Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

That sucking sound after EU member states voted to slap tariffs on imports of Chinese electric vehicles is ricocheting across the seas. Just as Chinese EVs have increased on the world’s roads, so too have they filled ships to journey from factories to motorists.

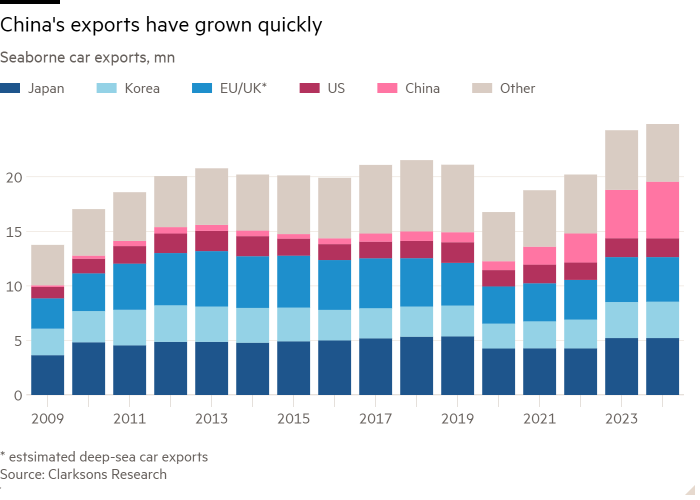

Total seaborne car shipments this year will come in about 25mn, up 17 per cent on pre-Covid 2019, reckons Clarksons, a maritime consultancy. Roughly a fifth of that comes from China and about one in eight are EVs.

Ro-ro vessels, on to which new vehicles roll on and roll off with minimal handling, have ridden this wave. Oslo-listed Wallenius Wilhelmsen, which operates about 128 ro-ro vessels, just posted a record quarter. Net freight rates rose from $56 per cubic metre in 2023 to $60 in the first half of this year, it said. Irish Continental Group reported a year-on-year 13 per cent increase in car volumes for the period to August 24.

With demand outstripping supply, auto manufacturers have been thinking outside — or rather inside — the box. More cars are being shipped in containers, to the tune of 200,000 to 400,000 a year, mainly EVs, estimates Drewry. This can be less space efficient and, due to more handling, means increased risk of damage.

Chinese manufacturers such as BYD, the world’s biggest EV maker by sales, and domestic peer SAIC are taking to the seas themselves. BYD Explorer No 1, registered to UK-based Zodiac Maritime, made its maiden voyage earlier this year and boasts capacity for up to 7,000 car equivalent units. Further capacity is coming online: shipbuilders’ order books are filling up, particularly in Asia.

Capacity booms and busts are the curse of every cyclical industry. But new or higher tariffs on EVs, both in the Europe and US, will exacerbate this. Nor is it just the developed world restricting imports. Brazil and Turkey imposed levies this year to ensure BYD went ahead with building plants on their turf.

None of this scuppers trade altogether: as the latter suggests, reshoring will play a part. BYD already has a plant in Hungary. In Europe, where BYD EVs cost roughly double the domestic sticker price, there may be leeway for the manufacturer to absorb some of the cost of tariffs or rejig production sites.

But switching production would still quash demand on the busy Asia-Europe routes and temper rates. These have already wilted slightly this year for chartered specialist carriers.

Some have already caught an early boat. Laeisz, which boasts a 200-year pedigree, in July sold its pure car and truck carriers fleet to Mediterranean Shipping Company for about $700mn. Chump change for the latter, admittedly. But it is a deal that hints the market has peaked.