Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Even unicorns grow up — at least, the lucky ones. More than 1,500 private companies have the $1bn-plus valuation that merits that label, first coined by venture capitalist Aileen Lee in 2013, according to data from Crunchbase. OpenAI is one that has outgrown the stable. But it is tougher these days to go from horned foal to winged steed — and what that takes, or who, is in dispute.

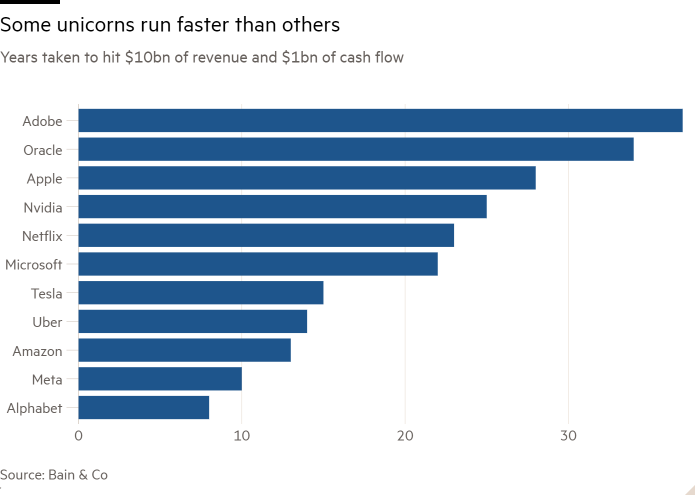

Cheap money and boosterism made it easier for founders to hit the fabled milestone. But among US companies founded in the past 20 years, only Meta and Uber have transitioned to what consultancy Bain & Company calls a “scale insurgent”, with $10bn in annual revenue and $1bn of operating cash flow. By contrast, the 1990-2003 vintage produced six such insurgents, including Tesla, Amazon.com and Alphabet.

Despite the seemingly lower chances of achieving greatness, money pours in. Today’s unicorns have raised $1tn in total — more than one-quarter of which was deployed in 2021, when US interest rates were essentially zero. After notching up a $157bn valuation this week, OpenAI is one of the biggest, behind TikTok owner ByteDance and Elon Musk’s SpaceX.

Most still fall lame. Fewer than 1 per cent of VC-funded start-ups become unicorns. Even those can find themselves in the knacker’s yard. More than 220 listed companies cemented a $1bn-valuation by merging with so-called special purpose acquisition companies in the past five years, ListingTrack data shows, most of them tech groups. Three out of four have slumped below that level.

What most stunts a unicorn’s growth? Bain theorises that overabundant cash has fuelled even founders who lack business acumen. Firms are less likely to be founded by a wunderkinder with prior start-up experience now than when Lee first birthed the unicorn concept, her firm Cowboy Ventures says. By that logic, visionaries need more old-fashioned capitalism.

Many in Silicon Valley draw the opposite conclusion. Venture capitalist Paul Graham last month celebrated the notion of “founder mode”, suggesting innovators who succeed are those who eschew management norms. Brian Chesky of Airbnb was an example. Musk might be another. Think of what Meta Platforms boss Mark Zuckerberg calls the “wartime CEO”, demanding unquestioning obedience.

Every company founder thinks they deserve to run free. And while funding remains ample, investors too easily agree. That’s why OpenAI’s Sam Altman was able to tell backers who provided $6.6bn that they must refrain from funding his rivals.

Altman is a highly visible experiment in whether power is the key to greatness. Investors in other groups who have been pricked by an ex-unicorn’s horn may feel like “founder mode” is overrated. Those still in for the ride will dearly hope it isn’t.