Stay informed with free updates

Simply sign up to the Automobiles myFT Digest — delivered directly to your inbox.

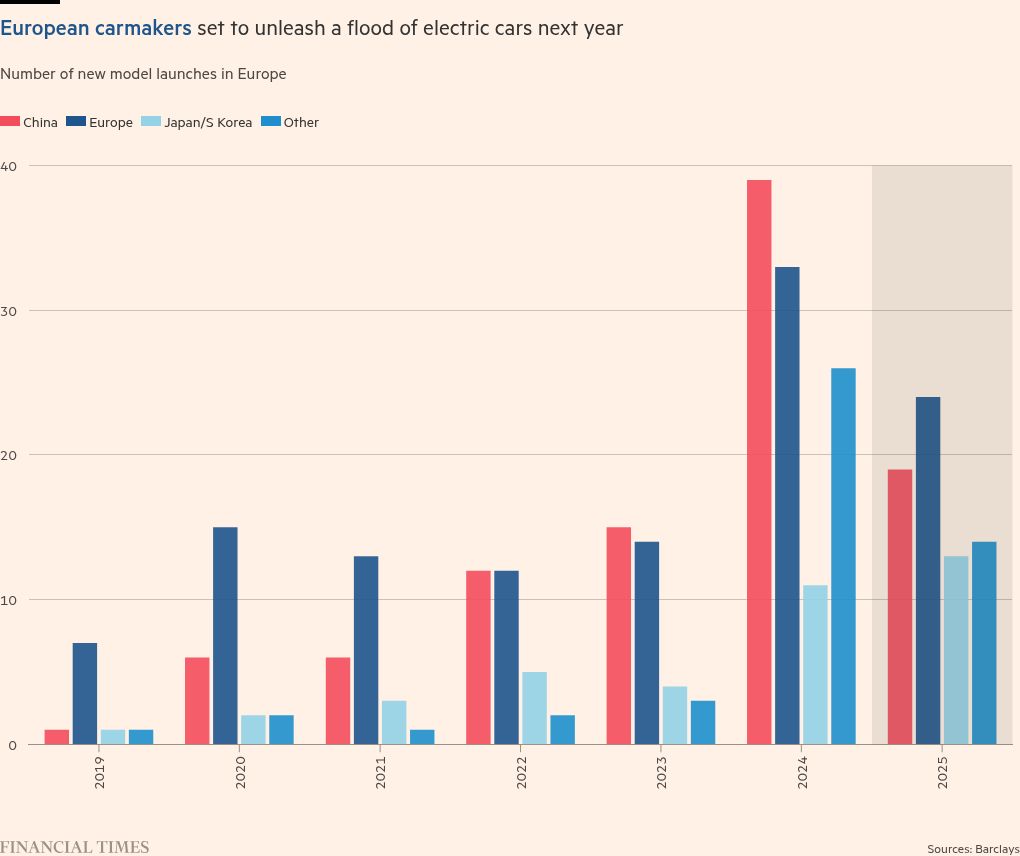

European carmakers are planning dozens of affordable electric models next year as they brace for an “EV winter” driven by tough new EU carbon emission targets and fierce competition from China.

Ahead of this week’s Paris Motor Show, the big European manufacturers, who have also been squeezed by falling demand, are focused on recovering lost market share with new vehicles.

“We are here to fight,” said Renault chief executive Luca de Meo earlier this month as he unveiled a battery recycling project and plans to support the company’s EV business. “We have challenges everywhere. It’s not a walk in the park but we see a lot of potential.”

Renault is the only major European carmaker that has not issued a profit warning recently. Volkswagen, Stellantis, BMW and Mercedes-Benz have all cut their earnings forecasts because of problems on multiple fronts from intense competition to weak European demand and rising inventories in the US.

