Monte dei Paschi di Siena was a glorious bank in the 15th century. Things have gone downhill since. Ill-conceived acquisitions, truly terrible loans and a host of other mishaps mean that, over the past 14 years, MPS has raised more than €23bn of equity — yet its market cap is basically zilch.

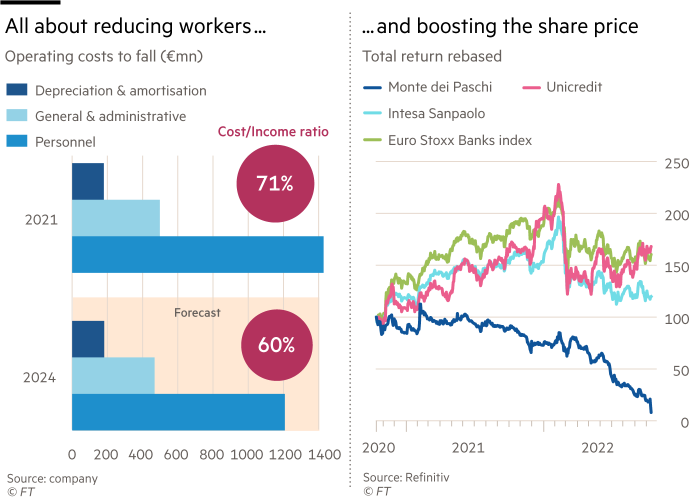

So it is no wonder that investors are looking at its most recent €2.5bn capital increase with scepticism, to put it mildly. The stock is down some 60 per cent since the bank announced it was ready to pull the trigger.

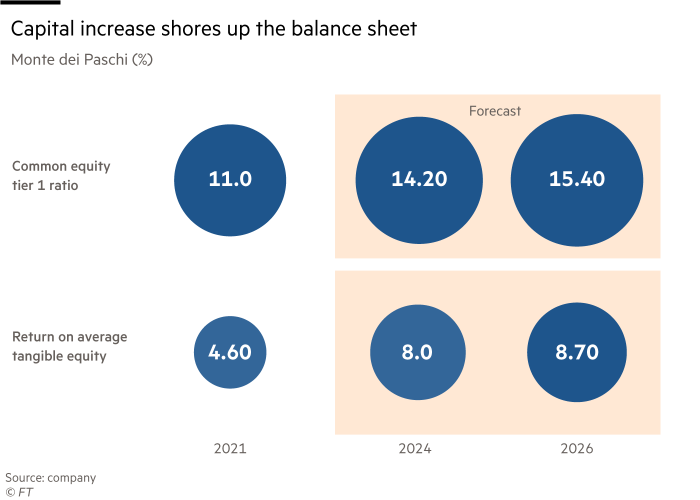

If one believed MPS’s turnround plan, a €2.5bn post capital-increase market valuation wouldn’t be unreasonable. It equates to some 0.34 times net tangible book value — on a return on equity that would hit 8 per cent if MPS met 2024 targets. Or, to put it another way, if new boss Luigi Lovaglio delivers on his promises, the stock would trade on a price/earnings ratio of 4 times two years hence.

There are two issues with this, however.

The first is whether the market will believe MPS’s turnround plan. Lovaglio comes with a strong industry record, and has already struck a deal with trade unions to reduce headcount and lop €300mn out of costs. Rising interest rates boosting net interest income will help with the rest. But the bank faces all the usual recession-linked uncertainties, plus a few others — including the ever-present legal risk from upset shareholders who lost their shirts.

The second is that, even if one believes MPS can deliver this beast of a turnround, the bank would still be no cheaper than much of the bedraggled Italian banking sector. It isn’t clear why even bulls on European banks — on the basis that swelling net interest income can outpace loan-loss provisioning, as Mediobanca Research suggests — would choose to bet on the ship already battered by the highest waves.

An exception might be groups with a special interest in MPS. These include partners such as Axa, holders of subordinated debt wanting to avoid a haircut and even patriotic Italian institutions keen to help outgoing prime minister Mario Draghi. With so much history and goodwill, this bank still needs a fair wind. Best wait until the weather improves.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.