AstraZeneca shares fell 8.4 per cent on Tuesday as a corruption purge involving its China chief risked spiralling wider, clouding the outlook in the drugmaker’s second-largest market.

On Tuesday, Chinese publication Yicai reported that dozens of executives have been implicated in an investigation of medical insurance fraud.

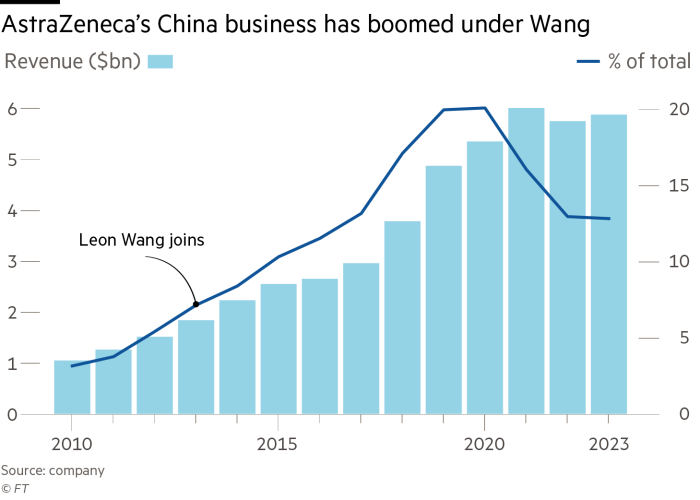

The report came after AstraZeneca disclosed last week that its China president Leon Wang, a high-profile executive who has overseen a period of strong growth for the company, was co-operating with “an ongoing investigation by Chinese authorities”.

The drugmaker has not revealed details of the probe involving Wang. On Tuesday, it said it did not comment on “speculative media reports”, adding that its operations in China were “ongoing” and “if requested, we will fully co-operate with the Chinese authorities”.

Three people familiar with the matter said the investigation into Wang was related to company salespeople being found guilty of fraud and imprisoned in China after “tampering” with patient test results. If Wang is found to be implicated, the fallout from the probe could widen to include more staff, one of the people added.

The share price drop led to a more than $14bn fall in AstraZeneca’s market capitalisation and highlights the importance of its Chinese operations.

The probe is part of a sweeping anti-corruption crackdown on the private sector by Chinese authorities, adding to mounting pressures in the country for foreign companies, including rising competition from domestic rivals and faltering growth.

It comes at a pivotal moment for the foreign drugmaker, which counts China as its second-largest market after the US. Wang had been spearheading a strategy to localise the supply chain and invest in start-ups researching breakthrough therapies in the country.

AstraZeneca is banking on growth in China to help reach its target of $80bn in annual revenue by 2030, up from $46bn in 2023. “AstraZeneca has gone above and beyond other companies to invest in China,” said Helen Chen, head of LEK Consulting’s healthcare practice in Shanghai. “It hasn’t just treated it as a place to sell or manufacture its drugs but has committed serious capital.”

The probe into the company’s China president relates to AstraZeneca’s sales of its lung cancer treatment, Tagrisso. The drugmaker had heavily promoted the oncology drug in China, which has 43 per cent of the world’s lung cancer cases due to high smoking rates and air pollution, according to the Global Cancer Observatory, a cancer data platform.

The best-selling drug was only eligible for national insurance coverage for patients with a specific genetic mutation until 2021 when coverage was expanded.

In the past two years, at least eight AstraZeneca salespeople have been found guilty of fraud after altering the genetic test results of patients in order to qualify for coverage between 2020 and 2021, according to a Financial Times review of Chinese court documents.

State prosecutors alleged that the state was defrauded of several million yuan, according to the court documents and public filings. The salespeople were given prison sentences ranging from eight months to three years.

In one case, three salespeople in their late twenties to early thirties were convicted of fraud in June for tampering with medical records in order to boost their sales performance in Xining in Qinghai province.

AstraZeneca said: “We have strong compliance policies in place and we expect our employees to operate fully in line with the rules and regulations in China.” The company said in the statement last week that “if requested, AstraZeneca will fully co-operate with the investigation” into Wang. It had no further comment on the investigation.

Last month, financial business publication Jiemian reported that former AstraZeneca head of oncology Yin Min had been detained. Authorities are trying to ascertain how much the senior leadership knew about the fraud, according to the people familiar with the situation. AstraZeneca declined to comment on the report.

Tagrisso has been pivotal for AstraZeneca’s recent success in China after changes to drug pricing resulted in plummeting sales of several lucrative products. In 2019, Beijing introduced reforms to replace foreign off-patent medications with cheaper domestic alternatives, hitting sales of the company’s heart medicine Crestor, cancer treatment Iressa and asthma drug Pulmicort.

AstraZeneca has been better placed than some rivals to weather the reforms due to its “big portfolio of innovative products to plug the gap, including its lung cancer therapy”, said Chen. Its diabetes medicine Forxiga has also helped offset losses.

The probe into Wang, considered by industry insiders as the most influential Chinese leader at a global pharmaceutical company, is a challenge for AstraZeneca’s fortunes in a country where it derives 13 per cent of its revenues, with $5.9bn of sales last year.

Wang, who joined the company in 2013 from Swiss pharmaceutical group Roche, became the country president a year later and drove a localisation strategy to widen its sales channels, which included building facilities in hospitals to introduce physicians to its respiratory products.

Through booming sales, Wang built the China business into an independent fiefdom with significant control over its operations, according to people close to the company.

“With the scale that AstraZeneca achieved, it is appropriate that they have more autonomy. Leon became the face of how multinational corporations can have strong Chinese leadership,” said Chen.

The autonomy allowed Wang to spearhead a partnership with state-backed investment bank China International Capital Corporation to launch an investment fund with a target size of $1bn to incubate local start-ups. AstraZeneca also signed several agreements with local governments to build regional headquarters with innovation centres to attract talent.

Over the past year, the company has also joined a rush of foreign pharma companies investing in Chinese drugmakers and products. In December 2023, it bought Chinese group Gracell Biotechnology for $1.2bn and in October licensed a cholesterol-lowering drug from Chinese biotech company CSPC Pharmaceutical Group in a deal worth a potential $2bn.

As the investigations into AstraZeneca intensify, it is unclear how they will affect its China sales and growth strategy. As Chen put it, the company “has tried to be a good China corporate citizen”.

Additional reporting by Clive Cookson in London