Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The yen carry trade that spectacularly reversed in August already feels long ago, but Bank of America thinks it’s found another potential landmine: International corporate deposits.

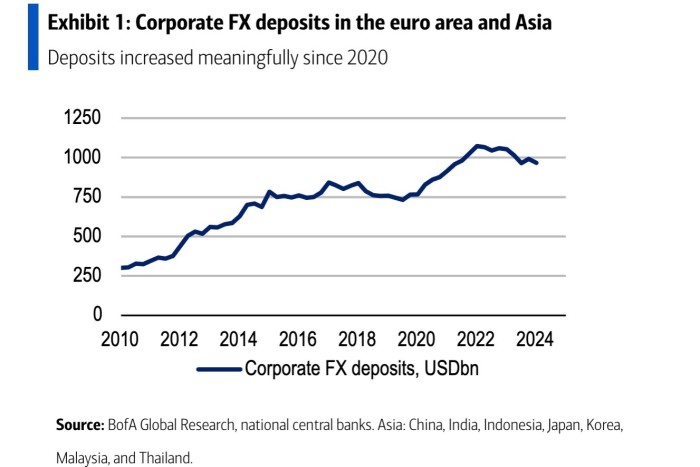

The bank’s analysts point out that companies in Europe and Asia have been accumulating a huge trove of FX deposits since 2019, initially as a precaution after Covid-19 and afterwards because higher US interest rates and the dollar’s strength made them attractive.

Even after dipping a bit lately, that stash now exceeds $1tn.

Of this they estimate that somewhere in the range of $260bn to $480bn are de facto carry trades, with dollar deposits exceeding dollar loans particularly starkly in China.

If this starts to unwind as the Federal Reserve cuts rates and the dollar weakens then it will add even more pressure on the greenback, BofA argues. From their note:

Monetary tightening by global central banks, in particular the US Federal Reserve, made it more attractive for corporates in the euro area and Asia to hold onto FX receipts and benefit from the associated higher rates, rather to convert these receipts to the local currency. The large FX carry position has sustained even as some corporates started to pay down FX loans

. . . A potential unwind of carry position by corporates may extend the broad US dollar weakness that we expect. To bring corporates’ FX carry position down to the average 2019 level, we estimate this may imply an unwind of c. USD 250bn-300bn in their FX carry position.

This doesn’t seem like a massive risk. Estimates vary but the yen carry trade was much larger, and the dollar is an even more liquid currency. The latest comprehensive BIS study estimated that there’s about $7.5tn of FX trading volumes daily, and the US dollar was on one side of 88 per cent of all trades.

That said, a dollar carry trade unwind sounds like it would be fun, so we’re rooting for it.