Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Bank of England has delivered its verdict on Rachel Reeves’ Budget: it will bring higher growth and higher prices in the short term, and new uncertainty over the outlook for the economy further ahead.

The UK chancellor’s £70bn boost to spending has reinforced the monetary policy committee’s caution about the scope for further interest rate cuts, following the reduction from 5 per cent to 4.75 per cent on Thursday.

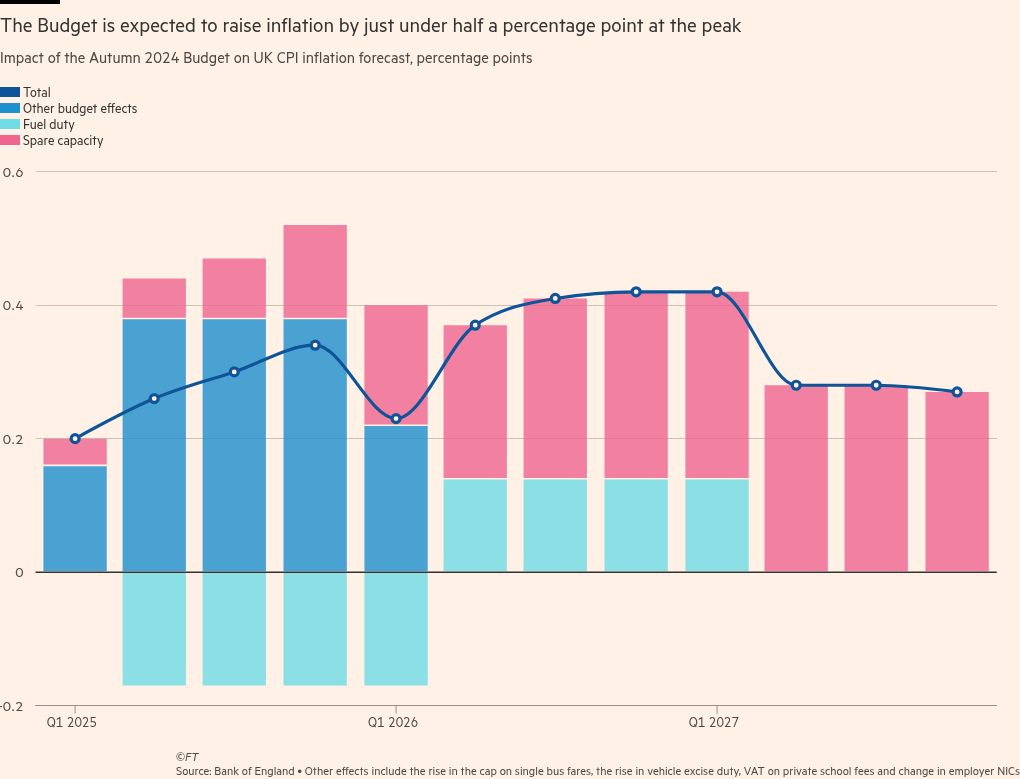

Budget measures will add 0.75 percentage points to GDP and around 0.5 percentage points to consumer price inflation in a year’s time, the MPC said. But the impact of the biggest tax change — the £26bn increase in employers’ national insurance contributions — is much harder to assess.

Policymakers, already wary of cutting rates too fast in the face of persistent wage pressures, want to see how businesses respond to a change that will make it much more expensive to hire low-wage workers.

“A gradual approach to removing monetary policy restraint will help us to observe how this plays out, along with other risks to the inflation outlook,” governor Andrew Bailey told reporters on Thursday.

The MPC’s new forecasts show consumer price inflation will be running at 2.7 per cent in the final quarter of 2025 — well above its previous forecast of 2.2 per cent. It will fall below the 2 per cent target only in mid-2027, a full year later than the committee expected in August. The higher inflation is largely because of the combined effects of the Budget measures.

The main driver is the big, front-loaded increase in government consumption and investment, which will pump up demand in the near-term, while any improvements in the supply capacity of the economy will take much longer to materialise.

The MPC now expects spare capacity in the economy to open up later, and to a smaller extent, than it expected in August — on the face of it pointing to a slower pace of rate reductions in the coming quarters.

The inflation forecasts also reflect the direct effects on prices of the rise in the cap on bus fares, the introduction of VAT on private school fees and the increase in vehicle excise duty, which will all take effect next year.

Plans to increase fuel duty in line with inflation from 2026 are also factored into the BoE’s new forecast, although previous chancellors have repeatedly failed to follow through on fuel duty uprating.

Far more uncertain, however, is the effect of the chancellor’s big tax hike on businesses through employers’ national insurance contributions.

Employers could respond in several ways, Bailey said: by raising prices, accepting lower profits, improving productivity, holding down wages or cutting employment. The overall effect was unpredictable as it would rely on the strength of consumer demand and workers’ bargaining power.

“There is obviously a lot we will learn about the effects of the Budget as they pass through. It’s important we all have the time to do that,” he said.

Clare Lombardelli, the BoE’s deputy governor for monetary policy, noted that the effects would differ between sectors: “It is very uncertain . . . we will want to observe it and talk to businesses about precisely how they plan to respond.”

The BoE’s task will be all the harder because poor data means it is still very hard to assess how strong the jobs market is, and whether workers are in a position to resist attempts to squeeze their pay.

Economists said it was striking, given the material impact of the Budget measures, that the BoE had not signalled any change in its policy stance, with Bailey saying it would not be right “to conclude that the path for interest rates will be very different due to the Budget”.

Its forecasts are premised on market expectations for interest rates in the run-up to the Budget, which implied the benchmark rate would fall to 3.5 per cent in three years.

Since that forecast was finalised, market expectations for bank rate at the end of 2025 have risen by nearly 0.5 percentage points.

But Sandra Horsfield, economist at Investec, said the implications of the two major developments since the BoE’s August forecasts — the UK Budget and US election — remained far from clear.

She said: “The MPC has chosen a middle path as its baseline, but stressed uncertainties on both sides — and its willingness to react should that judgment be wrong.”