Unlock the US Election Countdown newsletter for free

The stories that matter on money and politics in the race for the White House

Donald Trump believes that tariffs have magical properties. He even claimed in his speech at the Economic Club of New York last month that “I stopped wars with the threat of tariffs”. He added: “I stopped wars with two countries that mattered a lot.” So great is his faith in tariffs that he has proposed raising them to 60 per cent on imports from China and up to 20 per cent on imports from the rest of the world. He has even suggested a 100 per cent tariff on imports from countries threatening to move away from the dollar as their global currency of choice.

Can one defend such disruptive policies? In an article in The Atlantic on September 25, Oren Cass, executive director at American Compass and an FT contributing editor, argues that economists who criticise Trump’s proposals ignore the benefits. In particular, they ignore an important “externality”, namely, that consumers buying foreign goods “will probably not consider the broader importance of making things in America”. Tariffs can offset this externality, by persuading people to buy American and employ Americans.

However, as Kimberly Clausing and Maurice Obstfeld write in a blistering paper for the Peterson Institute for International Economics, it is not enough to argue that some benefits might follow. To justify Trump’s proposals one has to assess the costs of the proposed measures, the scale of the purported benefits and, above all, whether these measures would be the best way to achieve the desired objectives. Alas, the costs are huge, the benefits doubtful and the measures inferior to alternative options.

Tariffs are a tax on imports. Trump seems to believe that the tax will be paid by foreigners. Some argue, in support, that the inflationary effects of Trump’s tariffs were impossible to identify. That is highly debatable. In any case, Trump’s new proposals would, in the words of Clausing and Obstfeld, “apply to more than eight times more imports than his last round (about $3.1tn based on 2023 data)”. This would have a far bigger impact on prices than the relatively modest “starter protectionism” of Trump’s first term.

Moreover, note that if the cost of the tariff indeed fell on foreign suppliers, the price to US consumers would be unaffected. If so, why should the tariff cause a renaissance of import-competing US businesses? All it would then do would be to reduce profits and wages in foreign suppliers. Only if tariffs raise prices can they deliver the industrial regeneration protectionists desire.

So, what about the benefits? The 19th-century French economic journalist Frédéric Bastiat talked of “what is seen and what is not seen”. In trade policy, this distinction is vital. A tax on imports is, crucially, also a tax on exports. This is only partly because tariffs are a burden on exporters who rely on importable inputs. It is also because demand for foreign currency will fall and the exchange rate of the dollar will rise if tariffs shrink imports, as hoped. That will necessarily make exports less competitive. Thus, the ultra-high tariffs proposed by Trump will tend to expand less competitive import-substituting industries, but contract highly competitive exporting ones. That seems to be an extremely bad bargain. Foreign retaliation against US exports would exacerbate this damage.

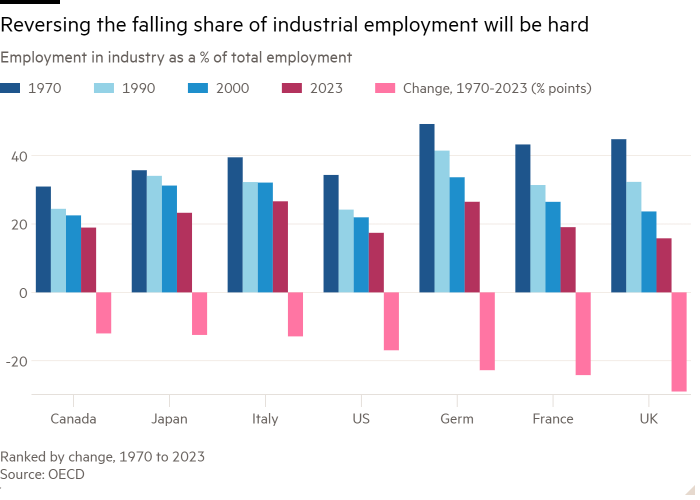

It is crucial to add that the US economy is now close to full employment. So, any shift of labour into import-substituting industry will be at the expense of other activities. Indeed, this is one of the most important differences from Trump’s beloved McKinley tariff of 1890. After 1880, the US rural population flooded into urban areas as industry expanded. Moreover, between 1880 and 1900, nearly 9mn immigrants entered the US, a little under a fifth of the initial population. This is equivalent to 60mn immigrants over the next 20 years. Needless to say, no such fresh labour supply exists now. On the contrary, Trump proposes removing millions of immigrants.

