Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Customers of CME Group have strongly criticised the US futures exchange after it was given the green light to become one of their main competitors.

Banks and small brokers have sharply criticised the Chicago group after it won approval last week to also act as a futures broker — blurring the traditional dividing line between operating an exchange and being a member of it.

“[It] raises serious concerns about market regulation and systemic risk,” said Walt Lukken, chief executive of the Futures Industry Association.

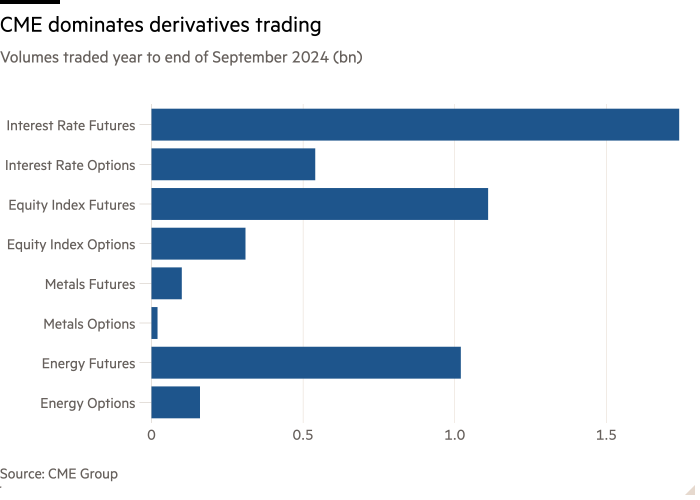

CME is the world’s largest derivatives exchange, handling an average of 28.3mn contracts a day during the third quarter on futures tied to interest rates, Treasuries, energy and equities.

Its new licence will allow it to offer trading directly to investors and ask for the margin that is the insurance for futures trading. It also means the exchange can bypass banks and brokers, who normally do the job as part of their membership of the exchange.

“Only a monopolist would brazenly attempt to disintermediate its clients,” said Lou Scotto, chief executive of FMX, part of billionaire Howard Lutnick’s interdealer broker BGC Group, which recently launched interest rate futures in direct — and fierce — competition with CME.

The licence will “ensure CME Group is in a strong position to quickly adapt to our clients’ changing business needs”, said Terry Duffy, the exchange’s long-standing chief executive.

The industry criticism comes less than three years after Duffy himself had led attacks against a similar plan by crypto founder Sam Bankman-Fried’s FTX.

Gary Gensler, chair of the Securities and Exchange Commission, has also hit out at crypto companies that run potentially conflicting services. Companies such as Binance and Crypto.com have typically run multiple services under one roof, including acting as an exchange, carrying out proprietary trading and custody of assets.

“In traditional finance, we don’t see the New York Stock Exchange also operating a hedge fund, making markets,” Gensler said last year.

The FIA said its members “strongly believe inherent conflicts of interest exist” when one company controlled critical market functions such as trading and clearing, while also acting as an intermediary.

The new licence gives CME the right to act as a broker, known in industry parlance as a futures commission merchant, even as it dominates crucial capital markets such as interest rate and Treasury futures.

Unlike crypto exchanges, it also holds an account at the Federal Reserve Bank of Chicago and can pay competitive rates to customers who deposit margin with it

“Given that they already do executing and clearing as a company, and now adding the broker function, it’s certainly not how other exchanges around the world operate,” said Steve Sanders, executive vice-president at Interactive Brokers.

He said more details were needed about the CME’s plans but added: “If they’re going to undercut our pricing and offer cheaper market data then that will be a problem.”

CME was approved to be a futures broker by the National Futures Association, an industry body that sets standards for brokers. While it has some industry regulating powers, it is overseen by the Commodity Futures Trading Commission, the federal regulator.

The NFA and CFTC declined to comment.

The CME’s approval is also controversial with customers because the US legal system allows exchanges such as CME Group to have quasi-regulatory powers. They include overseeing FCMs.

Brokers play a crucial role in the futures market. They collect collateral, such as cash, from the customer that acts as insurance. That is passed on to the exchange’s clearing house, so that if the customer defaults on payments the impact does not spread into the market.

If the customer’s bet sours, the broker can demand more collateral to keep it open, or close out the customer’s positions.

Duffy decried FTX’s plans in 2022 to set up a broker-free model as a move “with wide-ranging negative implications for the safety and soundness of US financial markets”.

After winning approval to be a futures broker, Duffy sought to assuage concerns, saying: “We remain committed to the FCM model and believe in the time-tested risk management benefits it continues to provide.”

“There’s a chance someone else could come and try to do the same (as FTX),” said Patrick Moley, senior research analyst at Piper Sandler, who viewed CME’s move as defensive.

“In that case, CME would be in a good position if there was another competitor,” he added.

The FIA’s Lukken, a former CFTC commissioner, urged the US derivatives market regulator to “immediately” create rules around exchanges wanting to also hold a futures broker licence.

When FTX made its application nearly three years ago, the FIA had warned that “such a novel structure would raise concerns about conflicts of interest”, Lukken said. “Three years later, these risks remain unaddressed.”