This article is an on-site version of our Trade Secrets newsletter. Premium subscribers can sign up here to get the newsletter delivered every Monday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Welcome to Trade Secrets. Today, a break from the modern kind of trade restrictions such as the US ban on Chinese software for electric vehicles, which I’ll write about later this week. Instead we go old school and look at ports: first, the threats to the US economy from a threatened strike by longshoremen (dockers) on the east coast, and second, the revelation that the UK freeports initiative was as pointless as we all thought it was.

Charted Waters is on uncertainty in trade policy. My question for you this week is a somewhat open-ended and philosophical one: when you hear about freeports and special export zones and the like, what do you think? Positive or negative, modern or outdated? I’m intrigued. Just a single word will do. Usual email address: [email protected]

Get in touch. Email me at [email protected]

Calling the strike

Here we go again: a threatened dockers’ strike on the east coast ports because labour unions object strongly to automation doing away with jobs. I say “here we go again” not just because of the obvious echoes of the snarl-ups in the west coast ports in 2021-22, but because we had east coast longshoremen fighting a war of attrition against technology in the 1960s and 1970s, when they fiercely tried to prevent the containerisation of trade in New York City.

The end result was that the container terminal was built across the river in New Jersey, but the struggle took a while. I imagine there are few Trade Secrets readers unfamiliar with Marc Levinson’s magisterial history of the shipping container, The Box, but if that is the case then go and read it: it covers this superbly. Ultimately, the unions could not prevent containerisation, but they sought to slow the pace and extract economic rent for themselves along the way, which is also what’s happening now.

Anyway, back to the 2020s. There are various estimates of the impact of industrial action, the neatest one being that each week the strike lasts will take 0.1 percentage points off annual GDP growth. The 2021-22 crisis isn’t a particularly useful comparator. Its proximate cause was a surge in demand into the west coast’s small and antiquated ports rather than Covid-related problems with the docks themselves. The congestion there lasted a lot longer than a week, but freight found ways round. It’s going to be difficult to find alternatives if ports from Maine to Texas are closed.

On the positive side, the disruption is happening in a relatively benign macroeconomic environment — with growth steady and inflation dropping in the US and elsewhere. A prolonged strike and higher consumer price inflation might delay the Federal Reserve making more cuts, but not for long. Having seen inflation drop sharply, the central bank must be pretty confident that any one-off price level shock won’t derail expectations.

Despite global freight rates already elevated by the Houthi attacks in the Red Sea, standard measures of supply chain pressure like the New York Fed one are at pretty benign levels. I’ve got zero confidence in my ability to analyse US labour relations. But based purely on previous experiences, I’d be relatively optimistic that precautionary inventory-building will ensure the economy could ride out a strike of a week or two without much visible damage.

Man is born in freeports, but everywhere he is in supply chains

Incredible to relate, but the now-departed Conservative government in the UK did something it falsely claimed was a Brexit dividend and which pretty much every trade expert said wouldn’t work. Surprise! It hasn’t. In this case it’s freeports, of which the Conservatives created twelve, amid gusts of breezy rhetoric about unleashing Britain’s entrepreneurial spirit.

Last week, my colleague Peter Foster revealed that only six (yes, six) companies have taken advantage of the customs sites to import goods tariff-free into any of the ports. (You can sign up to his newsletter here, btw.) This was foreseen by those who understand such things. The well-publicised governance issues with Teesport were also of little surprise. Freeports often spawn poor governance, sometimes of a rather more severe kind.

By early this year the Conservatives had already switched to claiming that the real benefits came in creating industrial hubs with extra investment. But it’s hard to see why governments should be offering tax breaks to tell companies where to invest rather than providing basic transport and other infrastructure, and getting the hell out of the way.

Freeports might make sense in closed and stultified economies with low state capacity by kick-starting growth and exports via deregulation and low taxes in a limited geographical area. The UK is not one of those countries. It can cut taxes and deregulate the whole economy if it wants. Liz Truss had plans to, but tragically left Downing Street before trying them out.

