Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Cinema audiences like their movies short. The optimum length, a survey found this year, is about 90 minutes. Nobody understands that better than Walt Disney: its summer release Inside Out 2, the highest-grossing animated flick of all time, came in at a snappy 96 minutes. So it is puzzling that the company’s own drama has been so painfully drawn out.

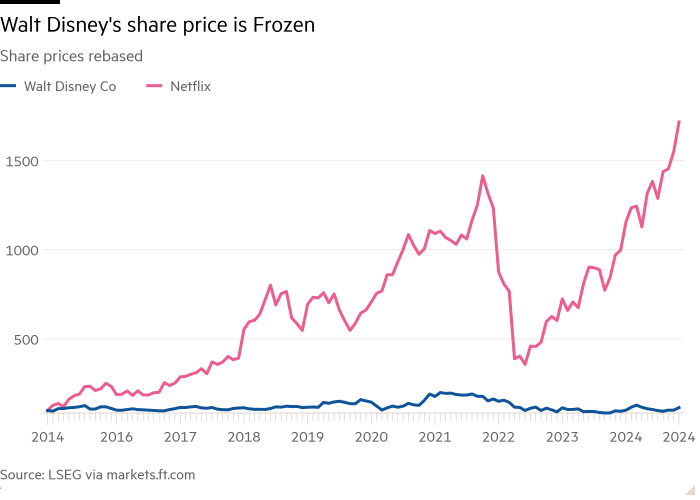

As an illustration, Disney stock is the same price it was a decade ago. Yet in that time, much has happened. The cruise ship-to-cable TV empire bought parts of 21st Century Fox for $71bn, and poured billions into a streaming service, Disney+. Boss Bob Iger retired, then came back; targets were set, then missed. In 2020, Disney reckoned that by 2024 it should have up to 260mn paid streaming subscribers. It has actually notched up 159mn.

A 6 per cent bump in the company’s shares after Disney reported third-quarter earnings on Thursday suggests a change of pace. The streaming division expanded its revenue by 15 per cent year on year, and turned in its second profitable quarter. Theme park revenue, one-third of Disney’s total top line, was flat but is set to pick up. The company’s traditional TV networks are withering, but investors accepted that reality long ago.

Iger is also now touting a cheerier future, with uncharacteristic detail. Disney says it will grow adjusted earnings per share in high single digits this coming year, then double digits for two years thereafter. The number to beat is $7.08, last seen in 2018 when the kingdom was still making magic. Analysts polled by LSEG expect $6.50. Streaming growth will hinge on pushing up prices, though, the company concedes.

Musing on profitability in 2027 has a whiff of fantasy, because Iger himself is due to be gone by then. Incoming chair James Gorman, former head of Morgan Stanley, has pledged to find a new chief executive by early 2026. With any luck, it will happen sooner: Gorman is a doer, and the board has been actively seeking Iger’s successor since at least January 2023.

Disney’s positive earnings projections make the wait seem less tortuous. But investors deserve better. Boeing, a much more troubled company, found new chief Kelly Ortberg four months after Dave Calhoun said he was quitting. HSBC, a sprawling bank, took three months to choose Georges Elhedery as its new broom. Disney knows how to keep the action moving, except where its own leading man is concerned.