Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Tokyo Metro, the underground railway network that carries more than 6.5mn passengers a day through the Japanese capital at levels of punctuality and cleanliness envied around the world, will list its shares on the Tokyo Stock Exchange on Wednesday in the country’s biggest initial public offering in six years.

The listing, backed by an extensive TV advertising campaign and door-to-door sales efforts by bankers, has been supported by more than 30 brokerages. It is the first major IPO since the government significantly expanded a tax-protected individual savings scheme this year aimed at drawing millions of ordinary Japanese into the stock market.

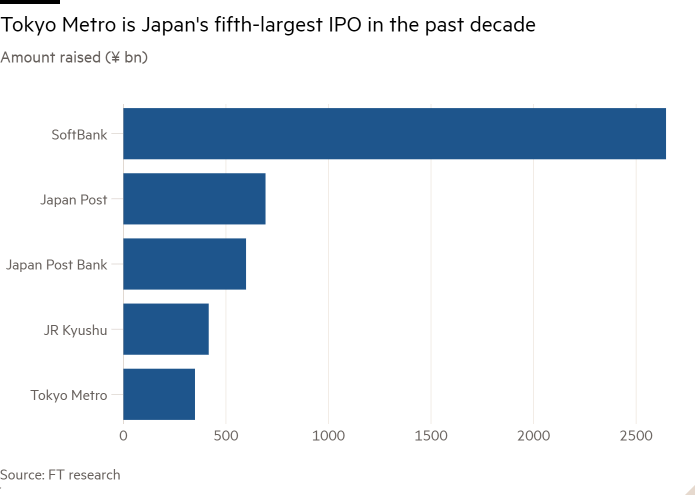

The long-awaited listing, which was heavily oversubscribed and has raised ¥348bn ($2.3bn), is Japan’s first privatisation of a government-owned company since the IPOs of JR Kyushu, which raised $4bn in 2016, and of Japan Post a year earlier, which drew in $11.7bn.

Those offerings took place when the Nikkei 225 benchmark was trading at around the 17,000 level. The index has risen more than 100 per cent since then, driven in part by institutional investors betting that rising consumer prices and the Bank of Japan’s attempts to “normalise” monetary policy will prompt households to risk part of their savings on higher-yielding investments such as stocks.

The Japanese rail operator’s float is the biggest on the Tokyo Stock Exchange since the $23.5bn listing of SoftBank’s mobile unit at the end of 2018.

The Tokyo Metro IPO has been priced at ¥1,200, the higher end of the forecast range. The proceeds will help the Japanese government repay bonds to rebuild Fukushima prefecture following the nuclear disaster in 2011.

Bankers involved in the listing said the IPO was 35 times subscribed for international institutional investors, 20 times for domestic institutional investors and about 10 times for domestic retail investors, who make up the bulk of the free float.

The subway operator has been enticing retail investors with freebies ranging from train tickets to passes for its own museum and golf driving range.

Based on the IPO price, Tokyo Metro’s expected valuation will be $4.6bn, with the Japanese government and the Tokyo Metropolitan Government holding the remaining half.

As well as testing retail investor appetite under the expanded tax-free savings scheme, Tokyo Metro’s listing will be closely monitored by Bain Capital, which is seeking to take public Kioxia, the flash memory business acquired from Toshiba, in early 2025, according to sources close to the company.

The IPO follows a volatile period for Japanese stocks caught up in the unwinding of a global “carry trade”, as well as increasing shareholder pressure that has pushed some companies to delist and conduct management buyouts.

Tokyo Metro’s debut will fuel a recovery for Asia’s IPO market after Hyundai’s $3.3bn listing of its India division in Mumbai this week. Japanese X-ray technology group Rigaku Holdings is set to float on Friday, raising $750mn.

The listing of the subway system, which is made up of nine lines, comes as rail travel rebounds following a collapse in passenger numbers during the coronavirus pandemic. Japan’s transport networks have also been boosted by an influx of tourists.

Tokyo Metro, which dates back to 1920, is relatively sheltered from declining passenger numbers related to Japan’s falling population, with the capital’s expected to keep growing to 2030, according to local government forecasts.

Despite the underwriters’ efforts to present Tokyo Metro as a company with long-term growth prospects, several fund managers said they were underwhelmed by the prospectus and had opted not to bother subscribing.

The stock, said one manager, was unlikely to be valued as a significant beneficiary of Japan’s ongoing tourism boom and would ultimately fall victim to Japan’s prevailing demographics of a shrinking and ageing population.

Beyond the free handouts for shareholders, retail investors are likely to be drawn in by the 3.3 per cent dividend yield the company will offer, which ranks above that of listed rivals such as Kyushu Railway and East Japan Railway Company.

Shingo Ide, chief equity strategist at NLI Research Institute, said Tokyo Metro would appeal to investors as an income stock with stable profits but did not present opportunities for serious growth.

“It’s the first big IPO in a long time. It’s a company without anyone who doesn’t know it [in Japan],” he said. “It might be negative for other yield stocks such as [telecoms group] NTT or East Japan Railway Company.”

Ide added that other rail operators were more attractive to institutional investors since a larger share of their revenues come from real estate, creating opportunities for bigger returns versus the 90 per cent of revenues derived from Tokyo Metro’s core transport business.