Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The UK has some of the smallest homes in Europe and new-build ones are especially bad. That is at least what you would believe if you read what is largely available on the topic.

When I first began investigating, I did not disagree. I had been into plenty of new-build flats and houses where this seemed true — a particular favourite being the master bedroom where you could end up boxed in by a combination of the bedroom, en suite and cupboard doors if you had more than one open at a time. Yet those visits to cramped properties have been matched by walking through some enormous new builds, from a footballer-style mansion in Surrey to a duplex apartment overlooking Hyde Park.

It turns out that understanding of how big our homes are is plagued by “zombie statistics” that refuse to die despite being discredited. The upshot is that UK properties are on the whole larger than you might have been led to believe. And rather than getting smaller, new homes have actually been getting bigger.

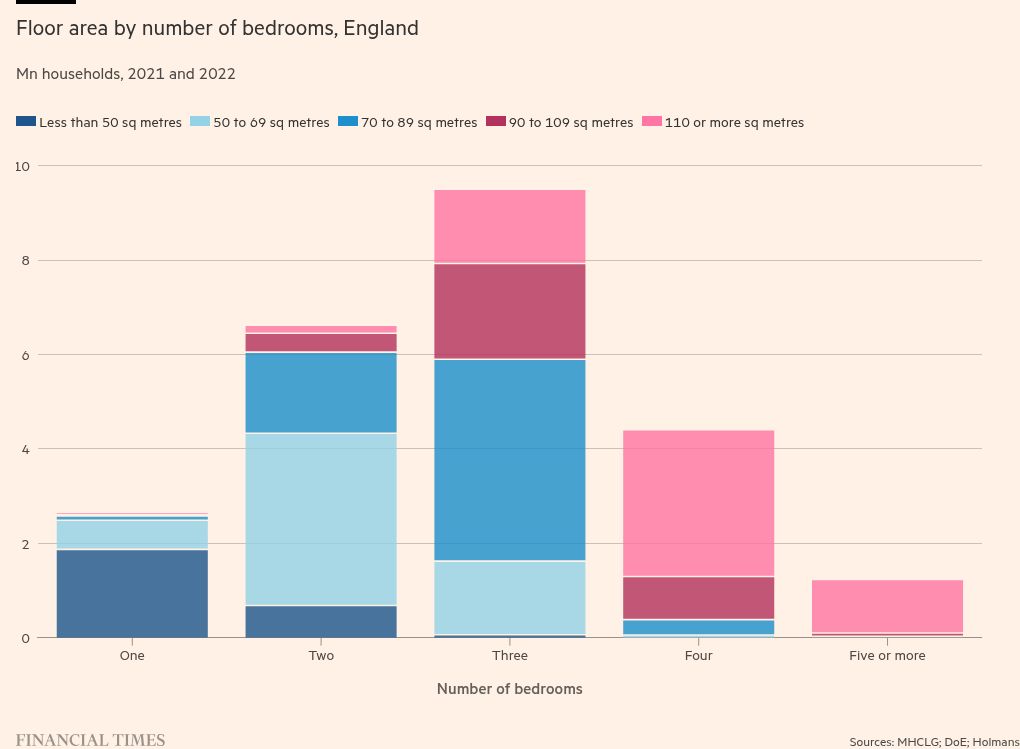

Ask most people how big their home is and they will probably reply with the number of bedrooms. This is understandable: ensuring you have enough rooms for your needs is essential. But fewer people will know how big their home is in square metres or square feet, which is the preferred metric for developers and investors.

