This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. China neglected to put numbers on its stimulus plan over the weekend — again. There are a few other opportunities coming up for the central government to announce the specifics, but we are getting pretty close to the end of the year. How long can China leave the world hanging? Email us with your thoughts: [email protected] and [email protected].

Pfizer and Starboard

The FT coverage of the Starboard Value-Pfizer affair has been a lot of fun to read. A week ago we learned that the activist investor had built up a $1bn stake in the drug company — market cap $165bn — and that former Pfizer CEO Ian Read and former CFO Frank D’Amelio had pitched current CEO Albert Bourla and several board members on the activists’ plan. Last Tuesday it came out that Bourla was set to meet with Starboard, and it looked like the activists had Pfizer on the back foot. But then on Thursday it turned out that Read and D’Amelio had had second thoughts and were “fully supportive” of Bourla and the board.

The final morsel to drop was the fact that Bourla had found out that Starboard was circling from what appeared to be a fat finger email from D’Amelio — with no message — that cc’d a representative of Starboard. Starboard had planned to announce its investment at a conference later this month. Oopsie.

Over in the Lex column, my colleague Pan Yuk has already pointed out the reason why Pfizer might look like a target for activists. The share price has been falling since Pfizer’s blockbuster Covid vaccines stopped bringing in big revenues. The stock is cheap compared to peers’. The company spent much of the vaccine windfall on the $44bn acquisition of Seagen in March last year, which has yet to pay off. Yuk also points out, however, that while Pfizer is in need of a turnaround, it is not at all clear what can be done. She’s right — but there may be one thing that would work for Starboard.

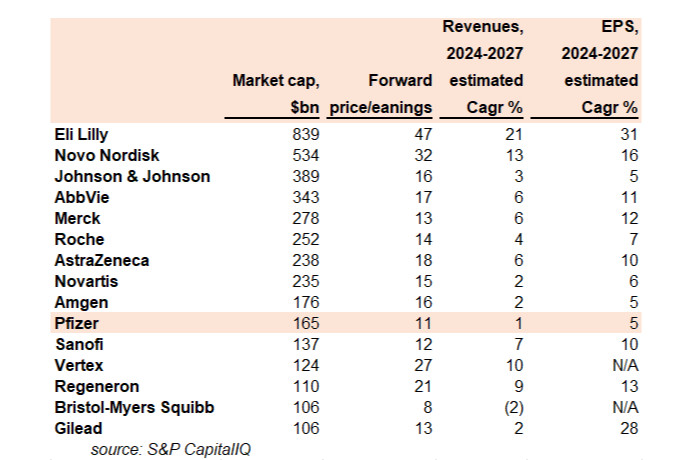

Some context first. Below is a list of the 15 largest pharma companies in the world, along with their price/earnings valuations, and expected revenue and earnings per share growth for the next 3 years:

The reason Pfizer is cheap is clear. It isn’t growing. Revenues are expected to grow at a sub-inflation 1 per cent rate over the next three years; earnings per share growth (supported by some cost cutting and share buybacks, presumably) are expected to average 5 per cent, among the very lowest in the group.

Low growth is not an easy problem to fix in pharma. Most of the time, pharma companies grow because their drugs work, and that depends on science, not corporate finance. Maybe the Seagen acquisition will pay off in the end, or maybe other pipeline candidates will come good. But Starboard can’t control clinical trials.

It is worth remembering that 15 years ago, Lilly, now the biggest pharma company in the world and still growing fast, was struggling mightily to grow as patents expired and one clinical program after the other went wrong. It had a P/E ratio of 8. Ten years ago, on the other hand, Bristol-Meyers’ cancer drug portfolio was the envy of the industry, its stock was on a rip, and it had a P/E ratio over 40. Now Bristol is looking at falling revenues and is the cheapest big pharma stock (and was, not coincidentally, the target of an unsuccessful Starboard activist campaign in 2019). Fortunes change slowly in pharma, and in unpredictable ways.

With that said, what can Starboard ask for that might help? A few ideas:

-

Allocate capital differently. Over the past five years — that is, since Bourla has been CEO — Pfizer has generated $98bn in operating cash flow. It has spent $77bn on cash acquisitions, $43bn on dividends, $14bn on capital expenditures, and $11bn on share repurchases (readers who are quick at arithmetic will notice that cash outgoings have exceeded incomings by $48bn or so; this is part of the problem). Cutting the dividend is probably a non-starter for the market. An activist who suggested buying back fewer shares because the stock was so cheap would be caught in something of a contradiction. One could call on Pfizer to do fewer acquisitions and focus on in-house R&D, but that is a project that would take, oh, a decade or two to bear fruit, which is a lot longer than Starboard will want to hang around.

-

Run the company more tightly. Too late. The company has been pushing a multibillion-dollar cost-cutting plan since 2023.

-

Sell stuff. Too late again. The consumer health and animal health units are gone. Pfizer is already selling down its stake in the consumer health company Halion. It might be able to sell its minority stake in Viiv, which makes HIV medication, to the other partners in the joint venture for a few billion dollars, though.

-

Fire Bourla. I have no view on whether Bourla has done a good job or not. But if Starboard’s view is that the strategy is wrong, or the company has proven to be poor at M&A, or that capital allocation is suboptimal, or that the company is dragging its feet on the cost-cutting plan, the fastest way for them to prove to the market that things are really different now is to get the boss sacked, and take a few board members with him. I just don’t see what other needle-moving announcements there are for Starboard to make. Am I being insufficiently imaginative?

Even a new management team and (say) some turnover on the board might not move Pfizer’s stock a ton. But if Starboard could move the shares, say, 10 per cent, they might take their $100mn gain and go home.

One good read

“The world’s foremost punk-rock economist”

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here