Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In 1975, Bill Gates and Paul Allen founded Microsoft in Mexico. Four years later in 1979, the US suffered its worst nuclear power disaster at the Pennsylvania plant known as Three Mile Island. More than 40 years later, these unrelated events have, perhaps surprisingly, collided.

The current operator of Three Mile Island (TMI), Constellation Energy, has announced a deal with Microsoft to restart a reactor adjacent to, but distinct from, the accident site. It is set to deliver 835MW of power capacity for a data centre run by the software titan. Constellation and Microsoft are keen to describe the deal as a win for carbon-free “clean energy”. At the very least, Constellation Energy shareholders are seeing green.

Constellation’s market cap has jumped by nearly $15bn to $80bn, in response to the deal. Since a spin-off from former parent Exelon in early 2022, its shares are up more than 200 per cent. Independent US power plant operators are riding high on an unusual confluence of factors where old-school technology — nuclear, natural gas, coal — is back in favour and deep-pocketed customers are able to pay top dollar for predictable output.

Constellation said the Microsoft deal showed “the power of competitive markets” where the company and Microsoft will be alone responsible for the near $2bn of cumulative capital expenditures to get TMI back online.

Constellation’s 2022 separation from Exelon left it as the power producer that generated electricity and took the risk of selling power at prevailing market prices. Exelon instead became a highly regulated, steady transmission and distribution utility whose consumer rates are set by states to earn a modest return on capital.

The TMI agreement with Microsoft is worth perhaps $115 per megawatt hour, according to analysts at Jefferies — perhaps twice or more the current market price of electricity. Jefferies pegs the impact of the Microsoft contract as worth a net present value of $3bn and an internal rate of return of 38 per cent, including debt capital.

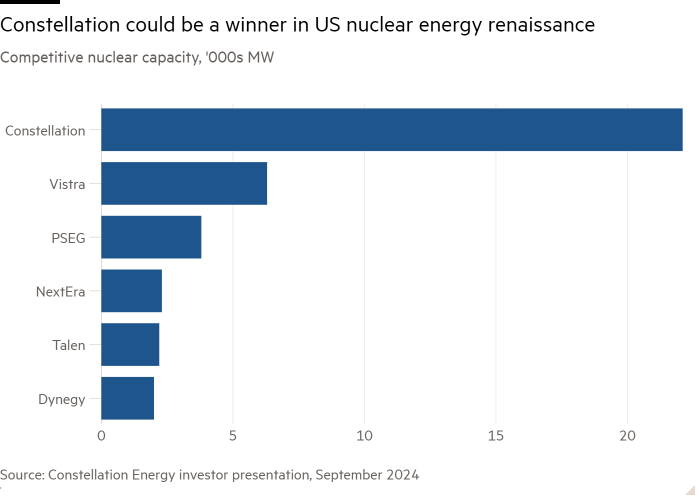

The huge jump in Constellation shares is rooted in the view that there could be more lucrative deals like Microsoft’s for the nuclear energy group to strike, along with accompanying new federal tax credits. Constellation has by far the largest nuclear fleet, a source of energy production that is suddenly in favour because of both its reliability and non-existent carbon footprint (leaving just the non-trivial matters of nuclear waste and safety).

The benefits of AI are, for now, unclear. But for many, its part in resurrecting nuclear power is a worthy externality all by itself.