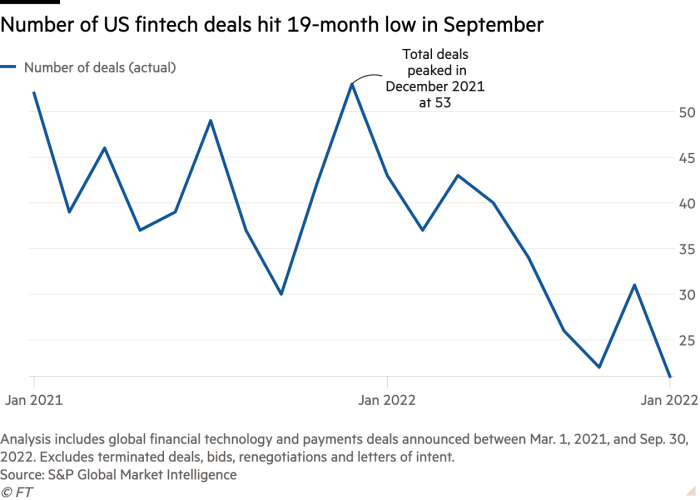

The number of fintech and payment deals announced last month fell 43 per cent compared to last year. September’s total of 21 deals marks the lowest count recorded since S&P Global Market Intelligence started tracking them in March 2021. Roughly $33bn worth of fintech deals have been announced so far this year, down from $57bn in the first three quarters of last year.

Recommended reading

Workers’ flight Many fintech employees are accepting lower pay to transition into careers in traditional banking as workers prioritise stability over compensation, recruiters tell Sid.

Founder’s remorse In our opinion section, serial fintech entrepreneur Bill Harris, the former chief executive of PayPal and current founder and CEO of Nirvana Money, says fintech overload may actually be making consumers’ financial lives worse.

Regulator’s lament A top US banking regulator tells Reuters that agencies are “spending too much time on crypto,” and some of the “brain space” lawmakers and regulators are spending on the topic could be spent monitoring other kinds of financial technology.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here