Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

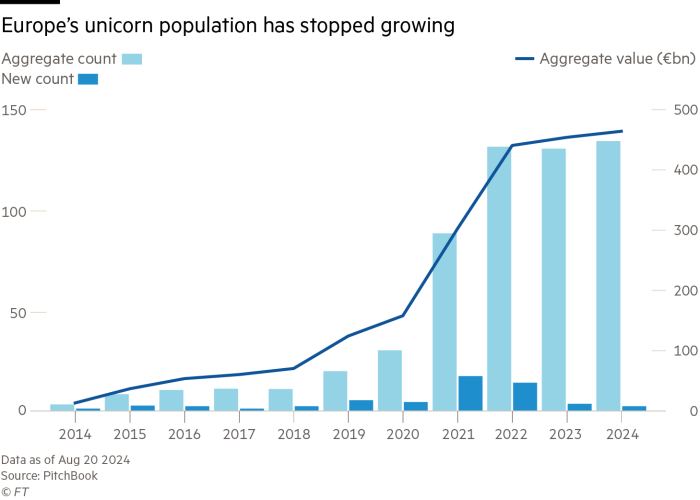

European unicorns are shrinking. The glory days of 2021 and 2022, marked by easy money and investor nonchalance over profitability, pumped up valuations. But the subsequent dearth of funding rounds — only half have passed the bowl since then — leaves these valuations looking desperately outdated.

Europe’s universe may be overvalued to the tune of nearly €100bn, or more than a fifth of aggregate value based on the last funding, reckons PitchBook, in the worst case. That means some of the continent’s 139 unicorns may no longer be worthy of the title. PitchBook cites Italian buy now, pay later fintech Scalapay and mobile payments app Satispay, both valued at more than €1bn two years ago, as examples.

More will amble out the (back) stable doors. So far this year, two out of five start-ups seeking funding have done so at a lower value than achieved previously. Only a handful of new unicorns were minted last year; the net number has more or less flatlined since 2022.

Gathering clouds over Europe, which has always lagged behind the US and China when it comes to creating $1bn-plus start-ups, are inevitable. Tech thrives on scale. Delivering meals, shopping and banking — or all three — is a lot easier when your home market of hundreds of millions all speak the same language.

This is a cyclical game. To keep investing, venture capitalists and their investing clients need to get money back. Stasis on distributions means stasis on fresh cash infusions. Thus few would argue that a new generation is about to be birthed, or that the worth of the old stable will swell. PitchBook’s best-case scenario is that valuations plateau.

But it is too early to pension the sector off. For one, fewer rounds also signal changing sources of funding. At least some of the stables are generating their own cash flow or still have some left from when markets were kinder. Others are turning to venture debt, which neither dilutes nor elevates equity valuations. Payments app SumUp raised €1.5bn from private credit lenders led by Goldman Sachs earlier this year.

Europe is less reliant on classic VC too. Corporate capital is playing a bigger role. Governments play an outsize role, accounting for more than a third of European VC funding last year.

Fintech is where Europe, specifically financial services-heavy Britain, flexes most muscle. Down rounds in the sector are eclipsed by Revolut, which secured a $45bn valuation a few months ago, up from $33bn in 2021. Or take peer Monzo, which secured a valuation of up to $5.9bn. Not a trendsetter, but a sign it is not all doom and gloom for European VC.