Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Investors running bets against renewable energy stocks have racked up profits of more than $1.2bn from the heavy sell-off that swept the sector in the wake of Donald Trump’s US presidential election victory.

Arrowstreet Capital and Qube Research & Technologies were among firms that had built up short positions against companies such as Norwegian hydrogen firm Nel and German wind turbine manufacturer Nordex, according to data group Breakout Point.

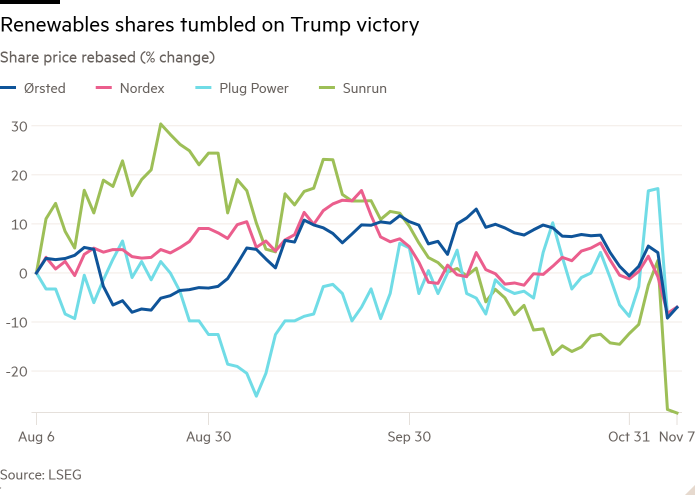

Shares in these companies fell sharply on Wednesday amid concerns that the president-elect will “terminate” President Joe Biden’s Inflation Reduction Act, a move that could result in a halt to tax credits, and pull the plug on offshore wind development.

Hydrogen producer Plug Power and solar developer Sunrun, both of which have been heavily shorted by hedge funds, fell 22 per cent and 30 per cent, respectively, as investors fled stocks likely to be hit by Trump’s plans. The two US stocks together generated around $350mn in profits for short sellers, according to calculations by data group S3 Partners.

In Europe, Denmark’s Ørsted, the world’s biggest offshore wind farm developer, fell nearly 13 per cent on Wednesday, while Nordex lost close to 8 per cent.

In total, funds made more than $1.2bn from bets against 20 of the largest renewable stocks in US and Europe, according to S3’s data.

The clean energy sector has been a popular target for short sellers, as high inflation and interest rates placed strains on businesses whose shares had soared in the early stages of the coronavirus pandemic. The growing possibility of a second Trump presidency has added to those worries this year.

“There have been jitters over the prospect of the US election result,” said Deepa Venkateswaran, head of utilities and clean energy research at Bernstein. “It’s only in the coming months we’ll know what the policies actually are.”

Trump has pledged to end offshore wind in the US on “day one” of his presidency and halt the rollout of subsidies that featured under Biden’s IRA.

Renewables have been in trouble for “a long time”, with investors losing patience with many of these stocks, said Eirik Hogner, deputy portfolio manager at Clean Energy Transition, a hedge fund spun out of Lansdowne Partners.

But on Wednesday, “every stock that was in the renewable basket collapsed”, he added. “Everyone knows how big the IRA announcement was for the sector when it was introduced.” He declined to say whether he had profited from Wednesday’s sell-off.

Bosses of renewables firms including Ørsted and wind turbine maker Vestas sought to stem negative commentary during their quarterly results on Tuesday as US voters went to the polls, telling the Financial Times that renewables played a key role in job creation in Republican-leaning states.

Henrik Andersen, chief executive of Vestas, said statements made during the contest may not be put in to practice when Trump takes office. “Sometimes comments are comments made in political statements, and then we will see what actually comes out of it,” he said.

Andersen on Thursday bought 10,000 shares in the business he leads, according to public filings.

Some analysts have pointed to the growth in renewables during Trump’s first term in office as a reason for optimism on the sector, although others have argued that a partial repeal of the IRA would significantly slow down growth.

Michelle Davis, head of global solar power research at Wood Mackenzie, said she anticipated elements of IRA would be “significantly modified”. She expects one-third less renewable energy capacity could be built over the next decade in a worst-case scenario under which tax credits are significantly changed.

Meanwhile, the “permitting process for future [offshore wind] projects might be halted by federal government agencies”, analysts at RBC warned on Wednesday.

Additional reporting by Ray Douglas