Investors have been raising their bets that next week’s US presidential election will trigger sharp price swings in bond and currency markets.

The Ice BofA Move Index, a closely watched gauge for future moves in the Treasury market, is up almost 40 per cent in October and hit its highest level in more than a year earlier this week.

“The most realistic near-term risk is the outcome of the election,” said Steven Oh, global head of credit and fixed income for PineBridge Investments.

Benchmarks that measure potential volatility over the next 30 days in foreign exchange and equity markets have also risen ahead of Tuesday’s vote, as polls indicate a very tight race between Republican nominee Donald Trump and Democratic candidate Kamala Harris.

Investors say the closeness of the contest is weighing even more heavily on markets than the possibility of an escalation of the conflict in the Middle East or concerns over the pace of interest rate cuts by the Federal Reserve.

“For us, this election really matters, and it matters . . . more than what the Fed or economic data is telling you right now,” said Andrzej Skiba, head of Bluebay US fixed income at RBC GAM.

Treasuries have already sold off sharply in recent weeks as investors judged a Republican victory that could lead to inflationary policies was becoming more likely. The elevated Move index, which reflects market expectations of volatility in Treasuries, suggests investors expect further swings to come.

“You could see a big re-rating in bonds on the other side” of the election, said Emily Roland, co-chief investment strategist at John Hancock Investment Management.

“Once the noise is out of the way, bond investors will be able to focus more on disinflation,” which should push yields back down, she said. Yields move inversely to prices.

However, an outcome such as a Republican sweep of the White House and both parts of congress could push yields higher still, she added.

The most well-known volatility gauge — the Vix index — has, at a headline level, remained relatively calm, although it climbed above 23 on Thursday as US technology stocks led a sell-off in equities.

The Vix reflects implied volatility in the S&P 500 index over the coming 30 days and has been below its long-term average of 20 for most of the past three months.

However, analysts said the index had been unusually high relative to realised volatility — the actual swings that take place in stock markets — in recent months, even before Thursday’s jump.

The Vix “doesn’t look elevated, but if you compare it with realised volatility, it is very elevated . . . Implied vol is telling you the market perceives there to be plenty of risk,” said Binky Chadha, chief global strategist at Deutsche Bank.

Typically, the Vix trades a few points higher than the backward-looking index of realised volatility, but the gap between the two has widened dramatically recently.

As of Wednesday’s close, the Vix was almost 12 points above realised volatility, around its widest gap since a brief spike around the August stock market sell-off.

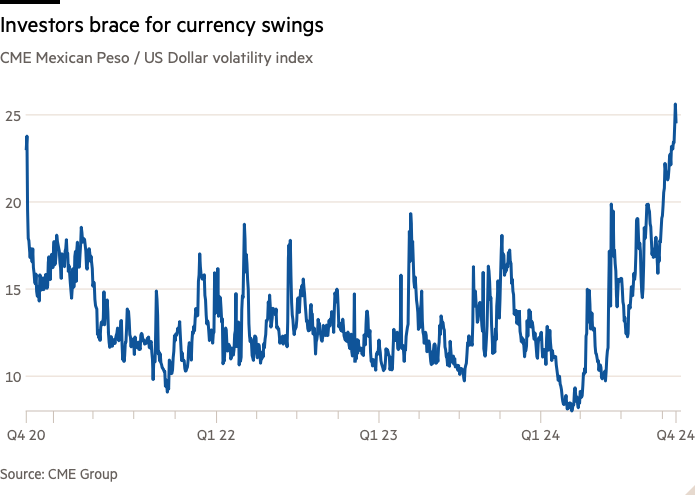

Expected currency market volatility has also jumped as traders debate the potential impact of policy proposals such as sweeping tariffs on US imports. A CME index of implied volatility across a basket of developed market currencies this week hit its highest level since early 2023, while its volatility index for the Mexican peso has surged to its highest level since the first Trump presidency.

Steve Englander, head of G10 FX Research at Standard Chartered, told clients on Wednesday that the moves in currency volatility had been sharper than during recent election cycles. They reflected “both uncertainty on the outcome of the election and on what the policy agenda would be in case of a Trump win, as well as uncertainty on whether the outcome will be a sweep or split Congress”.

Implied volatility has historically tended to rise before presidential elections and quickly dissipate after the vote, and many analysts and investors expect a repeat.

Englander said currency volatility could start to reverse “very quickly as election results are inferred”. John McClain, a portfolio manager at Brandywine Global, said “the market hates uncertainty [but] as soon as you have certainty, the market moves on.”

However, with polls suggesting the election is on a knife edge, some have cautioned that volatility could last longer than usual, for instance if the result is challenged.

There is a chance of “a very, very close disputed election that is challenged for an extended period of time”, said Pinebridge’s Oh. “It’s not a foregone conclusion that we won’t have some potential for violence — and hopefully we won’t have that type of action.”