Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Zantac may have been a heartburn medicine but it caused one almighty headache for GSK chief executive Emma Walmsley. Finally, it looks as though that particular aggravation is clearing after GSK said late on Wednesday that it was prepared to pay up to $2.2bn to settle 93 per cent of legal cases linked to Zantac.

It still has a further 6,000 cases to either settle or defend but the resolution of 80,000 (with no admission of liability) means that GSK “becomes investable again,” said Emmanuel Papadakis of Deutsche Bank Research. Unfortunately for Walmsley, GSK has more than one source of pain.

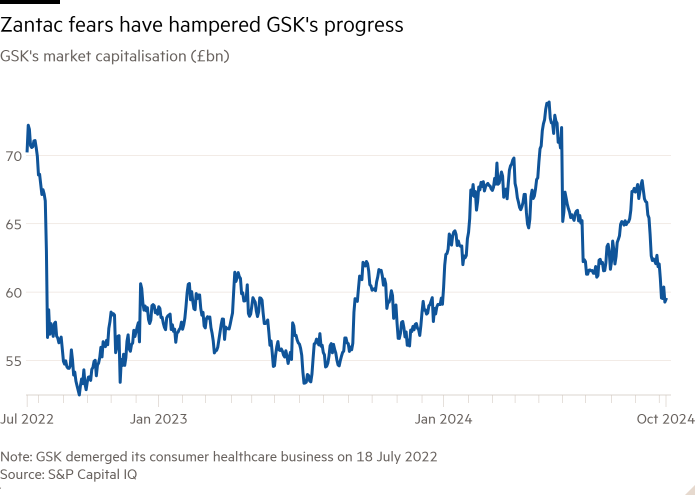

Zantac has played havoc with GSK shares ever since a Morgan Stanley note published in August 2022 estimated the company’s potential liability at anywhere between $3bn and $27bn. Markets assumed the worst: GSK’s market capitalisation plunged almost £13bn as a result, just after it had demerged its consumer health business Haleon.

By early this year, it had recovered to pre-August 2022 levels. But investors’ acute nervousness over Zantac was demonstrated again in early June when more than £6bn was knocked off GSK’s market cap in one day following a legal setback in Delaware, the US state that accounted for the bulk of Zantac cases.

This settlement is far lower than the worst-case scenario. If anything, it was surprising that the share price reaction, up 5 per cent in response, was not more enthusiastic. That can be explained by the fact investors now have to judge GSK on its own merits — and long-standing concerns about its pipeline have not gone away.

GSK has a long-term target to improve sales to more than £38bn by 2031, versus £30.3bn in 2023. Even though this is a mere trifle compared with AstraZeneca’s 2030 $80bn sales goal, the market does not yet believe GSK can reach it. Visible Alpha estimates for GSK suggest sales at the end of 2030 of £35.7bn. A key problem is the patent expiries from 2028 on HIV medicines containing dolutegravir.

Walmsley has emphasised the group’s ability to increase vaccine sales. The plan had been going well: Arexy, its vaccine for respiratory syncytial virus (RSV), quickly reached blockbuster status. But this summer, a US health committee narrowed the age recommendation for RSV vaccine use. Analysts tracking recent prescriptions of Arexy say they are down even more than expected. There is similar scepticism about whether global sales of GSK’s shingles vaccine can make up for a US slowdown.

Walmsley can ill-afford a big celebration over the Zantac settlement. An unpleasant ache has gone for GSK. But finding a balm to alleviate pipeline doubts is a tough task indeed.