This article is an on-site version of our Trade Secrets newsletter. Premium subscribers can sign up here to get the newsletter delivered every Monday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Welcome to Trade Secrets. For the past few years, I’ve caveated my habitual sunny optimism about globalisation by accepting all bets are off if Donald Trump gets elected and starts a full-on trade war. Currently it feels a bit surreal. We’re three weeks away from a coin-toss election that will deliver either business as usual, a Harris administration balancing trade-distorting industrial policy with international alliances, or potentially cataclysmic destruction. Today’s pieces are on what might stand in Trump’s way (not much) and how trade is doing right now (not bad). Charted Waters is on China’s car exports. Question for you: what do you think Trump will actually do? Will his bite be as bad as his bark this time? Answers to [email protected].

Who will stop Trump?

Traditionally, trade reporters spend a lot of time explaining to non-trade civilians (including newsdesks) the importance of Capitol Hill. See, look, it’s right here in Article 1 of the US constitution: “The Congress shall have power . . . to regulate Commerce with foreign Nations”. No, the president very probably won’t be able to implement deals without Trade Promotion Authority, that thing we used to call fast-track. Yes, Congress has always knifed agreements it doesn’t like without regrets. No, the main blockage to a US bilateral with the UK wasn’t President Joe Biden’s conjectured Irish-American anglophobia: even if he’d wanted one, it would have choked in the toxic atmosphere for trade deals on Capitol Hill. And so on.

But although Congress is still willing to block formal agreements it doesn’t like, such as the trade pillar of the Indo-Pacific Economic Framework, it and the courts have proved unwilling to provide checks and balances to Trump’s (and Biden’s) extraordinary use of executive powers.

Now, as ever with Trump, we have no idea what he’s actually going to do. Scott Bessent, one of his top advisers, told the Financial Times this week that Trump’s threats of across-the-board tariffs were basically a negotiating tactic. However, Trump did enough in his first term to suggest that prediction might be rather too optimistic.

The steel and aluminium tariffs Trump imposed on a range of countries (including foreign policy allies) used the Section 232 national security legislation, which is under the discretion of the president. He used Section 301 provisions against unfair trade to whack a big range of tariffs on China, and Biden added some more. The president has also used executive orders under various bits of legislation (the International Emergency Economic Powers Act, the National Emergencies Act, Section 301 again) to try to constrain China by restricting its access to US technology.

As a new paper from the Cato Institute points out, there are even more emergency powers a president could still use and not much to stop them. Lawmakers occasionally moaned about the use of executive authority under Trump, but never got anywhere close to constraining it. And even if they passed new legislation to do so, a president could just veto it unless they got a two-thirds majority. (In practice the only way to do this would be to pass the legislation between election and inauguration and have Biden sign it as a lame-duck president.)

As for the legal branch, federal courts have consistently sided with the administration, such as in a series of cases brought against Trump’s steel and aluminium tariffs. And both Trump and Biden have ignored WTO rulings against the US as you or I might ignore the buzzing of a fly banging its head against the other side of a window.

Veteran trade lawyer and former WTO official Alan Wolff from the Peterson Institute puts the optimistic side. He argues that the Supreme Court would be bound by its own previous arguments about deferring to the authority of the executive branch only in the case of genuine ambiguity. But I have to say I’m in Camp Gloom with Cato here. On any major question, the Supreme Court has generally done whatever Trump wanted, including granting him criminal immunity for his actions while president. If the election ends up being litigated, as it will, the Supreme Court is quite likely to be the institution that puts him back in the White House.

Domestic and international trade policy has always relied on a degree of self-restraint — an unspoken agreement to use national security loopholes only in compelling circumstances and comply with WTO rulings even if faced only with weak sanctions. Trump seems incapable of restraining himself in any of his actions, trade or not, and so does Congress, the courts and, most of all, the Republican party itself.

Trump’s eagerness to trash every norm of governance or law that gets in his way is evident, along with threats against anyone or anything that tries to stop him. Frankly, if Trump is re-elected, imposing import tariffs without due congressional approval is not going to be chief among our concerns.

Services trade is sparkling

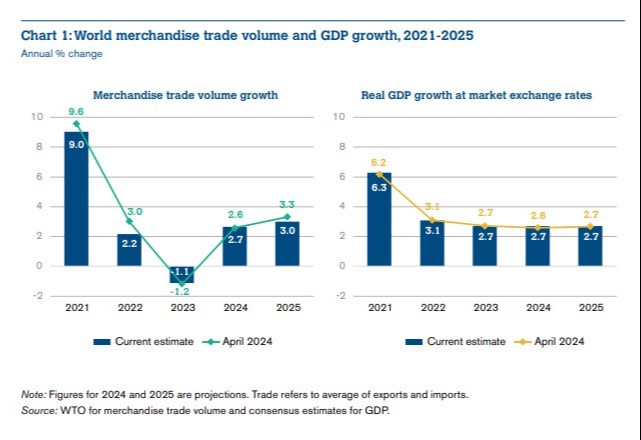

This may of course simply be the calm before the catastrophe, but the World Trade Organization’s latest projections for world trade came out last week and, as usual, everything is basically fine. Its goods trade forecast is now for 2.7 per cent this year, slightly revised up from 2.6 per cent previously, and for next year revised down from 3.3 per cent to 3.0 per cent. The risks are greater on the downside, but aren’t they always?