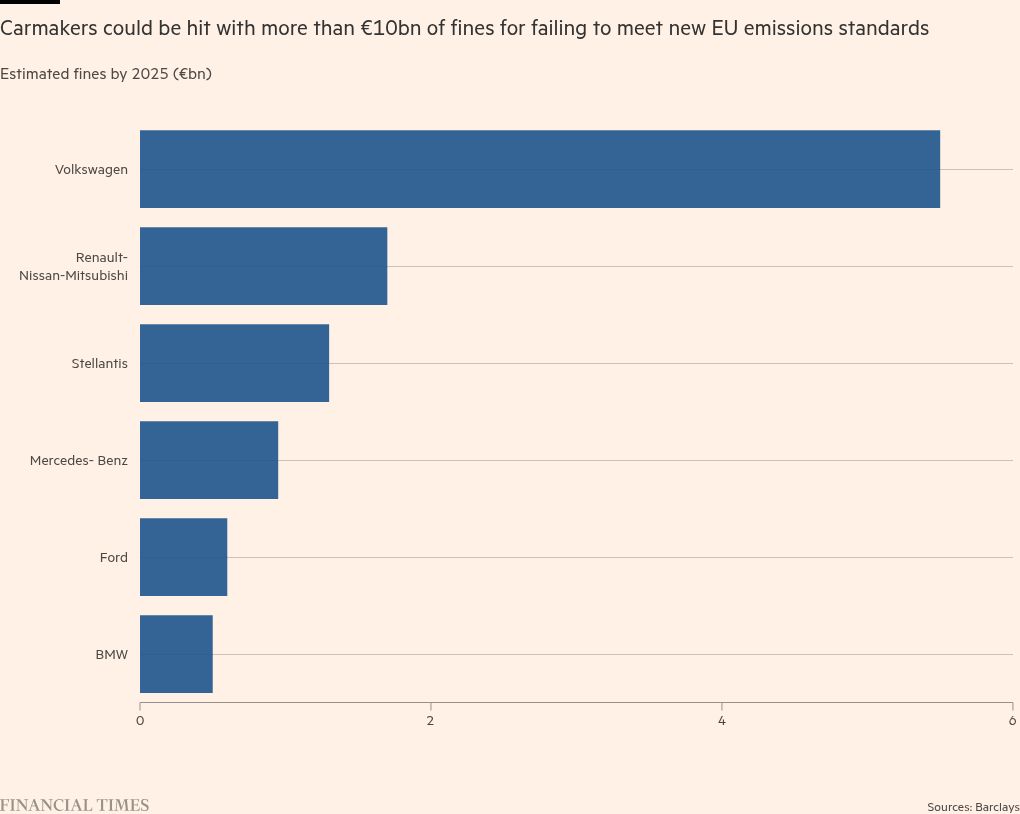

The pressure on the industry will increase again next year when new EU emissions targets come into force. These require carmakers to cut carbon emissions from their fleets — by increasing the proportion of electric and hybrid vehicles — or face large fines.

Executives say meeting the emissions targets has been made harder by a recent slowdown in the growth of EV sales: consumers have become more cost conscious and subsidies have been cut in big markets such as Germany.

Some carmakers, with the exception of Stellantis, have called for the targets to be watered down or delayed, to avoid fines that could add up to a collective €51bn by 2030 according to consultancy AlixPartners.

Addressing an Italian parliamentary committee on Friday, Stellantis CEO Carlos Tavares said the shift to EVs required by the rules would add significant costs for carmakers.

“In a system that cannot absorb more price because the consumer does not want to pay more, we are inserting 40 per cent more cost,” he said.

Barclays analyst Henning Cosman estimates global carmakers will launch more than 100 EV models this year in Europe and around 70 in 2025, but the cheaper prices required to make sales could cause an “EV winter”, he added.

“If you are a consumer, you almost feel like buying an electric vehicle today is a mistake because you know that you can get a better one with longer range and newer technology and most likely at a lower price pretty soon. That’s really the downward spiral,” he added.

European carmakers, knowing they would be under pressure to sell cheaper models in 2025, have focused on the more expensive end of the market this year.

