Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In most sectors, a single road bump is enough to send stocks skidding. The European car industry, however, is in the middle of a pile-up of jolts, including sluggish domestic demand, faltering electric vehicle sales, fierce competition from Chinese automakers, enduring overcapacity and plummeting profits. On top of all of this, it also faces the possibility of having to pay billions of euros in fines for carbon dioxide emissions.

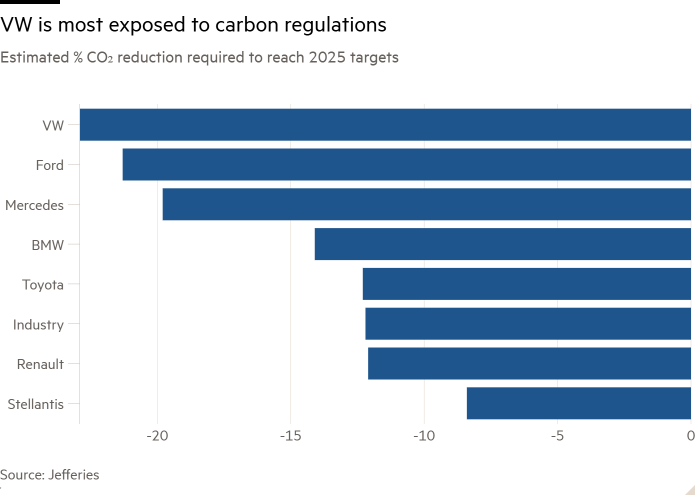

The scale of the potential charges is dizzying. The EU requires carmakers to cut the CO₂ emitted by the average of the vehicles they sell — measured in grammes per kilometre — by 15 per cent by 2025. For the industry as a whole, that works out to a target of 95g/km.

The trouble is, that is far lower than the average car sold in Europe, which emitted 107g/km in 2023 according to the International Council on Clean Transportation. On these numbers, EU carmakers would face an average excess of 12g/km on each of the roughly 11mn vehicles they sell. Fined at €95 each, that is a total charge of €12.5bn.

Given EU carmakers’ declining profitability, these are big numbers. Collective operating profits are set to fall from almost €90bn in the 2023 fiscal year to nearer €60bn this year, thinks Harald Hendrikse at Citigroup. The pain will be unevenly spread, with analysts identifying bedraggled Volkswagen as the most exposed.

These numbers may well change by 2025. Slowing demand for EVs worsens the mix. But carmakers may be able to offset this by fiddling their sales line-up to exclude the most polluting vehicles and launch new, cheaper EV models. The objective, here, will be to pick the lesser of the two evils between a margin hit and the CO₂ fine, in a sort of carbon catch-22. Carmakers — and some politicians — may also be hoping that they can convince regulators to soften the blow.

By any reckoning, this looms as a large threat, for the carmakers themselves and for a continent that relies on them to maintain employment and invest in an EV sector in which US and Chinese companies already have a solid lead.

Carmakers must shoulder a share of the responsibility for this state of affairs. They could have done more to produce better and cheaper EVs, and manage their cost base to protect margins. Yet supply-side targets are difficult to achieve when they are not accompanied by incentives to stimulate demand; consumers are not willing to buy climate-friendly products on merit alone. Blame for this, additional, obstacle is shared. But that will be little consolation for investors in the banged-up sector.