Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It is not a good time for global carmakers in Europe. Demand for new cars is slowing across the board. For Chinese makers, steep tariffs are looming. Investors, however, are still betting there will be significant demand for new budget electric vehicles.

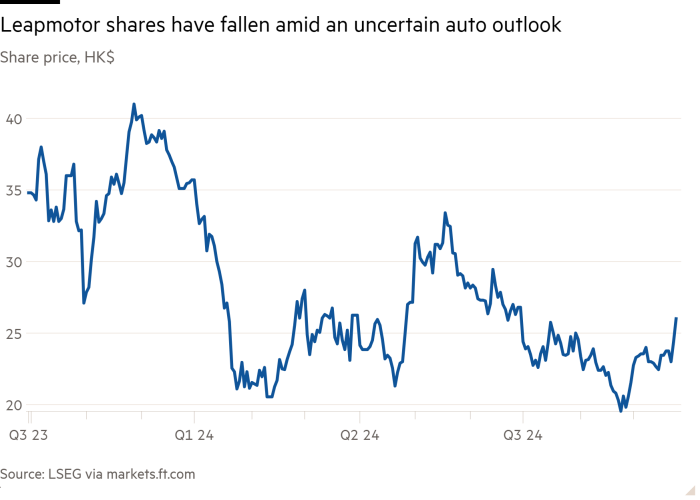

Shares of Leapmotor rose 9 per cent on Wednesday morning after the Chinese EV maker said it had started taking orders in Europe for a new city car and a sport utility vehicle. It expects to start assembling its urban EV model in Poland by the end of this year — a big step for Leapmotor and its partner Stellantis, the automaker created from the merger of France’s PSA Group and Italian-American Fiat Chrysler Group.

Leapmotor’s T03 compact electric car will have a starting price of €18,900 from the end of this month, with a new model set to be introduced each year over the next three years. It plans to have 350 sales points by the end of this year, with a focus on markets such as the UK, Belgium, France and Germany.

Its timing does not seem favourable. New car sales in the EU fell 18.3 per cent year on year in August to their lowest level in three years. For fully electric cars, the drop was steeper, down 44 per cent, marking the fourth straight month of falling EV sales. Germany recorded a decline of 69 per cent, according to the European Automobile Manufacturers’ Association.

One reason for the slowing growth is high purchase prices and concerns over depreciation: the average five-year depreciation rate for EVs is about 50 per cent. While EVs have been getting cheaper as battery prices drop, they remain on average more expensive than petrol equivalents, according to the International Energy Agency. Looming tariff rises could mean even higher prices going forward.

Still, Stellantis is positioned well. It holds a 51 per cent stake in the Leapmotor International joint venture and has exclusive rights to build and sell Leapmotor products outside China. Moving assembly to Poland should help circumvent European tariffs on China-made EV imports.

The fact remains that there will be ample demand in the budget EV segment longer term, especially given the EU mandate that all new vehicles sold should be zero emissions by 2035. Here, a €18,900 EV made in the EU should prove popular.

Getting a first-mover advantage in shifting production to Europe will give it an edge over other Chinese rivals. And at that price, it should remain a market difficult for legacy automakers to enter without sacrificing profitability.