Jules Rimmer worked in investment banking for 32 years, most of it focusing on emerging markets. He is now a freelance journalist

A crisis is temporary by nature, but the Turks are redefining the term to incorporate a sense of permanence. Turkoparalysis most neatly encapsulates the sense investors have of frenzied but motionless economic activity. The economy has been dealing with vaulting inflation, a mile-wide current account deficit, a plummeting currency and a balance-of-payments emergency for years now. Reasons to capitulate are legion.

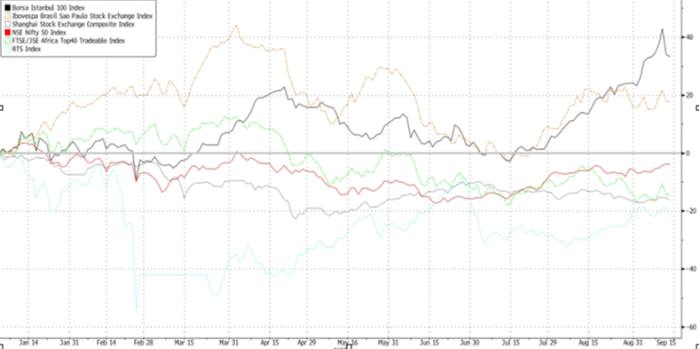

How is it then that the best-performing emerging market of 2022 is none other than Turkey? Defying predictions of another year of catastrophic returns, the Turkish XU100 benchmark rallied as much as 33 per cent in dollar terms, convincingly outstripping its peers with the MSCI EM index slumping almost 20 per cent year-to-date. In a high-inflation/weak-lira environment an equity market jump in local currency should not be surprising but Turkey’s hard-currency return has confounded expectations.

The outperformance has been chiefly registered over the summer months with a ~50 per cent rally in the overall index, the main locomotive of which was a 160 per cent surge in the banking sector. Volumes soared, last week recording an all-time high of $7.6bn. How to explain this move, defying a worsening economic outlook and all investment logic?

For sure, banks were cheap by any standard valuation metric, but they always were, and this did not precipitate the five-year peak. Foreign ownership of the Turkish market languishes around 33 per cent, barely off its record low. Regulatory changes imposed by the Turkish central bank forced banks to dispose of highly profitable CPI-linkers and invest in local currency government bonds. As a result yields on the latter declined 1000 basis points and traded through Eurobonds in spite of CPI measuring anywhere between 80 per cent and 150 per cent, depending whose forecasts are trusted.

Analysts cited these circumstances as possible explanations for the baffling spike in share prices. There were other left-field suggestions: the dab hand of Turkey’s sovereign wealth fund, perhaps? Retail investors capitulating on crypto and swarming into stocks? The likely cause, though, is more mysterious.

Turkish investors who, for reasons legitimate or otherwise, store their wealth offshore and reinvest it back into the stock market have been a powerful determinant of asset prices on the Istanbul bourse for a long time. Brokers refer to them colloquially as “the moustaches”. Back in 2016 one such, who achieved notoriety as The Dude, was said to be responsible for huge gyrations in stocks.

Come the summer of 2022 and the talk locally has been of another shadowy figure. According to market commentators, one speculator placed a string of hugely levered bets on single-stock futures in banking stocks in July. These contracts aren’t especially liquid. The trades — which started off with the smaller banks and initial positions on just 100-200mn TRY — led to a squeeze as arbitrage players exploited the gap between futures and cash.

The derivative splurge coincided with a period of relative stability for the lira as Turkey’s president Recep Tayyip Erdoğan negotiated swap deals and loans with the Saudis and the Russians and Turkey’s oversized retail investor base desperately chased the bandwagon.

If rumours are to be believed, the lone punter’s exposure has ballooned to 20bn TRY giving a paper profit of some 2-3bn. In a market characterised by regulatory vigilance and overseen by an obsessively panoptic finance ministry and central bank, these moves simply could not have passed unobserved. Approval might at the very least be considered tacit, if not explicit.

The authorities are quick to shout economic sabotage whenever the market falls but were seemingly acquiescent to so long as the direction of asset price travel is higher. There are scarcely any constitutional limits on Erdogan’s power; a freely-traded lira is the one thing beyond his control.

For the government, relief from economic pressure is always welcome, no matter the source. Allowing retail punters to cream the froth off a banks rally might have lessened the criticism of the AKP’s astonishingly cack-handed mismanagement of the economy, if only for a moment.

By the end of last week, though, the signs were that even the central bank was uncomfortable with the bubble created and the minimum collateral required for margin positions was raised 30 per cent. Local brokers facilitating the execution of so-called moustache trades also raised margin requirements. Suddenly, momentum faltered and consecutive limit down falls were registered by bank stocks.

Exiting a highly levered position will be harder than it was to enter it. The cumulative impact of the market tumult is to discourage international institutional investors. The Potemkinisation of the stock market means that equities fail to represent economic fundamentals, the volatility is off-putting and with Turkey only holding a 37 basis point weighting in the MSCI EM, money managers can easily afford to ignore the circus.

The outperformance of the Turkish market is an optical illusion. Remain aloof.