Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Goldman Sachs’ quarterly profits jumped 45 per cent to $3bn in the third quarter, boosted by its equity trading business, even as the investment bank took another hit from its retreat from retail banking.

Goldman’s net income compared with $2.1bn in the third quarter of last year and outstripped analysts’ estimates of about $2.5bn.

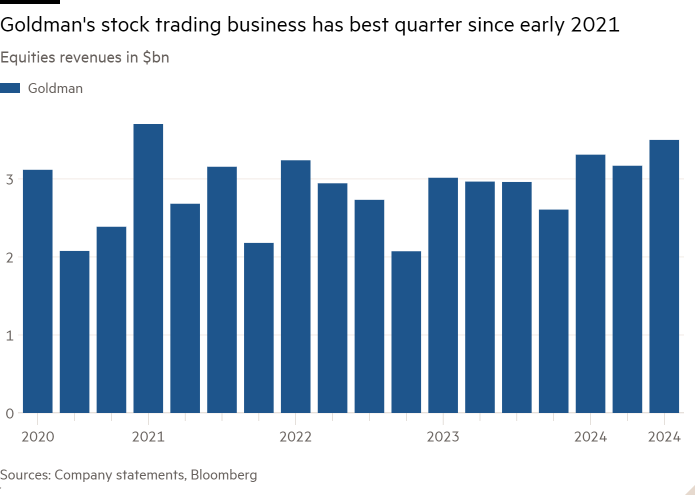

In the best quarter for Goldman’s stock trading business since the start of 2021, equity trading revenues reached $3.5bn, up 18 per cent and defying expectations they would be roughly flat compared with a year earlier. Fixed income trading revenues fell 12 per cent to $3bn.

Overall trading revenues were up about 2 per cent from a year earlier despite a warning by chief executive David Solomon last month that trading revenues were likely to drop by close to 10 per cent, largely due to sluggish activity in fixed income.

Goldman’s stock was up more than 2 per cent in pre-market trading on Tuesday.

The year-on-year increase in net profits was also flattered by losses Goldman took a year ago tied to its pullback from consumer banking and writedowns on real estate investments.

In the latest quarter, Goldman took a roughly $415mn pre-tax hit from moving its credit card partnership with General Motors to Barclays, the cost of exiting from small business loans and further writedowns on the GreenSky business that it sold last year.

Goldman benefited from a continuing revival of dealmaking activity in what Wall Street hopes is the start of a sustained recovery.

Fees were up 20 per cent at $1.9bn, slightly ahead of estimates. JPMorgan Chase last week reported a 31 per cent increase in investment banking fees to $2.3bn.

Goldman’s asset and wealth management division, which is central to Solomon’s efforts to make the bank less reliant on investment banking and trading, reported a 16 per cent increase in revenues to about $3.8bn.

Longtime Goldman rival Morgan Stanley will report its results on Wednesday.