Within those numbers the outlook for the EU doesn’t look great, and is the main cause of the overall downward revision for next year. Germany looks particularly bad: chemical and machinery imports are down, car exports are down. But as usual, this is basically cyclical and related to weak GDP. There isn’t much sign that the overall trading system is malfunctioning.

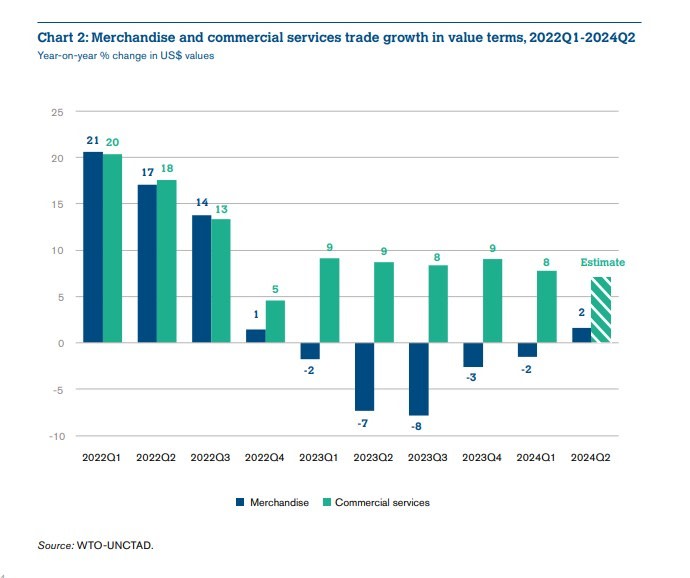

Meanwhile, of course, while we’re all focusing on goods trade, it turns out that other bits of globalisation are fine. Services trade has held up well over the past few years and is growing well in 2024.

It’s not as if there’s nothing to worry about, but at least we can be pretty confident there hasn’t been a big lasting shock from either the Covid-19 pandemic or the Ukraine war, and for that we should be grateful.

Charted waters

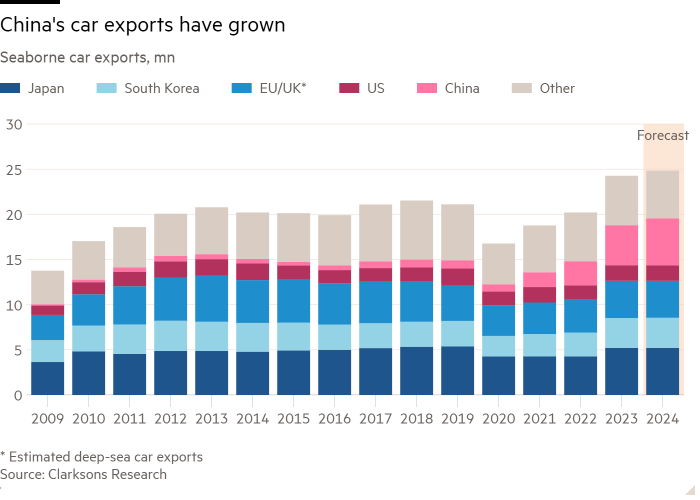

Whatever’s happening to China’s economy and demand for cars at home, its auto exports are still roaring away.

Trade links

Last week China said it would impose anti-dumping duties on brandy in what was a fairly clear retaliation for the EU anti-subsidy tariffs on electric vehicles, French President Emmanuel Macron’s attempts to negotiate an, ahem, sauve qui peut reprieve for cognac producers evidently having failed.

Sarang Shidore from the Quincy Institute says in Foreign Policy magazine that China should not be counted a member of the so-called “global south”. Reasonable enough, but unfortunately for this argument it counts itself as such and no one will stop it, imho underlining the fundamental destructiveness of the term.

My FT colleague Martin Sandbu asks whether Germany should seek a new economic model or continue with the one that has brought it past success.

A paper by the Center for Global Development looks at how falls in oil prices will affect hydrocarbon-exporting African countries and whether the IMF and World Bank can help.

India continues not to like the EU’s carbon border adjustment mechanism, though apart from sabre-rattling at the WTO they haven’t said what they’re going to do about it.

Trade Secrets is edited by Jonathan Moules

Recommended newsletters for you

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

Europe Express — Your essential guide to what matters in Europe today. Sign up here