Chinese merchants have flooded online marketplaces to sell US presidential election merchandise — despite both sides in a campaign marked by hostility towards China seeking to promote locally-made products.

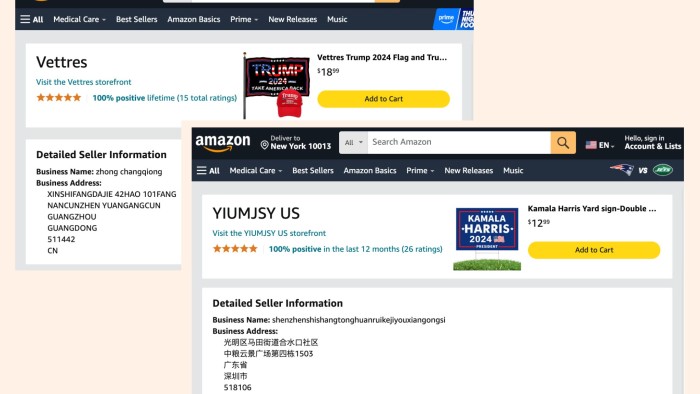

More than 90 per cent of the best-selling Donald Trump and Kamala Harris flags and hats on Amazon provide a seller’s address in China, according to a Financial Times analysis. Both candidates state on their official websites that they only sell US-made products.

Chinese manufacturers interviewed by the FT said they were counting on direct online sales to supporters of the two candidates after orders from US retailers fell off amid tensions between Washington and Beijing.

Many Chinese merchants say on their Amazon pages that their Trump or Harris campaign flags are US-made to appeal to patriotic American buyers, although they go through US customs with “made in China” labels.

The influx of cheap items has taken a toll on American factories that are grappling with elevated labour and raw material costs. Several US flag makers said the election year sales bump they had expected had not materialised as they lost market share to Chinese competitors.

The loss of sales and mislabelling of the products’ country of origin have sparked anger among US manufacturers, who accused Chinese flag makers of undermining fair competition.

The backlash has underscored the challenges the US faces to reduce its reliance on Chinese products and comes as the Biden administration is trying to close a trade loophole that lets Chinese groups send shipments worth less than $800 into the US without paying import tariffs.

Chinese factories have supplied US campaign merchandise for years. Merchants in Yiwu, an eastern Chinese city with one of the world’s largest wholesale markets for manufactured goods, said they could foresee Trump’s 2016 election victory based on stronger orders from his supporters than from those of Hillary Clinton.

But the growing US-China rivalry has made Yiwu’s bulk purchase business model harder to sustain. Five sellers of flags and hats in the commerce hub told the FT that their orders for 2024 US election merchandise were 20 per cent to 30 per cent below 2020 levels as US wholesale buyers began sourcing instead from Vietnam and Cambodia.

“Our US clients do not want to work with Chinese suppliers alone even though we offer the lowest price and good quality,” said Jack Zhang, a flag seller in Yiwu. “They want to have a more diversified supply chain even though that means they need to pay a higher price.”

Official data from the US International Trade Commission also points to a slowdown, showing US imports of national flags from China fell more than a quarter between 2022 and 2023, to $2bn.

Despite the pushbacks, Chinese merchants are keen to tap the lucrative US political market as overcapacity has driven their profit margins to razor thin levels at home.

“Very few markets could rival the US when it comes to scale and profitability,” said Zhang, the Yiwu flag seller who said he made a 15 per cent profit margin in May on a $12,000 order for Trump-themed merchandise.

As wholesale channels shrank, Chinese merchants began launching online stores to target US voters directly. According to a search of best-selling items on Amazon with the keywords “Trump flag 2024”, 46 of the first 48 listings state their seller address in China.

There is little barrier in running a campaign merchandise business from so far away. Chinese factories said they could pick up layouts for election flags from the internet or create new designs on their own. Jonathan Wang, a flag seller in Yiwu, said local factories churned out a flag featuring an image of Trump responding to the failed attempt on his life in July less than 24 hours after he was shot.

“We care about US current events as much as the American public,” said Wang, adding that the flag had briefly sold for “a premium price due to its newsworthiness”.

“It will take you a week or two in the United States, if not longer, to start pumping stuff out,” said Cameron Johnson, senior partner at Tidal Wave Solutions, a Shanghai-based consultancy: “In China, they can do it within a day or two and it’s very difficult to compete against.”

American peers also struggle to contend with Chinese manufacturers’ cost advantages. Flag makers in Yiwu are charging as little as 90 cents a piece for 1,000 nylon campaign flags. Carl Porter III, president of WGN Flag & Decorating Co in Chicago, said he could not “even buy raw materials to make a flag for under $5”.

“We know our product is going to be more expensive,” said Porter, who added his company had lost half of its retail business to Chinese peers over the past five years: “There is no way we can compete with Chinese labour.”

After the Democratic and Republican campaigns both pledged to sell locally-sourced political merchandise, many Chinese factories began concealing their identities online. Now, 15 of the 16 best-selling Trump-themed flags with a “Made in the USA” logo on Amazon report a seller’s address in China.

An official at Xiankang Excellence Construction Co in the western Chinese city of Xi’an said the inclusion of the “Made in the USA” logo on a Trump flag made it one of their best-selling products on Amazon.

“We are doing what we can to meet the needs of American consumers,” the official said.

US manufacturers say the popularity of such items has come at their expense. Reginald VandenBosch, vice-president of sales at Valley Forge Flag, one of the largest US flag makers, said the five per cent to 10 per cent pick-up in industry-wide sales that had been expected from the 2024 presidential race had given way to flattening growth and in some cases a “significant” drop as Chinese-made flags swarmed the market.

“The expectation was that sales were going to increase,” he said. “They just didn’t.”

US industry members said the mislabelling of products’ country of origin needed addressing.

“This is egregious,” said Kim Glas, CEO of the National Council of Textile Organizations. “Consumers are clicking a button thinking they are purchasing something that’s benefiting workers in Ohio, Wisconsin, New York, wherever, but they don’t realise that the photos and claims of made-in-the-USA that your search turned up appear to be false and this is being manufactured offshore at a subsidised rate and many times in conditions that would not be allowable under US law.”

Some Chinese manufacturers were unconvinced that their labelling was to blame. Zhang, the flag maker in Yiwu, said Chinese factories had built strength in cost and quality control that may take years for US manufacturers to catch up with.

“American factories are just not as competitive as they use to be,” he said.