Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A government’s first budget in power is an opportunity to set the right tone for their term. The mood running up to the UK’s Budget on October 30 — the first fiscal event under a Labour government since 2010 — has been downbeat: the party inherited an indebted and sluggish economy and taxes are set to rise. The combination of a promise not to raise levies on “working people”, an estimated £40bn gap in the public finances, and plans to raise borrowing have added to the anxiety of businesses, investors and markets.

Chancellor Rachel Reeves needs to allay those concerns. She must convincingly show that she is, in fact, steadying the British economy, and paving the way for a brighter outlook. To do so, her budget must pass three core tests.

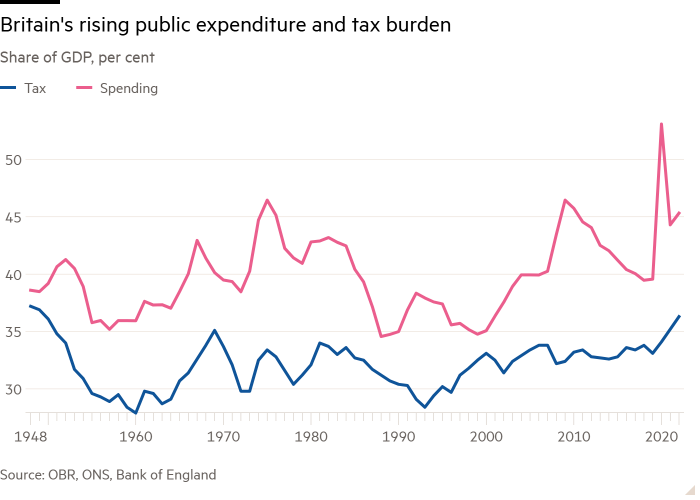

First, her measures must boost economic growth. The IMF raised its forecast for UK growth in 2024 last week, but the country’s long-term trajectory is still subdued. Reeves’ agenda must ensure that Britain’s recent low-growth, rising-tax ratchet will not be entrenched.

This will not be easy. The government’s plan to boost public investment and streamline the planning system is a promising start. But tax-raising plans must not overburden highly mobile wealth-creators. She also needs to outline bold plans to reform the tax and pension system, to support growth and investment. Businesses will judge her proposals in the round. If her Budget puts too much strain on them today, while doing little to address broader obstacles to scaling, hiring and investing, the UK’s competitiveness will suffer.

Second, Reeves’ spending plans must be credible. The chancellor has admirably trailed this Budget as one to begin fixing Britain’s strained public services by promising no return to austerity and a jump-start to public investment. Better funded hospitals, courts and schools are a foundation for the economy, but spending must come alongside reform to raise public sector productivity and find savings. Otherwise, with rising demands on the public purse, the state risks growing ever larger.

On investment, Reeves should channel any additional borrowing towards growth-enhancing projects, particularly to improve the UK’s infrastructure. But rather than splurging, the chancellor needs the country to get better at appraising and delivering investments, cost-effectively. The UK has a poor record here. Greater funding for public services and investment is only worthwhile if spent wisely.

Third, the chancellor must convince financial markets. Her main fiscal rule to balance day-to-day budgets shows a commitment to fiscal prudence, and creates borrowing capacity for investment. But bondholders are still looking for discipline with a credible debt-based fiscal rule and evidence that funds will go towards productive investments.

She is likely to emphasise a new measure, or definition, of debt which will open up additional borrowing headroom. Writing in the Financial Times, the chancellor also outlined new institutions to scrutinise spending. She has to be more precise about how additional fiscal space will be used prudently to avoid higher gilt yields adding to the fiscal hole.

In recent weeks, Labour has said its Budget aims to restore public services, unleash investment, support wealth creators and plug a “black hole” in the finances. Reeves’ announcements will need to do enough on each front, even if she cannot realistically hit all goals comprehensively.

For a government elected to turn Britain’s economic fortunes around, the overarching test for the chancellor on Wednesday will be whether she has set the country on a better course. Focusing on growth, prudent spending, and a credible fiscal framework would help.