Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Britain’s wealthiest residents will be hit by a string of tax rises after chancellor Rachel Reeves ignored warnings about an exodus of rich foreigners and pressed ahead with a contentious raid on offshore trusts used by non-doms.

The government said on Wednesday that it would end the use of trusts to shelter assets from UK inheritance tax, part of a wider move to abolish the non-dom regime that the chancellor says will raise £12.7bn over the next five years.

The changes formed part of a £40bn tax increase by the Labour government that included higher taxes on private equity, second homes, private jets and private schools.

One European businessman affected by the end of the non-dom regime said that it was “a real problem” that wealthy foreigners who live in the UK would now face inheritance tax of 40 per cent on their global assets. He added that he had “zero regrets” that he began moving his family to Switzerland earlier this year: “It’s a real Labour Budget: they were quite upfront about taxing the rich.”

A second European non-dom, who recently left the UK to divide her time between Greece and Switzerland, said: “It’s a shame but now we’ll be guests in the UK and not forming more permanent ties. Most of our friends have left already or will definitely leave after what we’ve heard today.”

But government analysis suggested that only 1,200 non-doms out of a total of 74,000 were likely to leave because of the changes to the regime.

The analysis estimated that only 200 more non-doms were likely to leave because of the stricter rules to be introduced by Labour, after the Conservatives announced they were scrapping the regime earlier this year.

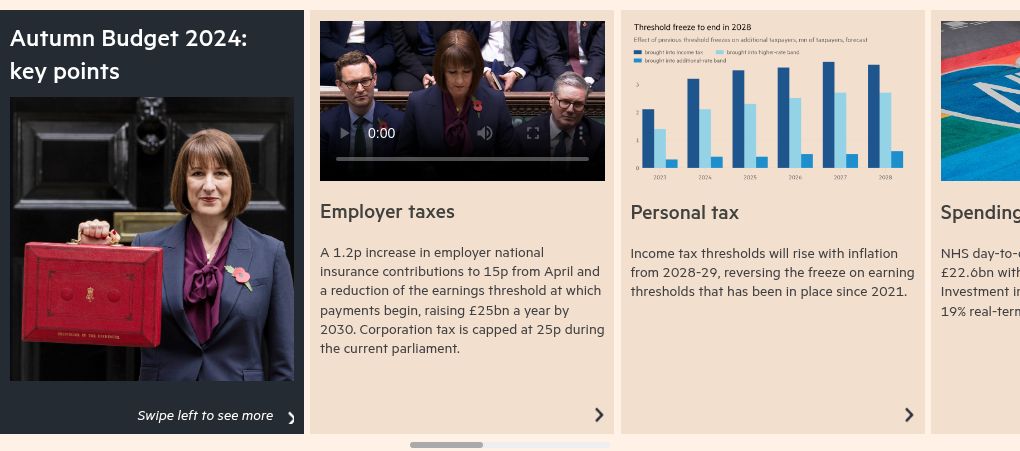

Reeves also said the government would increase the tax on carried interest — the share of profits that private equity managers get to keep when they exit investments, currently taxed as capital gains — from 28 per cent to 32 per cent in April. It will be reclassified as income from 2026, albeit at a lower rate than the top income tax rate of 45 per cent, and “with bespoke rules to reflect its unique characteristics”, according to the Treasury.

Advisers warned that Reeves had left the door open to further changes.

One leading tax lawyer said the government’s new rules for carried interest marked a “ticking bomb”. The reform came alongside an increase in the higher rate of capital gains tax for other assets from 20 per cent to 24 per cent.

Haakon Overli, co-founder and general partner at European venture capital firm Dawn Capital, said that tax increases to capital gains and carried interest may mean that “money leaves the UK tech ecosystem”.

A senior partner at a large British private equity firm said the government had “mismanaged expectations” by “creating a drought of confidence then presenting it as more positive than it is” on Wednesday.

Other measures targeted at the wealthy include increasing the stamp duty charged on purchases of second homes, lifting the rate of air passenger duty on private jets by 50 per cent, and imposing VAT on private education from January.

The increase in the stamp duty surcharge for properties bought by non-residents from 3 per cent to 5 per cent means that the overall tax on the purchase of a £10mn second home will now be £1.8mn, up £200,000 from before the Budget.

Ed Tryon, co-founder of Lichfields property buying agency, said that the UK capital’s attractiveness for foreign buyers had been waning for a decade. “London’s appeal for international buyers has been slowly eroded ever since the [market] peak of 2014 — an extra 2 per cent is just another reason not to commit,” he said.

Reeves also announced pensions will be brought within an estate for inheritance tax purposes from April 2027 unless passed on to a spouse. The change is expected to raise £1.46bn a year by April 2030 and could presage a fundamental shift in how the wealthy think about retirement planning.

Beneficiaries may have to pay income tax on the pension proceeds even after inheritance tax has been deducted, if the pensioner dies after they turn 75.

The chancellor’s decision to limit agricultural and business property relief for assets of more than £1mn from April 2026 also means that business owners and landowners will potentially face large inheritance tax bills.

The inheritance tax reliefs were designed to ensure family and farm businesses continued after the owner’s death, but currently overwhelmingly benefit the country’s largest estates.

Reeves said that the first £1mn of combined business and agricultural assets would attract no inheritance tax, as before. But assets over £1mn would attract death duty at a reduced rate of 20 per cent: a reform designed to protect family farms, but hit large landowners exploiting the loophole.

Leslie MacLeod-Miller, chief executive of lobby group Foreign Investors for Britain, called the move a “bombshell for entrepreneurs”.

Edmund Fetherston-Dilke, a partner at law firm Farrer & Co, said there were “other tools” estates could use to avoid being subject to inheritance tax, “but all of these different strategies may be expensive, may not be appropriate and there’s going to be some hard thinking”.

Additional reporting by Alexandra Heal, Michael O’Dwyer and Madeleine Speed