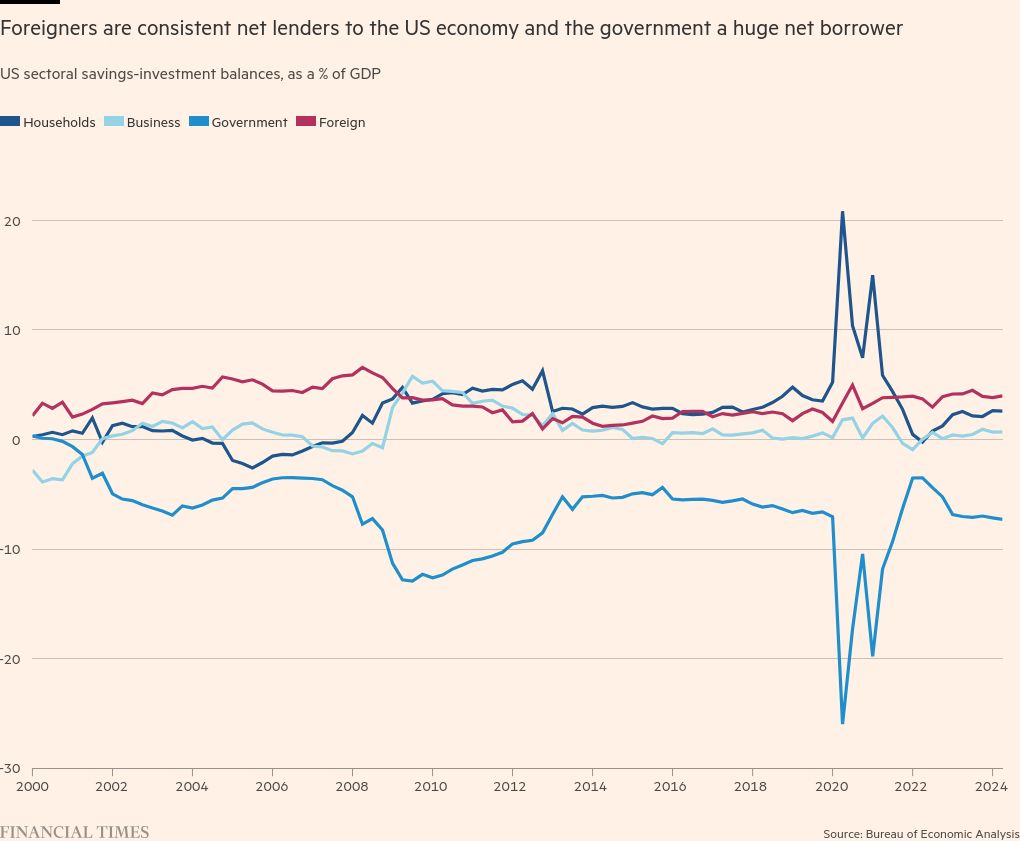

Trump himself seems to believe that high tariffs and lower imports will improve the US external deficits. But the latter is in part the mirror image of the capital inflow into the US. One of the reasons for this inflow is that foreigners want to use (and so hold) the dollar, something Trump is desperate to maintain. Another reason is excess domestic demand, today largely the counterpart of the fiscal deficit, which he also seeks to continue. Indeed, inflows of foreign savings and fiscal deficits are arguably the dominant causes of the persistent external deficits Trump detests.

Last and most important are the purported benefits of these high tariffs to working-class people. One proposition advanced by Trump is that tariff revenue could replace income tax. That is nonsense. If the attempt were made, programmes of great importance to ordinary Americans, such as Medicare, might collapse. Thus, according to another paper by Clausing and Obstfeld, the revenue-maximising tariff of 50 per cent would deliver only $780bn, less than 40 per cent of the revenue from income tax. Worse, as a tax on sales of imported goods, tariffs are highly regressive. Rich people spend relatively little of their income on such products.

Trump’s tariffs are, in sum, a grotesque idea: they will help the less competitive sectors of the economy, while harming the more competitive parts; they will damage many of his own supporters; and they will inflict grave harm on international trade, the world economy and international relations.

Yes, there is a case for targeted industrial interventions. But Trump’s tariff walls are precisely the opposite of this. Targeted and transparent subsidies would be far better. We must hope that this new trade war never even starts.

Follow Martin Wolf with myFT and on X