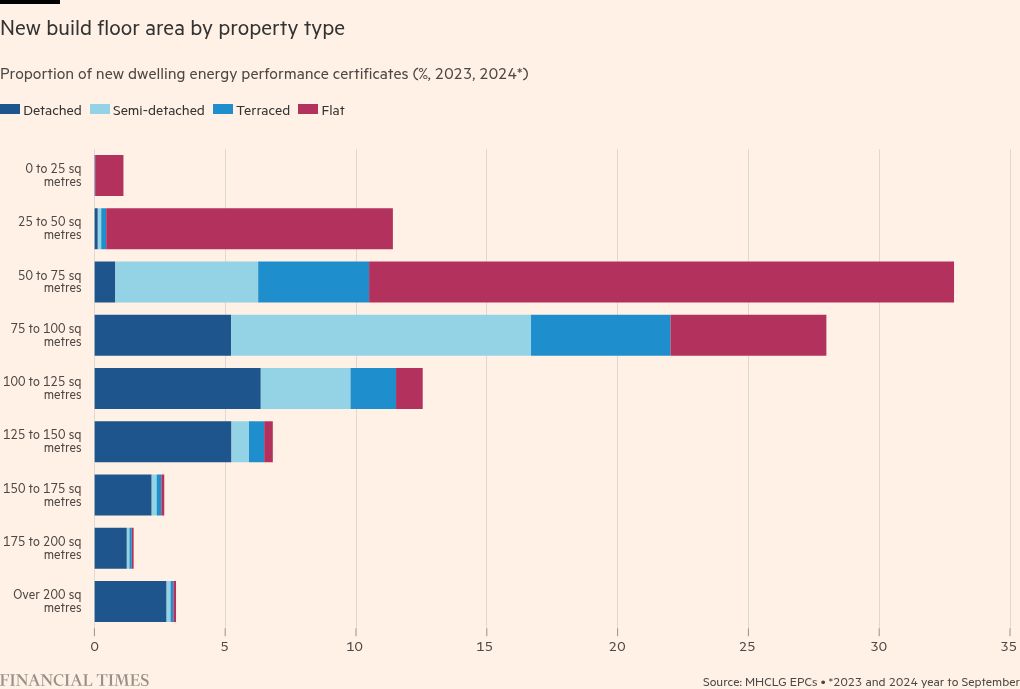

There can be issues ensuring consistency when measuring floor areas, but the definition of a bedroom can be even more flexible. As the chart shows, there is considerable variation in floor areas across different bedroom numbers, with some two-bed homes a similar size or even larger than three-beds. Just ask those who squeeze a small bed into what is clearly an office to increase the bedroom count on the property listing.

The British focus on bedroom numbers is reinforced by major property listings sites. You can filter searches by property type and number of bedrooms, but there is no easy way to compare floor areas on a square metre or square foot basis. This is not the case in the US, where floor area and lot size are readily available filters, though they do tend to have a wider range of much larger properties to choose from.

It is even more difficult to filter or compare prices on this basis. Zoopla recently reported that the typical UK home costs an average of £300 per sq ft, but it is a challenge to compare this figure to a home you find on their website. You will need to dig into the floor plans or Energy Performance Certificates, and may even end up having to add up all the room sizes to get a rough idea of the total floor area.

This, as I know from experience, can quickly get tedious when you are doing several. As a result, few know how much they are paying for a property on a floor area basis. And yet some of the savviest buyers can be overseas investors who will use this pricing approach.

The results could surprise those who are used to focusing on the number of bedrooms. For example, analysis of published price data by UCL showed the average price per square foot of a one-bed home in my local market of Bath was £584 in 2022-23, compared with £485 for a two-bed and £414 for a three-bed. That small flat might be more affordable based on the headline price, but you are probably paying a premium.

So how big are our homes? There is plenty of data on this, at least for England, with an average floor area for all homes of 97 sq m in 2022. That puts it on a par with the European average, slightly above France and Germany, and a little below Spain and Sweden — assuming we believe the statistics are comparable.

However it is not just the average that matters, but also the distribution.

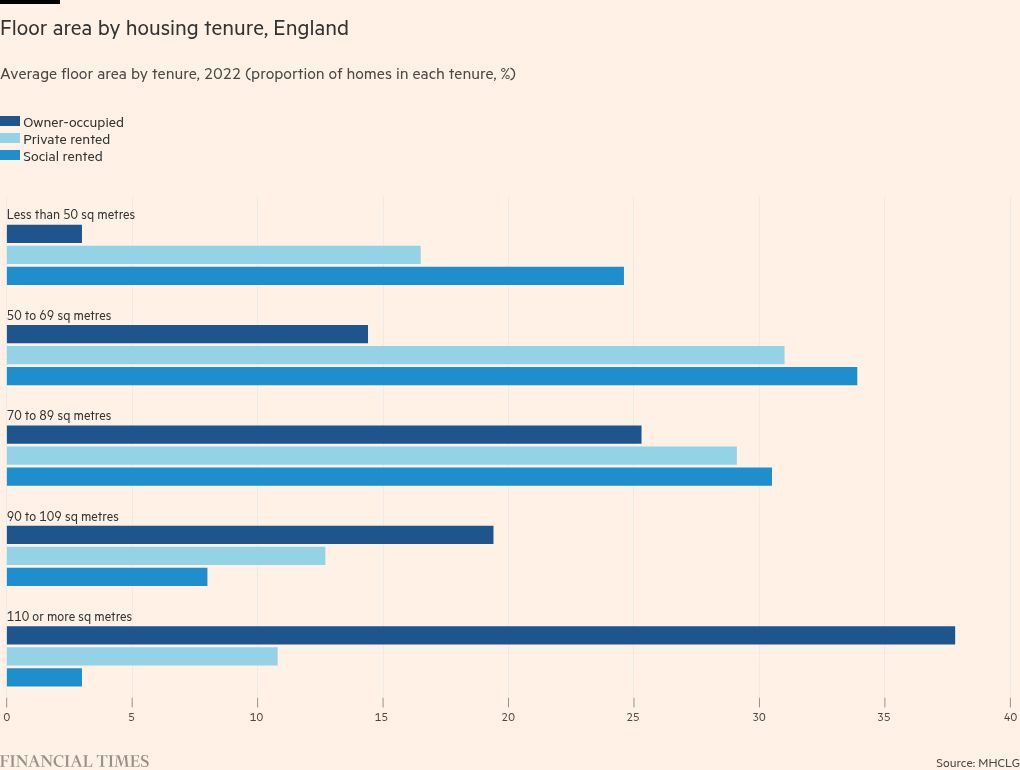

Further data from the English Housing Survey showed the average size of owner-occupied homes was 111 sq m in 2022, with more than a third of them above this size. Yet property sizes in the rental sectors were much smaller, partly reflecting the higher proportion of flats, with an average size of just 67 sq m for social rented homes. About a quarter of these were under 50 sq m in size.