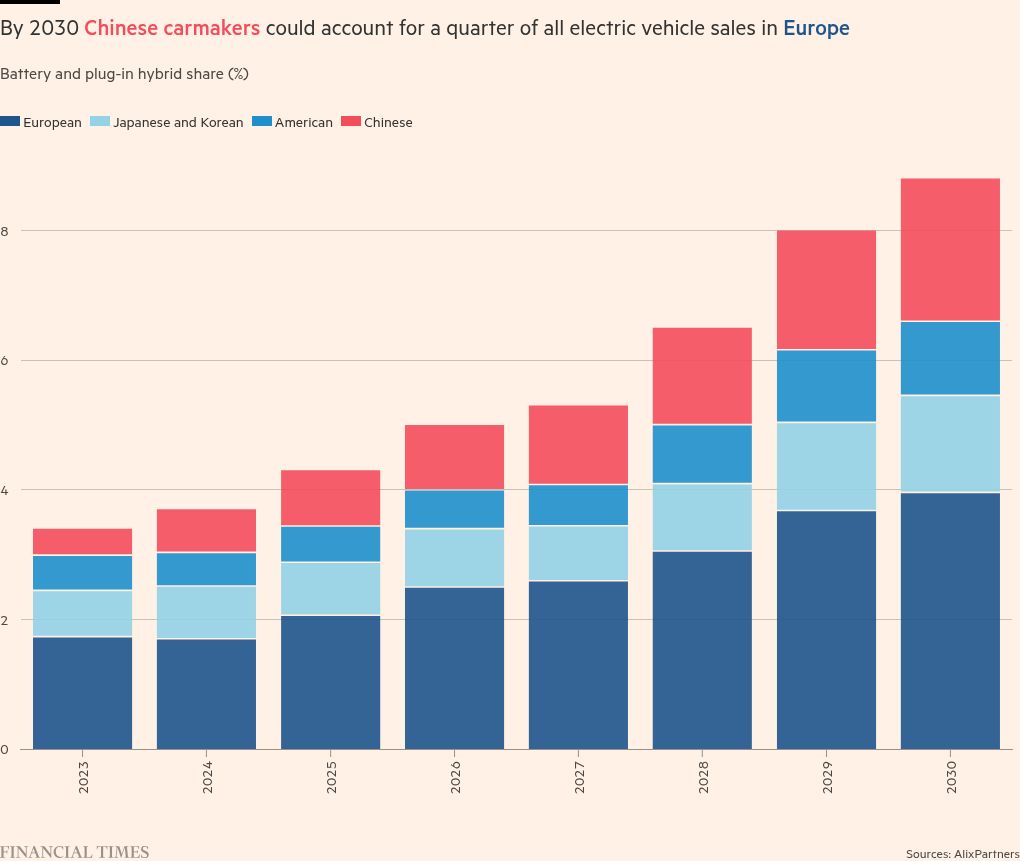

That has made them less able to compete with the likes of China’s BYD and Xpeng which have a €20,000 price tag for some models — about half the average price of an EV in Europe according to Transport & Environment, an NGO.

“There could be a price war, but I’m not sure the Europeans are the best place to win it,” said Alexandre Marian of AlixPartners.

EVs are already less profitable for carmakers before any new discounting next year. Across the industry, gross margins are about 15 percentage points lower than they are for combustion engine models, according to Barclays.

Some cheaper models will be displayed at the motor show, including an under €20,000 car made by Leapmotor, the Chinese partner of Stellantis.

Renault is already taking orders for its electric R5, priced at around €25,000. While Citroën, another Stellantis brand, will show models including the C3 Aircross compact SUV, though only the non-electric versions are priced at around €20,000.

According to research compiled by Renault, EU carmakers will need a 20 to 22 per cent share of the European market share to comply with the emissions targets. But at the moment, they are stuck at less than 15 per cent.

Analysts say the targets are achievable if carmakers buy emissions credits from rival groups that sell cleaner vehicles. But the cost of doing this for the likes of Volkswagen and Ford, which are the most behind on the targets, are likely to drag their profits down further.

Ahead of the motor show, Luc Chatel, the head of French car lobby PFA, told radio station RTL that “manufacturers and the whole industry are investing billions of euros” to shift to EVs.

But he added a warning on the “serious danger” for the industry. “Consumers aren’t following any more. This means manufacturers will no doubt have to pay European fines next year, which is pretty surreal.”