Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Activist investor Carl Icahn has suffered a new blow to his ailing financial empire as its largest investment runs into financial difficulties.

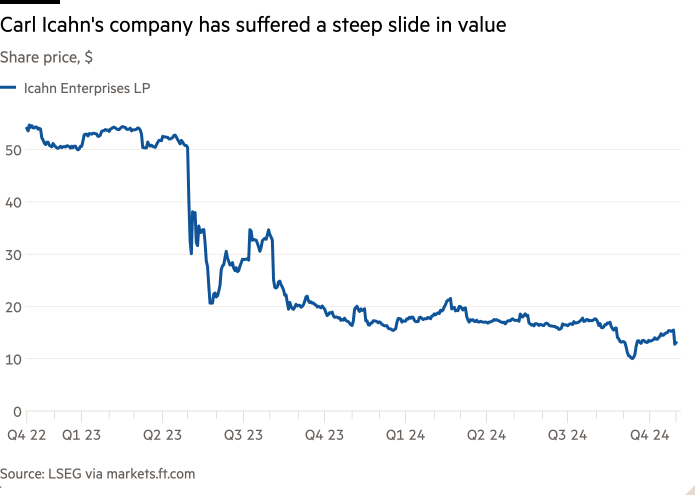

Icahn’s publicly listed holding company has fallen more than 10 per cent this week after a small Midwestern refinery it owns suspended its dividend, cutting off one of the veteran investor’s crucial sources of cash. It has created another big setback for Icahn, 88, as he works to revive his corporate empire amid a decade-long run of investment losses and scrutiny into large personal debts he has accumulated.

CVR Energy, an operator of refineries in Oklahoma and Arkansas that is majority owned by Icahn Enterprises, on Tuesday suspended its dividend to conserve cash amid heavy spending needs and operational problems. The company had unexpected downtime at its refineries, spreads on refining margins have contracted and it needs cash to upgrade equipment.

The announcement sent CVR shares tumbling by nearly a third this week and hit the value of Icahn Enterprises, which owns 66 per cent of CVR’s outstanding stock. Icahn Enterprises fell 14 per cent before recovering slightly on Wednesday. The value of its stake in CVR dropped by about $500mn to $1.1bn.

Icahn did not respond to an email and phone call seeking comment.

CVR shares account for roughly a quarter of Icahn Enterprises’ $4bn in net assets. Their plunging value could mean Icahn’s investment portfolio will lose money for an 11th consecutive year.

Investment losses aside, the dividend suspension may create added financial pressure on Icahn as he tries to reverse a steep slide in the value of Icahn Enterprises, which is his principal asset. Icahn owns 86 per cent of the company’s outstanding shares.

Last year, the seller Hindenburg Research, led by Nathan Anderson, characterised Icahn Enterprises’ dividend as unsustainable and was critical of the heavy personal debts Icahn had taken against the shares in his own company.

Hindenburg’s report revealed that Icahn had borrowed against most of his Icahn Enterprises shares, debts that came with the risk that he could be forced to sell shares to repay the loans, potentially driving down their price. The risk became more pronounced when Icahn Enterprises’ shares plunged after the short seller’s attack, forcing Icahn to restructure the loan so it would be tied instead to the value of the company’s net assets.

But earlier this year, Icahn restructured the loan once more. In the amendment, which some analysts have taken as evidence of rising financial pressure, Icahn pledged all of his shares, nearly $1bn in personal investments, and other personal assets as collateral for the loan and was forced to make some accelerated principal payments.

Amid these challenges, CVR has been a ballast of strength for Icahn because of the large dividend payments it had paid. Earlier this year, the FT reported that CVR was a vital source of cash to Icahn Enterprises, paying the holding company more than $3.2bn in dividends since 2013 and more than $400mn in each of the past two years alone.

Now CVR’s falling value and the shuttering of its dividend spigot have prompted analysts to question whether Icahn Enterprises may be forced to cut its own dividend. Icahn Enterprises currently pays a $4 per share annualised dividend, equating to a 31 per cent yield.

“I don’t see any other company issuing a dividend that yields over 30 per cent to the stock,” said Nick Moglia, an analyst at research firm CreditSights. “That yield seems fairly unsustainable to me.”