In reality, of course, a lot of this is just about vibes. The Conservatives were presumably hoping that voters had some vague sense that freeports (see also “special economic zones” and similar) are all about entrepreneurialism something . . . China Shenzhen something . . . Ireland Shannon Free Zone something . . . Hanseatic League something.

In the UK they don’t seem to have done a huge amount of damage, and clearly didn’t save the Conservatives many seats in the general election. But elsewhere these vibes can slide towards a creepy Year Zero kind of mindset, bypassing democracy by carving out artificial deregulated enclaves. The largely failed charter city movement too often sits in this space. It’s not comforting that charter cities have been adopted by the cryptocurrency crowd, within which often lurks distaste for the messy process of democracy.

Perhaps the weirdest project in this area is the fantastical scheme obtained by the Jerusalem Post earlier this year of Benjamin Netanyahu’s apparent plans for a postwar Gaza. It envisages rebuilding the shattered territory into a gleaming new manufacturing and transport hub with a trade zone spanning parts of Egypt and Israel, connecting the strip with Saudi Arabia and other countries in the Middle East. (Hat tip to the historian Quinn Slobodian for spotting this, and much more on the subject here by Adam Tooze.)

Israel has already used freeports as a form of economic diplomacy in the region, but this one has almost no chance of happening. Its aim is political, to convey the sense Gaza must be reconstructed from the beginning and to pull the Arab states into its postwar governance. It’s not actually going to be built.

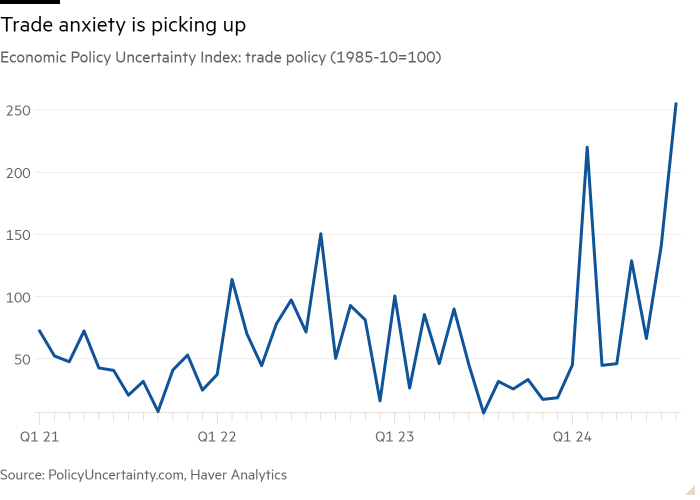

Charted waters

It’s not necessarily what’s happening: it’s what you don’t know that might. The index of economic trade policy uncertainty has shot higher this year. Hard to prove the cause beyond doubt, but it seems pretty likely there’s one big reason and it rhymes with Bonald Pump.

Trade links

-

Presidential candidate Kamala Harris said last week in an MSNBC interview regarding the proposed takeover of the US Steel company by Japan’s Nippon Steel (which she opposes) that keeping steel production in American hands was more important than creating jobs. Make sense to you? Me neither. US Steel’s management say they’ll cut production if the takeover fails, but what would they know?

-

Relaxedly, Harris was campaigning last week in Pittsburgh when she gave the interview. Here’s a speech she made there and here’s the 82-page economic policy platform she released last week.

-

European paint manufacturers say they’ll be bankrupted by EU anti-dumping tariffs on Chinese titanium oxide.

-

The FT’s Unhedged discusses how immigration is affecting US employment.

-

Indonesia has formally applied to join the CPTPP Asia-Pacific trade agreement, a bloc whose waiting room is rapidly expanding and of course already contains China and Taiwan.

Trade Secrets is edited by Harvey Nriapia

Recommended newsletters for you

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

Europe Express — Your essential guide to what matters in Europe today. Sign up here