Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Nvidia sits at the centre of what we’ve dubbed the AI-financial complex, but there are a lot of people that want to make bank from the market frenzy. Cerebras Systems has now filed for an IPO, and it will be an interesting test of just how AI-mad investors have become.

As mainFT quoted a VC as saying in a round-up of pretenders for Nvidia’s throne last month:

There has been a near insatiable desire from public investors to find and back the next Nvidia. This isn’t just about chasing the latest trend. The momentum is also benefiting several VC-funded chip start-ups that have been toiling away for nearly a decade.

As a result, the valuations are appropriately punchy. Bloomberg reported last week that the Silicon Valley-based maker of chips optimised for artificial intelligence was hoping to raise $1bn at a valuation of $7bn to $8bn, for a company that was started in 2016 and only began generating any revenue in 2019.

But Cerebras’s pitch is pretty transparent: by FT Alphaville’s count the summary prospectus alone contains 142 mentions “AI”. We gave up counting the rest of the S-1 filing. It’s core product is a wafer-sized chip . . .

. . . which Cerebras says leads to vastly more memory and faster computing than with other commercially available GPUs.

This enables Cerebras customers to solve problems in less time and using less power. Our AI compute platform combines processors, systems, software, and AI expert services, to deliver massive acceleration on even the largest, most capable AI models. It substantially reduces training times and inference latencies, while reducing programming complexity.

We’re not even going to try to judge the tech here. FTAV is primarily a financial blog and, luckily, there’s a lot there to dig into.

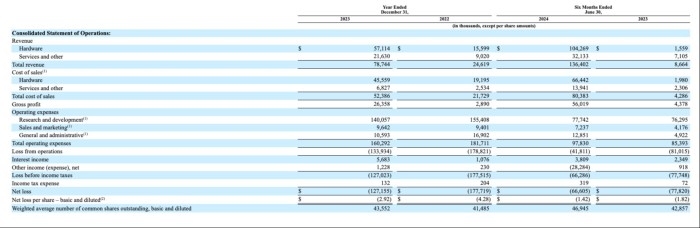

For example, revenues more than tripled in 2023 to $78.7mn, and climbed to $136.4mn in the first six months of 2024. But that still means the company remains deeply unprofitable, with a net loss of $66.6mn so far this year, roughly the same annualised run rate as in 2023.

(Sorry for terrible size, zoomable version here)

Another thing that jumped out was Cerebras admitting in its risk disclosures that “we currently generate a significant majority of our revenue from one customer, G42, and a significant portion of our revenue from a limited number of customers”.

And by significant, Cerebras really does mean SIGNIFICANT, and rising. From the filing, with FT Alphaville’s emphasis below:

Group 42 Holding Ltd (together with its affiliates, “G42”) accounted for 83% and 87%, respectively, of our total revenue for the year ended December 31, 2023 and six months ended June 30, 2024. Our dependence on our relationship with G42 subjects us to a number of risks. Any negative changes in the demand from G42, in G42’s ability or willingness to perform under its contracts with us, in laws or regulations applicable to G42 or the regions in which it operates, or in our broader strategic relationship with G42 would harm our business, financial condition, results of operations, and prospects. Even if G42 remains satisfied with our offerings, it is possible that it will no longer need to purchase additional AI compute or services at the same quantity as prior periods, or that G42’s ability to purchase our products may change for reasons outside of its control. G42 may also choose to purchase more of its AI compute from our competitors.

Further, as of December 31, 2023, customers representing 10% or more of total accounts receivable consisted of four customers (including G42) who accounted for 43%, 22%, 15%, and 15% of our accounts receivable balance. Two customers accounted for 68% and 16%, respectively, of our accounts receivable balance as of June 30, 2024. This customer concentration increases the risk of quarterly fluctuations in our results of operations and our sensitivity to any material adverse developments experienced by, or in our relationships with, our significant customers. The loss of, any substantial reduction in sales to, or the default on payments by, any of our significant customers may harm our business, financial condition, results of operations, and prospects.

So what is the blandly named G42? An AI company based in Abu Dhabi, the capital of the United Arab Emirates, which invested heavily in Cerebras’s 2021 series F and received a somewhat controversial $1.5bn slug of investment from Microsoft earlier this year.

The US has slapped export controls on AI tech that might be passed on to the likes of China, and it seems like the Cerebras chips that it has bought are actually being used in the US, which sounds awkward. Again, our emphasis below:

While we have obtained an export license from BIS to export, reexport, or transfer (in-country) our CS-2 systems to G42 in the United Arab Emirates, all of the systems we have sold to G42, or for which purchase orders have been placed by G42, to date have been or are expected to be deployed in the United States, which does not require an export license from BIS. To the extent that we cannot export to a specific customer without a license from BIS, we may seek a license for the customer. However, the licensing process is time-consuming. There is no assurance that BIS will grant such a license or that BIS will act on the license application in a timely manner. Even if BIS issues a license, it may impose burdensome conditions that we or our customer cannot accept or decide not to accept.

So this is a fast-growing but extremely unprofitable company utterly dependent on selling its products to one of its biggest investors, which might not be able to take them out of the country?

Put FTAV down for a yard.