It is the private rented sector that is most squeezed, with an average floor area of 28 sq m per person, slightly lower than the 30 sq m in the social rented sector and well below the 61 sq m per person for owner occupiers.

So what about new-build homes? A quick search tells you that the average new build home is 76 sq m, well below the European average. You might conclude this reflects the stinginess of the industry that looks to squeeze as many homes as possible into a development.

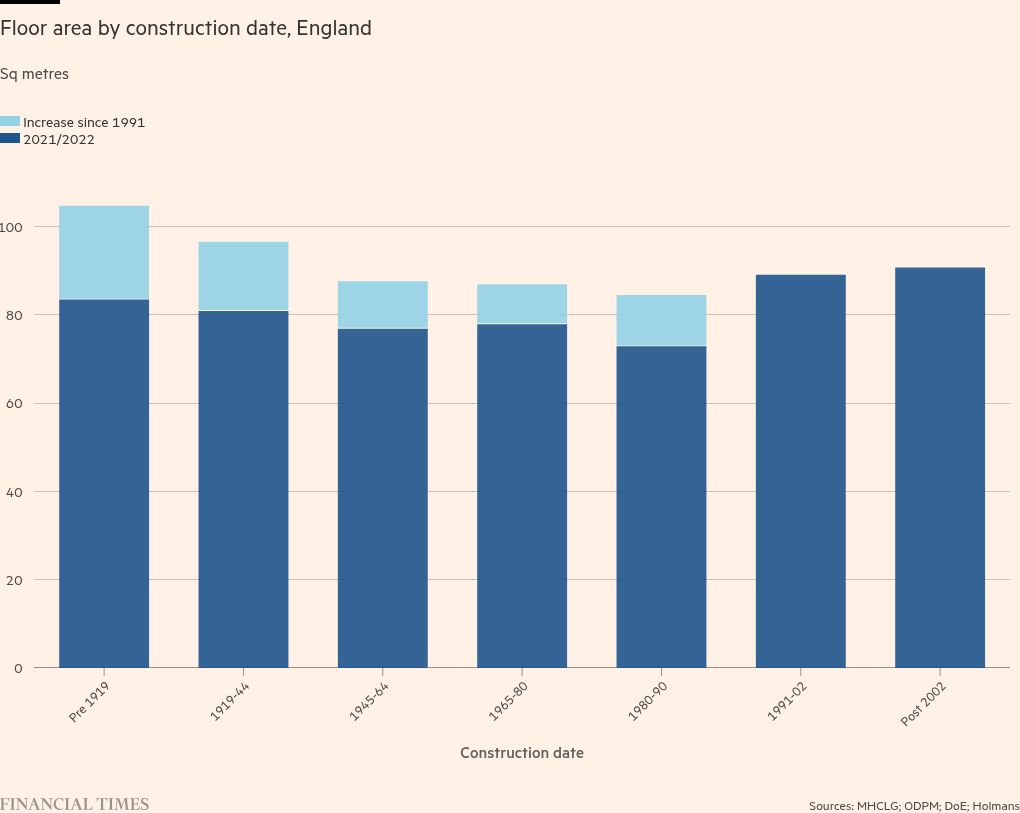

Indeed, it appears to be correct at first glance as older homes are, on average, much larger than newer ones. For example, the average floor area of a home built before 1919 was 105 sq m in 2022 compared with 85 sq m for those built in the 1980s. Yet, as the chart shows, the older homes we now live in started off much smaller and have been extended since first being built. About half of those built before 1919 have been extended, while slum clearances and other demolitions will have removed many smaller period properties from the market.

It turns out that, rather than shrinking, new homes have become larger. The frequently used 76 sq m figure is simply wrong and does not reflect the reality of the recent housing market. A housing market analyst tracked the source of this figure to a report published in 1996 that was based on new builds in the 1980s and early 1990s. As the chart shows, the homes built in this period were the smallest on average of any period.

Unfortunately, the 76 sq m continues to appear in new articles and reports — a true zombie statistic. Instead, new homes have actually been getting larger and are now slightly bigger, on average, than existing homes.

This should not be a surprise given that, for the past decade, we have had the Help to Buy equity loan scheme — nicknamed Help to Buy bigger — that resulted in a significant shift in the new-build market away from a preference in the lead-up to the 2008 financial crisis for city centre buy-to-let flats. Since then, buyers have been more interested in four- and five-bed family homes in suburban locations.

Looking ahead, it is unclear how big the 1.5mn new homes promised by the Labour government will be if and when they are built. But with higher mortgage rates constraining affordability, Help to Buy ended and the focus switched to city centre delivery, they might be a bit smaller than those seen over the past decade. Either way, it is advisable for buyers to break out the tape measure.

Neal Hudson is a housing market analyst and founder of the consultancy BuiltPlace